Highlights

- Not paying taxes could lead to a lot of hassles later.

- Penalties could be overwhelming in case of tax default.

- Filing taxes on time is the responsibility of every citizen.

Filing taxes is the responsibility of the citizens of a country. However, many people are either lazy or find it daunting when filing taxes. So, many miss the deadline and end up paying penalties. It is worthwhile to mention that there are consequences for not paying taxes.

Here, we’ll discuss what could be repercussions of not paying your taxes:

There will be penalties

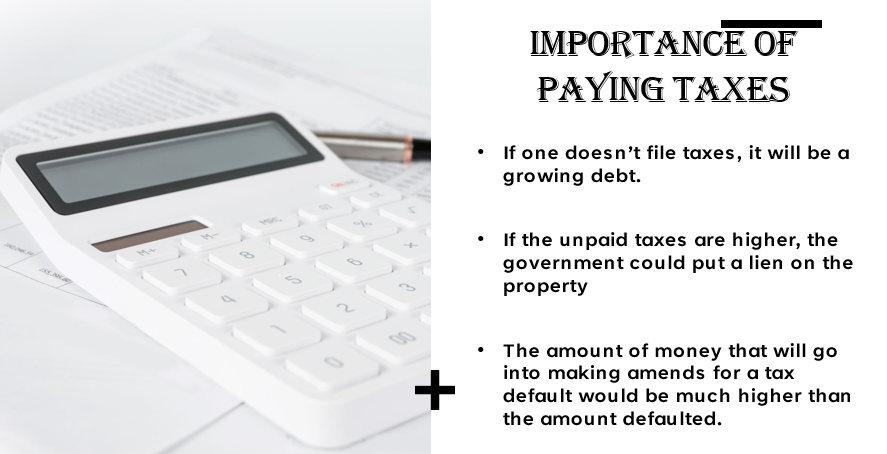

If one doesn’t file taxes, it will be a growing debt. Skipping a tax filing would invoke interest payments and penalties until the next year. The penalty for not filing taxes is five per cent. If you find the penalties by the IRS complicated, go to their website for clarity.

There could be a lien on one’s property

If the unpaid taxes are higher, the government could put a lien on the property owned by the individual. The IRS files the papers with the local county government. So, when the defaulter individual sells the property, the government will stake claim to the amount owed as penalties.

©2023 Krish Capital Pty. Ltd

©2023 Krish Capital Pty. Ltd

It will invite financial unease

If someone thinks that the government is not keeping track of every individual tax default, it is like living in a fool’s paradise. Eventually, the department will knock at your door to claim and levy the penalties. The government can take away the passport and confiscate other documents like driver’s licenses. This will eventually become a blot on one’s financial situation.

It could result in paying more money to make it right

The amount of money that will go into making amends for a tax default would be much higher than the amount defaulted. Cleaning up the act could get murkier when the government sends notice to a defaulter. Hiring an expert to fix the matter with the government could entail fees apart from the penalties to the IRS. So, it is any day better to pay the taxes on time and not end up coughing up more money by defaulting.

Bottom line

It is always better to pay one’s taxes earnestly rather inviting trouble later and deal with departmental abrasion. Financial obligations like paying up taxes should be dealt with utmost care for peace of mind.