Formed in 1997, Advance NanoTek Limited (ASX: ANO) deals in the manufacturing, development and marketing of innovative products based on a range of manufacturing processes and proprietary advanced material technologies. The commercialised products of the company include dispersions of zinc oxide and metal oxide powders. The company has a global chemist network of around 29 chemists and is looking to grow this number to beyond 70.

The company today declared an unexpected increase in sales orders from the United States close to 100T in additional orders at the companyâs current pricing. According to the company, the preliminary negotiations held with a number of sunscreen manufacturers in the US during the companyâs recent meetings resulted in an unexpected significant increase in orders. The company now expects its current growth trajectory to be maintained in the first half of FY 2020 subject to no adverse unexpected issues.

The company informed that the additional orders fit well with the companyâs current increases to production capacity to September 2019. It plans to visit a number of potential new distributors in Europe in early June.

Advance NanoTek recently reported that its powder production will be at capacity to August 2019 as it has received a number of new sales orders, indicating that the first quarter FY20 volumes will continue to grow at the current rates.

Also, the company has placed orders for additional equipment that will probably arrive by November 2019, leading to a further 50 per cent increase in capacity.

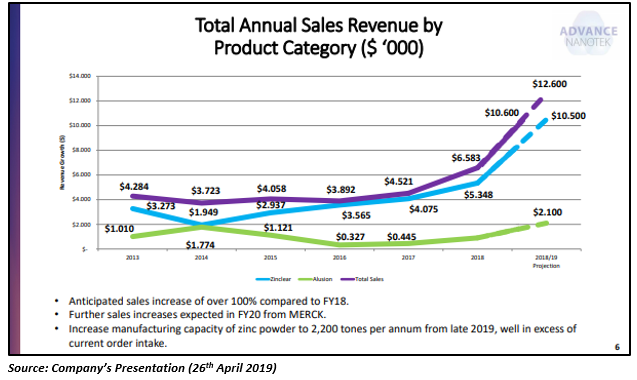

The company released its Investor Presentation on 26th April 2019 that indicated a further increase in total sales of the company for FY19 from $10.5 million to $12.6 million.

The company informed that its March 2019 quarter profit after tax was $1.8 million, three times higher than the March quarter FY18.

The presentation incorporated the Strategic Initiatives of Advance NanoTek for 2019/ 2020.

Highlights of companyâs future outlook:

- ANO targets production capacity close to 30T per week as from May 1, 2019.

- In late 2019, the company expects further uplift in production capacity to be in excess 40T.

- The annual capacity is anticipated to be over 2,200T, well in excess of current order intake.

- ANO plans to increase the range of end products beyond the present range of sunscreens.

- The company targets for the development of additional powders and dispersions using alternative natural ingredients in 2019 / 2020.

- ANO aims for growing distribution network in Europe.

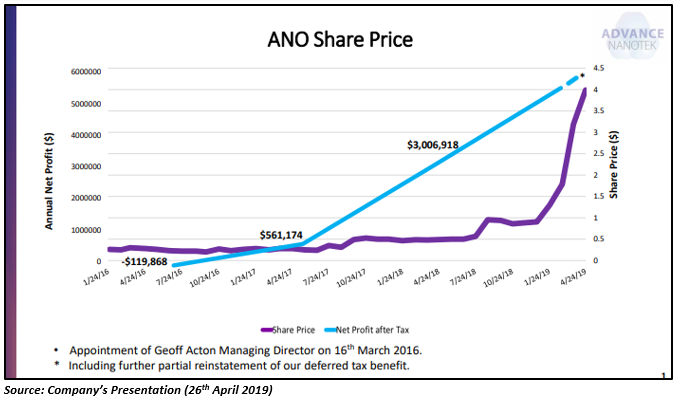

The share price of ANO has improved over a period of time, as demonstrated in the below figure.

The companyâs stock settled higher on the Australian Securities Exchange today at AUD 7.020 (on 24th May 2019) with a rise of 20.41 per cent in comparison to the previous closing price on the announcement of an increase in sales orders.

The companyâs stock had performed exceptionally well in the past. The stock has generated an outstanding YTD return of 501.03 per cent.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.