US Markets: The US market is likely to get a quiet start in trades today, taking cues from the Asian markets. S&P 500 future was up by 6 points or 0.15% at 4,791, while the Dow Jones 30 futures was up by 0.16% or 57 points at 36,439. The technology-heavy index Nasdaq Composite future was up by 0.15% at 16,515 (At the time of writing – 8:50 AM ET).

US Market News: Shares of the biotechnology firm Biogen (BIIB) was down by over 6% in the premarket trading after Samsung denied the media reports that it was in talk with the company for a possible acquisition. The shares of the airline company JetBlue (JBLU) was down by nearly 1% after the company confirmed that it had cut down nearly 1,300 flights amid the rise in Covid-19 infections across different destinations.

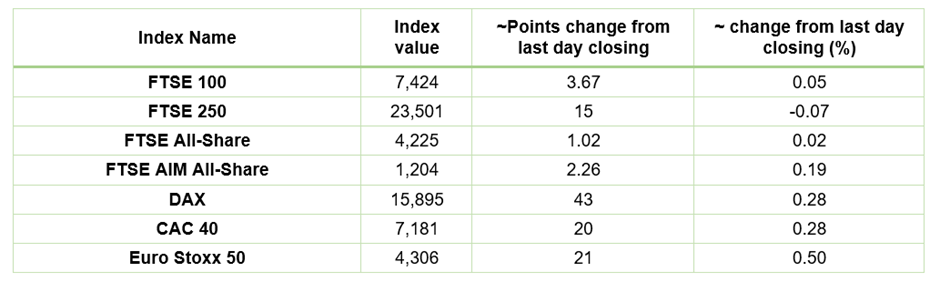

UK Market News: The UK stock market held its ground trading in positive territory. The benchmark FTSE 100 index was modestly up by 0.02% at 7,421, while the mid-cap focused FTSE 250 index was at 23,500. The UK stock market followed the Asian peers, where major indices traded in a range throughout the day.

Univision Engineering Limited (LON:UVEL): Shares of the electronics equipment maker was down by 11.77%, with a day’s low of GBX 0.65 after the company announced its interim result for the six months ended 30 September 2021. The company’s profit declined during the period.

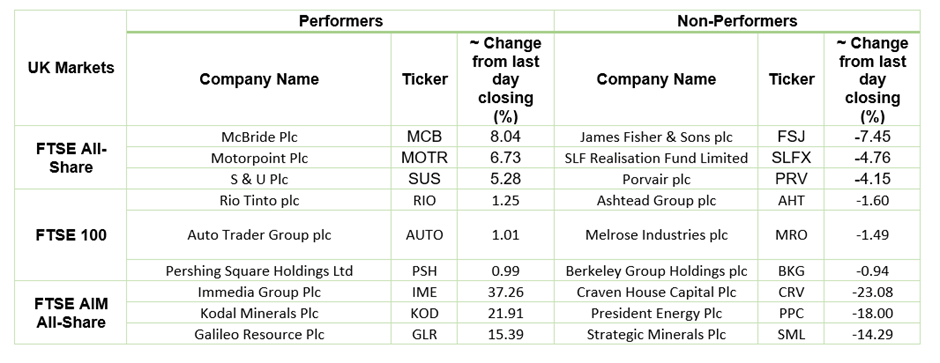

Rio Tinto Plc (LON: RIO): The metal and mining company’s shares were up by 1.35%, with a day’s high of GBX 4,925. The stock saw buying interest from investors amid anticipation of commodity price rise in the international market.

IOFINA Plc (LON:IOF): Shares of the speciality chemical company were up by over 10.6%, with a day high of GBX 19.75 after the company announced a positive business update. The company said it had achieved its crystalline iodine production target of 260-275 MT set for the second half of 2021.

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as of 30 December 2021)

(Source: Refinitiv)

Top 3 Volume Stocks on FTSE 100*: Lloyds Banking Group plc (LLOY), Vodafone Group Plc (VOD), International Consolidated Airlines Group (IAG)

Top 3 Sectors that traded in green*: Real Estate (0.64%), Basix Materials (0.46%), Healthcare (0.28%),

Top 3 Sectors that traded in red*: Industrials (-0.24%), Utilities (-0.20%), Financials (-0.12%)

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $79.19/barrel and $76.47/barrel, respectively.

Gold Price*: Gold price quoted at US$ 1,800 per ounce, down by 0.31% against the prior day closing.

Currency Rates*: GBP to USD: 1.3498; EUR to USD: 1.1320.

Bond Yields*: US 10-Year Treasury yield: 1.538%; UK 10-Year Government Bond yield: 0.9785%.

*At the time of writing