TechnologyOne Limited (ASX:TNE), one of the largest Software as a Service (SaaS) company based in Fortitude Valley, Australia is engaged in R&D, development, marketing, sales and deployment of integrated enterprise business software solutions in New Zealand, Australia, and globally. The companyâs clients include local government (more than 300 council customers) and businesses from asset-intensive sectors, health and community services, education, financial services industries as well as corporates.

With a market capitalisation of around AUD 2.33 billion with ~ 317.12 million outstanding shares, the TNE stock closed the market trading session today (24 May 2019) at a price of AUD 7.170, dipping 2.58% by AUD 0.190 on prior dayâs close (AUD 7.160). The stock price has a 52-week high and low of AUD 9.395 and AUD 4.097 respectively. In addition, the stockâs YTD return also stands positive at 21.65% so far.

Recently on 21 May 2019, TechnologyOne declared an ordinary fully paid dividend of AUD 0.0315 (up 10%) (Record Date: Friday, 31 May 2019) to be paid out on Friday, 14 June 2019 with respect to the period of six months ended 31 March 2019.

On the same day, the Half-year Results for the six months to 31 March 2019 were disclosed to the market whereby the company reported a continued growth trend with profits underpinned by the accelerated growth of its enterprise SaaS solution.

A quick look at the figures are as follows:

- The Revenues were up 5 % to $ 129.3 million.

- Expenses decreased by 7 % to $ 104.8 million.

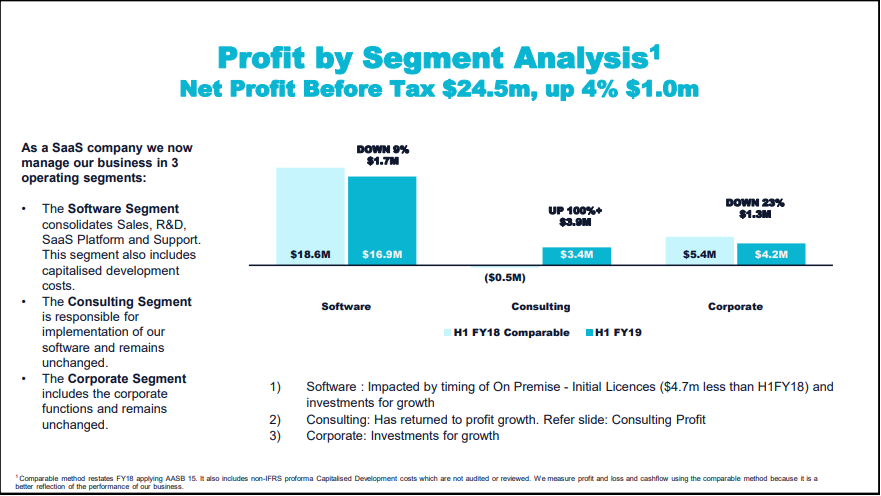

- Net Profit Before Tax staggeringly up 130% to $ 24.5 million.

- SaaS Fees Recognized of $ 37.5 million, also increasing by 42%.

- SaaS Annual Contract Value (ACV) improving 45% to $ 85.8 million

Source: 2019 Half Year Results Presentation

Source: 2019 Half Year Results Presentation

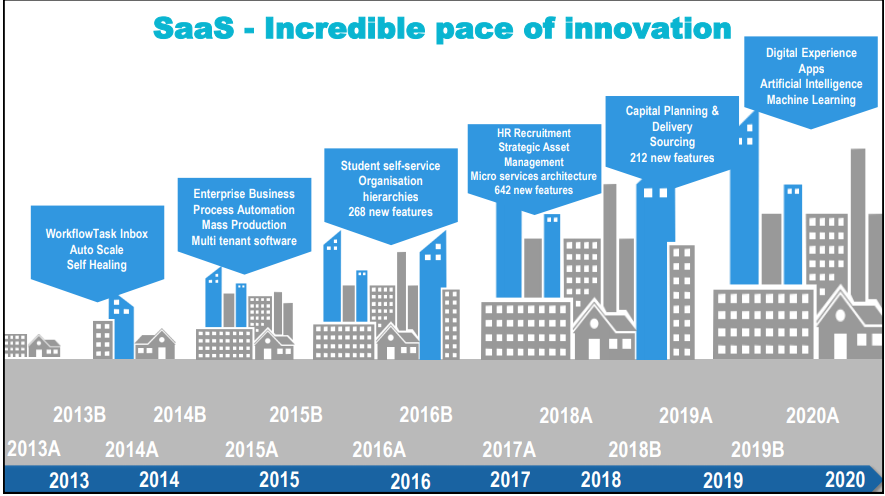

In addition, TechnologyOne recorded a 7% rise in the R&D expenditure (before capitalisation) to the value of $ 27.8 million, which represents 22% of the revenue.

TechnologyOneâs SaaS offering presents a compelling value proposition to the customers which has pushed the number of large-scale enterprise SaaS customers 389 (up 39% on pcp).

2019 Half Year Results Presentation

2019 Half Year Results Presentation

With a consistently positive operating cash flow of $ 7.8 million (up 100+%), the companyâs net cash and cash equivalents stood at $ 68.2 million (up 19%).

TechnologyOneâs CEO, Mr Edward Chung, pleasingly commented on the results and explained that the company has delivered record profit for the 10th in a row along with excellent revenue figures and a rising product fees.â According to the CEO, the company is well headed towards further growth and expected to deliver Net Profit Before Tax over the full year of between $ 71.6 million -$ 76.3 million.

Previously, on 27 February 2019, the Company informed the stakeholders that Mr Clifford Rosenberg has joined as the new independent, Non-Executive Director. This follows the addition of Dr Jane Andrews and Ms Sharon Doyle to the Board in 2016 and 2018 respectively. The fourth appointment is scheduled to be finalised in the second half of CY2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_07_01_2025_00_35_15_412895.jpg)