Brisbane Broncos Limited (ASX: BBL) is involved in the management and operation of the Brisbane Broncos Rugby League Football Team. On 14 May 2019, the company held its Annual General Meeting at which three resolutions were passed - Resolution 1: Remuneration Report, Resolution 2: Re-Election of Director Mrs. Katie Bickford and Resolution 3: Re-Election of Director Mr. Darren Lockyer.

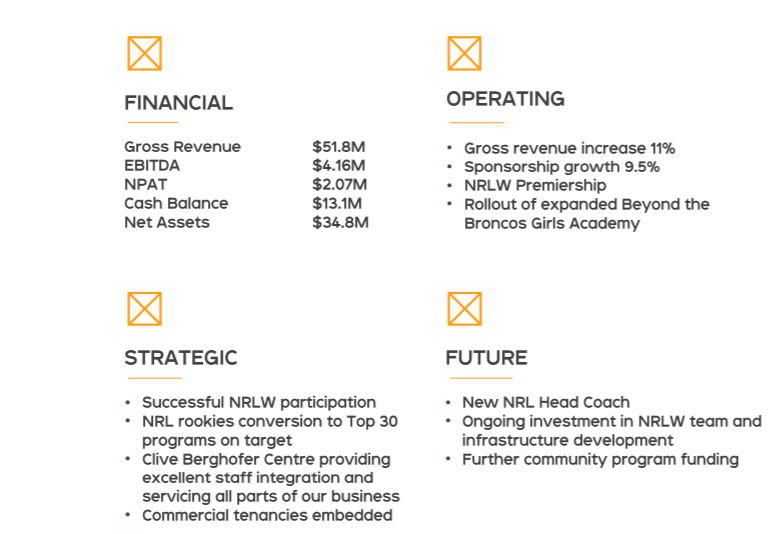

While addressing the shareholders at the AGM, the companyâs Chairman told that the year 2018 was a transformational year for the company. The company believes that it is well positioned for a positive future, both on and off the field. Careful planning by the Board, and its CEO Paul White and his executive team, continues to position the Brisbane Broncos to further grow the commercial business and its investment in community programs that change young peopleâs lives. The company reported 9.5% sponsorship growth in 2018 due to a stable portfolio of committed partners. The Group recorded gross revenue of $51.8 million for FY18 which was 11% higher than the previous corresponding period. The companyâs revenues were boosted by the increased Club Grant, increased sponsorship sales and increased funding for the expanded community programs, being largely cost recovery revenue. The Group expenditure increased by around 15% during the year to $48.7 million.

Group Highlight (Source: Company Reports)

Group Highlight (Source: Company Reports)

The Groupâs profit after tax decreased by 25% in FY18 and reached to $2.1 million. The financial result are reflecting the companyâs solid underlying commercial business and cash position which was impacted by the net costs of participation in the inaugural NRLW competition, home game related shortfalls, coaching and player related restructure costs, an increased spend in resourcing the expanded funded Indigenous and Community Programs, a reduction in interest revenue and a full year of depreciation of the Clive Berghofer Facility. At the end of FY18, the company had Cash balance of $13.1 million.

On 20 February 2019, the Companyâs Board of Directors declared a fully franked final dividend of one cent per share in respect of FY18 and the dividend was paid on 10 April 2019.

With a strong executive team and restructured football department, the company is moving forward under its strategic plan, focused on delivering further growth and striving for further on-field success. The company is seeking opportunities to partner with business and government to further expand its reach. The companyâs Management believes they have taken appropriate steps to ensure that the Group is strongly positioned to deal with current economic uncertainties and capitalise on future opportunities to grow returns on investment.

In the last six months, the share price of the company decreased by 4.08% as on 13 May 2019. On 14 May 2019, the stock of the company closed at a price of A$3.080, down 2.057% during the dayâs trade with the market capitalisation of ~A$46.08 Mn.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.