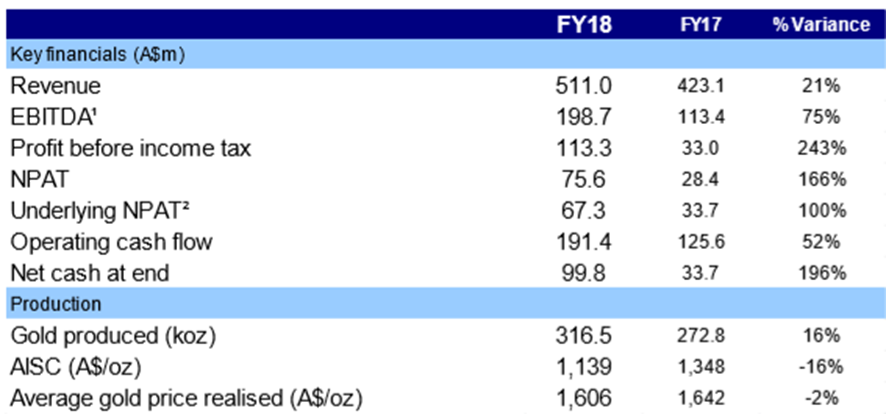

Strong FY 18 Performance: Saracen Mineral Holdings Limitedâs (ASX:SAR) stock fell 1.2% on August 22, 2018 despite the company delivering robust net profit growth of 166% to A$75.6m for FY 18. The company in 2018 has posted 75% rise in EBITDA to A$198.7m and 21% growth in revenue to A$511.0m. During FY 18, the companyâs gold production increased 16% to a record 316,453 ounces, while all-in sustaining costs fell to A$1,139/oz from A$1,348/oz in FY17.

In other words, drop in AISC and higher sales supported the result significantly. While the gold prices in the previous period have boosted the performance, the recent scenario is little bleak and has been impacting the stock lately.

[optin-monster-shortcode id="wxhmli4jjedneglg1trq"]At June 30, SAR held cash and equivalents of $118.3 million, up from A$45.2 million a year earlier, and has no debt. Meanwhile, SAR stock has fallen 6.04% in three months as on August 21, 2018Â and is trading at a P/E of 26.53x.

FY 18 Financial Performance (Source: Company Reports)

The Income available from dividends remains attractive for many investors.

We take a look at the best yields on the market and assess what they say about a companyâs prospect.

One Thing is certain, though, Australia interest rates are still low, making income difficult to come by and keeping the focus for many investors on high yielding stocks. Kalkineâs team of analysts bought you handpicked report for âTop 25 Dividend Stocks For 2018.â

ASX-relevant Special Reports are published year-round to provide a detailed analysis into an investing opportunity or a potential risk to your portfolio.

Click here to get your free report.

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkinemedia.com and associated websites are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.