Source: Freedomz, Shutterstock

Summary

- WPP PLC had reported a decline of 9.3% in revenue during FY20.

- The headline operating margin was dropped by 150 basis points to 12.9% during FY20.

- WPP would pay the FY20 final dividend of 14.0 pence per share on 09 July 2021.

- WPP reported £2.80 billion of goodwill impairments during FY20.

WPP PLC (LON:WPP) is the LSE listed media stock. WPP’s shares have generated a return of approximately 42.29% in the last 12 months. It is listed on the FTSE 100 Index. WPP was incorporated in 2012.

Business Model

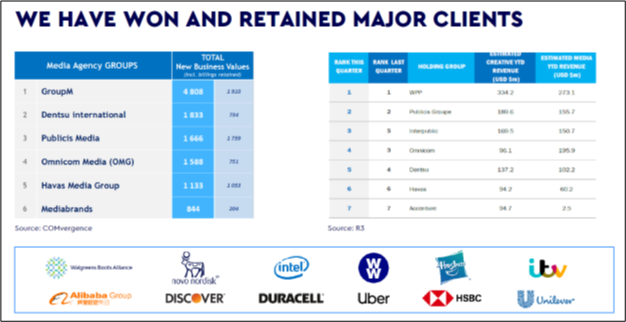

WPP PLC is a leading provider of communication services. It is engaged in a diverse range of services such as investment management, advertising, media, public relations, and public affairs. Moreover, WPP has operations in more than 112 countries.

(Source: Company presentation)

Recent News

On 11 March 2021, WPP announced a share purchase program commencing from 11 March 2021 till 18 June 2021 with an objective of reducing the share capital of the Company. The share purchase activity would be funded from the proceeds of the Kantar transaction.

On 03 March 2021, WPP announced Wunderman Thompson had acquired leading mobile commerce partner NN4M.

FY20 Financial Review (for 12 months ended 31 December 2020, as of 11 March 2021)

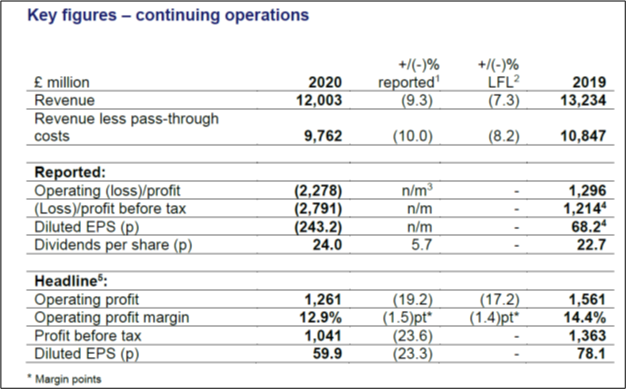

(Source: Company result)

- WPP had reported a 9.3% decline in the revenue to £12.0 billion during FY20. On a like-for-like basis, it went down by 7.3% during the period.

- The revenue across all three reportable business segments witnessed a decline. Furthermore, revenue for Global International Agencies, Public Relations, and Specialist Agencies had shown a drop of 8.8%, 6.6% and 12.8%, respectively, during the period.

- The digital media expenditure accounted for around 59.3% of total expenditure in 2020, while it was 51.6% during 2019 due to the rising popularity of eCommerce.

- The headline operating margin was dropped by 150 basis points to 12.9% during 2020 as cost-saving of £800 million managed to offset the revenue declined during the period.

- WPP had reported a loss before tax of negative £2.79 billion during FY20 due to £2.80 billion of goodwill impairments for the period. The headline profit before tax remained £1.04 billion during the period.

- Moreover, the headline profit before tax went down by 23.6% during FY20.

- On the leverage front, the Company had reduced its net debt to £0.7 billion as of 31 December 2020, driven by the favorable working capital movement and efficient cash management.

- Meanwhile, WPP had generated a net cash inflow of £1.0 billion during FY20, while the inflow was £2.5 billion during FY19.

- WPP had total liquidity of £6.4 billion as of 31 December 2020.

- The average net debt to EBITDA ratio stood at 1.57x as of 31 December 2020.

- WPP will pay an FY20 final dividend of 14.0 pence per share on 9 July 2021, taking the total FY20 dividend to 24.0 pence per share.

Share Price Performance Analysis of WPP PLC

(Source: Refinitiv, chart created by Kalkine group)

WPP’s shares were trading at GBX 932.80 and were up by close to 2.28% against the previous closing price as of 11 March 2021 (before the market close at 12:16 PM GMT). WPP's 52-week Low and High were GBX 450.00 and GBX 935.60, respectively. WPP PLC had a market capitalization of around £11.18 billion.

Business Outlook

WPP had managed to reduce its debt levels as markets started to recover from the Covid-19 pandemic. Moreover, WPP had provided proper FY21 guidance. The Company had anticipated an organic revenue growth of mid-single digits percentage points during FY21. The headline operating margin was estimated to be ranging between 13.5% and 14.0%. Furthermore, WPP had estimated to incur total capital expenditure ranging from £450 million to £500 million and net working capital outflow falling between £200 million to £300 million during FY21. The Company also intended to grow its annual dividend payment with a payout ratio of around 40% of headline diluted Earnings per share. WPP would likely to maintain its leverage (net debt/EBITDA) ranging from 1.50x to 1.75x. Overall, WPP is well-positioned to accelerate the progress of growth objectives.

(Source: Company presentation)