Blockchain

On a basic level, blockchain can be explained as a chain of blocks. Here, blocks comprise of digital pieces of information and precisely contains three parts as following:

- Blocks are used for storing data related to transactions such as date, time, along with the amount of the current purchase made.

- Blocks keep a record about the participants involved in the transactions.

- Blocks keep information that differentiates them from other blocks. Each block has a unique code known as a hash which distinguishes one block from the other.

Can Australia become a global blockchain leader?

Since the last two years, the World Economic Forum has been working for above two years to figure out how innovations would transform the financial services. Efforts were made to understand the breadth of the effect of the innovations on the sector, creating a classification to help do that.

Two zones were identified by the participants, which were believed to make a difference. These are Digital Identity, and the other is blockchain or distributed ledger technology.

Australian banks are taking a practical view and ensuring the costs of using blockchain are justified.

Some of the Cases where the Potential distributed ledger technology is applied in financial services are as follows:

- OTC derivatives

- P&C Insurance

- Records Management

- Contingent Convertible Bonds

- Clearing and Settlement

- Trade Finance

- Continuous Auditing and many more

Blockchain is now seen as one of the technologies that can drastically transform businesses. It would help in increasing the truthfulness of financial transactions. Further, it would help in increasing durability as well as transparency and, will in turn, result in lower compliance costs.

The three ASX companies demonstrating the application of blockchain in banking sector and in chemical space are as follows:

FinTech Chain Limited

About the company:

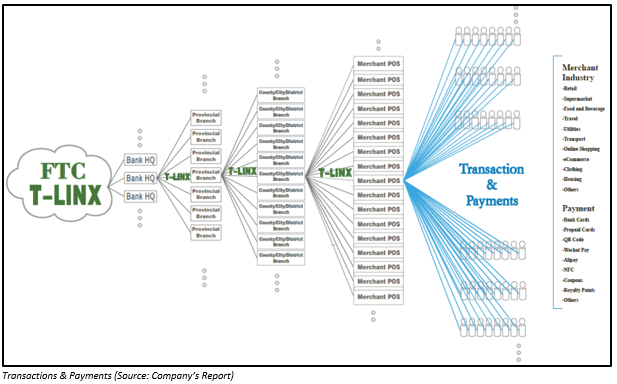

FinTech Chain Limited (ASX:FTC) is a leading provider of Integrated Payment Acquiring infrastructure for banks and Industry Application Solutions in Greater China. The Integrated Payment Acquiring infrastructure for banks and Industry Application Solutions is known as T-LinxTM System. After more than 8 years of delicate development, rigorous testing followed by validation by banks, T-LinxTM was recognized, approved & used by several banks for years. It has been provided to 400+ banks and indirectly serving more than 4 million merchants.

Recent Update:

Recently on 31 May 2019, the company released its preliminary final report for the period ended 31 March 2019. During the period, the company reported a strong increase in the revenue by 341% to RMB44.186 million. The company made a net profit after tax attributable to the members worth RMB 3.758 million, up by 116% as compared to its previous corresponding period.

The revenue during the period boosted as a result of the successful implementation of blockchain technology of the company, which generated RMB15.4 million income during the period. The revenue from T-linxTM related products and services in sum was RMB28.8 million. Other than this, the company reported a fall in the other income and noted net gain from RMB2.2 million to RMB0.5 million as a result of a gain on early redemption of convertible bonds, over-provision of other payables along with write-off advance from a client in the previous year.

Financial Update:

The balance sheet of the company reported a fall in the net liabilities from RMB 30,259,312 in FY2018 to RMB 17,762,129 in FY2019. The cash outflow from the operating activities of the company declined during the period from RMB 16,175,849 in FY2018 to RMB 7,484,747 in FY2019. There was also a fall in the cash outflow from the investing activities of the company from RMB 4,272,396 in FY2018 to RMB 2,309,688 in FY2019. By the end of the FY2019, FTC had net cash and cash equivalent worth RMB 2,289,152.

Outlook:

The company is on track to expand T-LinxTM linked products and services along with blockchain technology. The company expects that T-LinxTM related products and services along with the blockchain technology would rapidly grow and enter the market effectively which would help the company in growing the revenue, gross profit as well as margin.

The company is hopeful that T-LinxTM products, along with blockchain technology, would be able to achieve a rise in the recognition as well as acceptance in the market. In a medium to long term, the company aims to become the biggest Fintech provider of Integrated Payment Acquiring infrastructure for banks as well as Industry Application Solutions in Greater China.

Stock Performance:

By the end of the trading session on 11 June 2019, the shares of FTC closed at A$0.150, up by 3.448% as compared to its previous closing price. FTC has a market cap of A$95.36 million and approximately 650.77 million outstanding shares.

DigitalX Limited

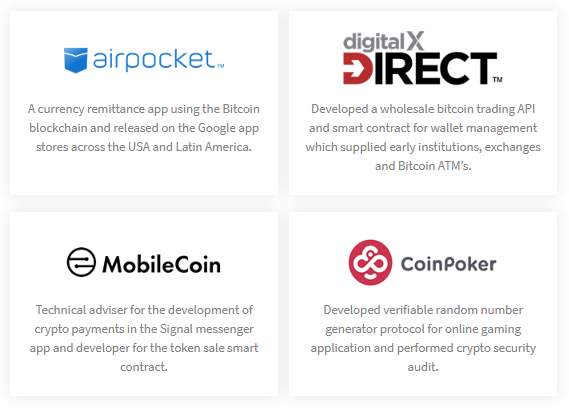

DigitalX Limited (ASX: DCC) is listed on ASX and offers services in segments like token sale advisory, asset management as well as blockchain technology development from various regions.

Blockchain consulting comprises of deployment of smart contract, blockchain selection advice and solution architecture. It also includes API integrations along with the technical support for the government as well as the private sectors.

Blockchain Consulting (Source: Companyâs Website)

Token Sale Advisory: The company with a team of financial markets along with technology experts, tries to figure out the most suitable token structure from utility to security token offerings and beyond.

Asset Management:

The company through its subsidiary, DigitalX Asset Management offers a diverse range of investment products which focuses accelerating in technology disruption that will influence the industry over the next 10 years, where stress is laid on the role of blockchain as well as distributed ledger technology.

Recent Updates:

On 27 May 2019, the company further to its announcement on 7 May 2019, issued a total of 1,576,568 shares at a deemed issue price of $0.074 per share, as a second tranche related to the settlement deed.

On 7 May 2019, the company had highlighted about the finalization of the legal proceedings (as per ASX announcement on 28 September 2018) related to an Originating Application as well as Statement of Claim, which was filed by a group of parties who made an investment in an initial coin offering to which the Company was an advisor. The claim amount was ~ US$1,833,077 along with damages. In defense, the company strongly denied any and all wrongdoing.

On 7 May 2019, DigitalX Limited also signed a settlement deed to offer complete release from the claim of the applicantâs sans any admission of its liability. Moreover, DCC also freed the parties from any and all claims.

Within two days, the company was supposed to make a cash payment of A$250,000. Apart from this, a cash payment of A$150,000 along with interest will be paid on 1 July 2019, which was made through the existing cash reserves of the company.

Along with this, the company was supposed to issue shares worth A$350,000 as per ASX listing rule 7.1 placement capacity in three tranches by 6 weeks of the settlement deed. On 13 May 2019, the company issued a total of 1,895,453 shares at a deemed issue price of $0.061551 per share as its first tranche related to the settlement deed.

Q3 Results:

In the third quarter of FY2019, the company used US$0.536 million in its operating activities. The company made payment for advertising and marketing, staff cost, administration and corporate costs along with the professional fees. By the end of Q3 FY2019, the company had net cash and cash equivalent worth US$3.435 million.

Outlook:

Leigh Travers, the CEO of DigitalX stated, that the company was well positioned to take advantage of the renewed confidence in crypto assets as a result of the strong focus of the companyâs team to maintain energy in recent months in the middle of softer prices for digital currencies.

By the end of the trading session on 11 June 2019, the price of the shares of DCC was A$0.053, down by 3.636% as compared to the previous closing price. DCC has a market cap of A$31.33 million and 569.63 million outstanding shares.

Security Matters Limited

About the company:

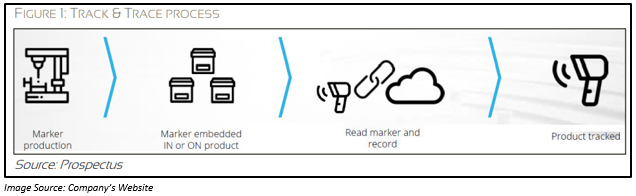

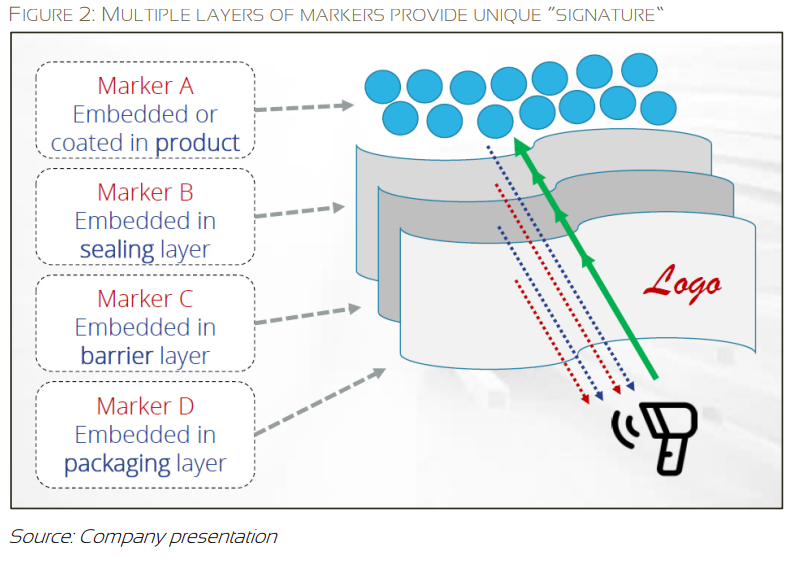

Security Matters Limited (ASX: SMX) is an Israeli B2B technology company that owns and has started the commercialization of the technology to permanently and irrevocably âmarkâ any object in any form whether solid, liquid or gas, which allows identification, proof of authenticity, tracking supply chain movements as well as quality assurance.

Technology: The technology of the company consists of a chemical-based hidden "barcode" system, together with a unique âreaderâ which helps in identifying these codes as well as a blockchain record to store and protect ownership data. The company provides B2B, âwhite-labelâ solution for serving the needs of the market leaders.

Key Addressable Markets for SMXâs Technology:

- Electronics such as chips, circuit boards, high-end mobile phones.

- Plastics as well as wrapping materials.

- Precious metals and stones such as gold and diamond.

- Raw materials and performance chemicals.

- Food and agricultural goods.

- Art and valuable objects.

- Paint and coatings.

- Official documents.

- Pharmaceutical products.

Recent Updates

The company on 11 June 2019, announced that it has started with the commercial discussions with Ambar, which is the leading Israeli animal feed supplier, after the conclusion of Phase II testing. The Phase II pilot project started in the first quarter of FY2019.

The Phase II pilot project involved SMX integrating its disruptive technology into the animal feed of Ambar through a drop-in solution during the production process. The result of the test was that the companyâs technology could be successfully merged with the supply chain of Ambar, and there was no negative effect on any of the animal feedâs properties.

Further, all the results were validated independently by Ambar, and it also concluded that the markers do not have any impact on its production processes as well as production costs.

Post this, the company along with Ambar have entered into commercial discussion w.r.t future collaboration agreements which are expected to finalize during the third quarter of FY2019.

Stock Performance:

The shares of SMX have generated a decent YTD return of 36.21%. By the end of the trading session on 11 June 2019, the price of the shares of SMX was unchanged at A$0.395 from its previous close. SMX holds a market cap of A$43.41 million outstanding shares and approximately 109.91 million outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.