Laneway Resources Limited (ASX: LNY), an Australia based gold & Coal miner and explorer, provided an update of gold production from its 100% owned Agate Creek Gold Project (Sherwood Deposit) on 20th May 2019. The company recently secured Mining Lease (ML100030) from the Queensland Government.

Laneway mentioned that the company poured the first gold within ten weeks after it secured the Mining Lease and undertook the first ore blast on 10th April 2019. On 13th April 2019, LNY transported the first ore, which went for crushing circuit of Maroonâs Black Jack Gold Processing Plant on 17th April 2019.

The overall gold recovery for April 2019 stood at 2,220 ounces from nearly 5,012 tonnes of material with a reconciled grade of 13.91 gram per tonne of gold. The extraction method used by the company at the processing plant includes gravity, Intensive Leach Reactor (ILR), and Carbon in Leach (CIL).

The refined gold sales for April 2019 stood at 57,821 gram (1,859 Oz) of 99.999 gold; the recovery received by the company exceeded their expectation, and the company achieved 99% plant recovery in April 2019.

The Gravity and Intensive Leach Reactor portion of the plant recovered 65% of the total gold, and the traditional Carbon in Leach method recovered additional gold. As per the company, the bullions averaged around 73% of gold and 26% of silver, which was in line with expectation considering high gravity recoveries.

The current processing rate of the project stands around 20 tonnes an hour, and the processing rate is further expected to be inched up steadily over the coming weeks. The aimed processing rate of the company is at 25 tonnes an hour.

The mining, transportation and processing of the ore are going in line with LNYâs expectation, and the company mined 13,000 tonnes to date out of which it processed 11,000 tonnes of ore at the Maroonâs Gold Black jack plant in Charters Towers.

Laneway expects the processing to continue for around 16 weeks and further expects that the aimed processing rate of 25 tonnes per hour reaches without compromising recoveries amid high-grade nature of the ore.

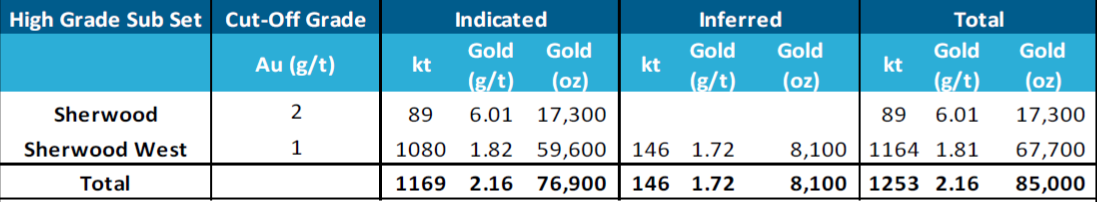

The recovered gold grades are trending significantly higher than the modelled figures incorporated in the Sherwood High-Grade subset of the Resources estimate of 89,000 tonnes @ 6.01g/t, and LNY expects the outcome of significant high-grade is likely to be due to the selective mining techniques.

Source: Companyâs Report; Subset of the resource estimate

Source: Companyâs Report; Subset of the resource estimate

The stripping ratio for April 2019 stood around 6:1, and the company expects it to an overall average for the mining period. The company is using a 40t Articulated Mining trucks for hauling and an excavator for mining at the project site. The personnel of the company are focussing on maintaining high-grade ore with minimal dilution, and Laneway expects the mining activity to continue for around 10-12 weeks and ore transportation to the plant for two weeks.

The company entered a Mining and Processing Agreement with Maroon, in which it would transport the ore for processing at Maroonâs Black Jack Gold Processing Plant. As per the agreement, Maroon would cover the cost of mining, transportation, crushing and processing of ore and rehabilitation of the disturbed area, for which it will get 40% above 3.5g/t gold head grade (initial 3.5 g/t to be retained by Maroon towards the costs).

Laneway further intends to expand the current mineralisation and explore further potential high-grade zones, and the company started an initial 1,100 metre Reverse Circulation (RC) drilling program around the vicinity of the current mining operations.

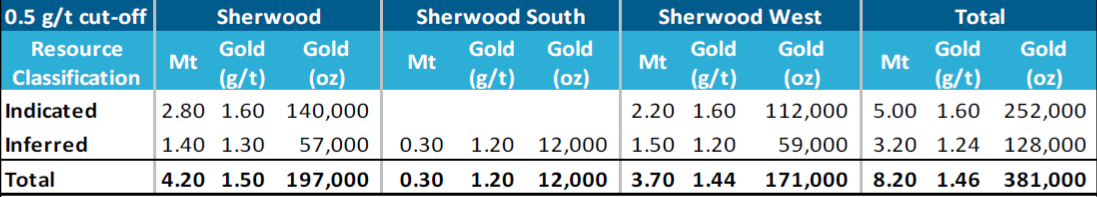

The current mineral resources of the company are as:

Source: Companyâs Report

Source: Companyâs Report

The shares of the company are trading at A$0.011 (as on 20th May 2019 AEST 02:20 PM), up by 10% as compared to its previous close.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.