Caribbean Investment Holdings Ltd (LON:CIHL)

Caribbean Investment Holdings Limited is a parent holding group of a financial services business. The company invests in its subsidiaries, holdings of cash and cash equivalents and intercompany balances. The company was earlier known as BCB Holdings Limited. Its subsidiaries are the warhorses of the parent group.

Incorporated and based in Belize, The Belize Bank Limited (BBL) operates in the realm of financial & banking services and extends credit to domestic clients. The Belize Bank Limited is the leader in the commercial and retail banking sector in Belize city and has more than ten branches catering to all the six districts in Belize. The bank is into accepting deposits and ancillary functions of banking along with consumer & commercial lending.

Based in Belize, Belize Corporate Services Limited is owned and operated by Caribbean Investment Holdings Ltd.

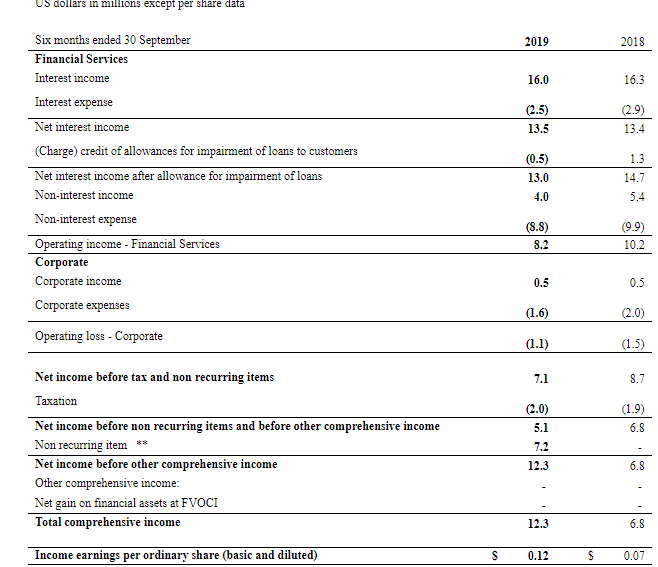

CIHL-Business performance for H1 FY20 period ended 30th September 2019

(Source: Companyâs filings, London Stock Exchange)

The interest income of the company decreased by US$0.3 million to US$16 million in the first half of the fiscal year 2020 from to US$16.3 million in the first half of the fiscal year 2019 due to reduction in loan principal balances. The net interest income of the company was recorded at US$13.5 million in the first half of the fiscal year 2020, which was at almost similar levels in comparison to the first half of the fiscal year 2019.

The operating income from Financial services declined to US$8.2 million in the first half of the fiscal year 2020 from US$10.2 million in the first half of the fiscal year 2019. Â The companyâs net income excluding non-recurring items was recorded at US$5.1 million in the first half of the fiscal year 2020 as against net income excluding non-recurring items of US$6.8 million in the first half of the fiscal year 2019.

The net income per ordinary share of the company from continuing operations stood at US$0.12 in the first half of the fiscal year 2020 as against net income per share of US$0.07 in the first half of the fiscal year 2019. The companyâs total comprehensive income of the group was recorded at US$12.3 million in the first half of the fiscal year 2020 as against US$6.8 million in the first half of the fiscal year 2019. The company declared an interim dividend of US$0.07 per share in the first half of the fiscal year 2020.

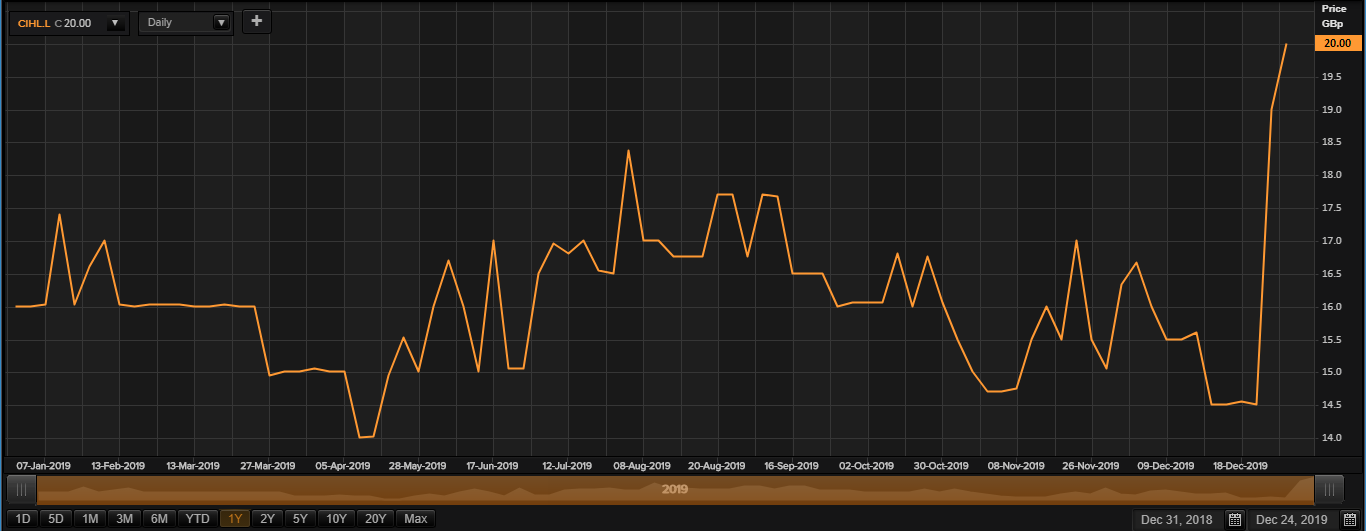

CIHL-Stock price performance

(Source: Thomson Reuters) Daily Chart as on Dec-24-19, before the LSE market close

The market capitalisation of the company while writing as on 24th December 2019 (at 08:58 AM GMT) was approximately £19.08 million.

While writing, Caribbean Investment Holdings Ltdâs shares were trading at GBX 20.00 per share; which were 5.26 per cent up in comparison to the previous day closing price level.

The shares of the Caribbean Investment Holdings Ltd have struck a high of GBX 19.56 (as on December 23, 2019) and a low of GBX 13.12 (as on November 05, 2019) in the last twelve months. At the current price point, as quoted in the price chart, the companyâs shares were trading 2.25 per cent above the high price point attained in the last twelve months, and 52.44 per cent above the low price point attained in the last twelve months.

At the time of writing, the stock's average daily traded volume for 5 days was 95,641.00; 30 days- 97,595.00 and 90 days â 39,716.48. The 5 days daily average traded volume of the shares of the company was down by 2.00 per cent in comparison to 30 days daily average traded volume. The shares of the company were trading above the 30-days and 60-days SMA while writing.

On a YTD (Year-to-Date) time interval, the shares of Caribbean Investment Holdings Ltd surged by approximately 11.76 per cent and were up by 10.14 per cent in the last quarter. However, Caribbean Investment Holdings Ltdâs shares have delivered 18.75 per cent positive return in the last one-month period.