US Markets: Wall Street indices traded mixed on Wednesday, 5 January, 2022, with the NYSE-controlled Dow Industrials rising more than 100 points, while the wider share average S&P 500 and technology benchmark Nasdaq Composite oscillated in negative territory. Investors are keenly awaiting the outcome of FOMC minutes as the US Federal Reserve already indicated the possibility of three interest rate hikes in the present calendar year, effectively terminating the bond purchases effectuated to stimulate markets in the pandemic era.

American equities have witnessed a sparkling start to the new year 2022 with the Dow Jones Industrial Average and S&P 500 recognising new record highs in the last two trading sessions. Market participants have apparently overpowered the extended jitters due to rapidly increasing Covid-19 cases related to the Omicron variant as the consequences remain mild as compared to the repercussions associated with previously existing variants of Covid-19.

However, the massive increase in the daily number of infections has categorically unnerved the local businesses as the total number of infected individuals in the upcoming weeks will put extra burden on the healthcare arrangements. A large section of people remain highly vulnerable to the Covid-19 infection even after securing the maximum protection level through the two-dose regimen, alongside the extra defence through the booster shot or the third dose of Covid-19 vaccine.

As the trading progressed, Dow Industrials pared off gains, whereas S&P 500 and Nasdaq Composite dived deeper into the negative region. The ADP report showcasing better-than-expected hiring by private businesses in the United States in the month of December also reinstated confidence amidst the equity participants as December hiring hit the highest in seven months.

Even after higher-than-anticipated hiring by the private sector businesses, the total private sector payrolls are still 4 million below the pre-pandemic levels. Of the total 807,000 individuals hired by the private enterprises, 246,000 workers were hired by the leisure and hospitality businesses.

The Dow Jones Industrial Average rose 76.38 points, or 0.21% to 36,876.03, whereas the technology leader Nasdaq Composite dropped 126.74 points, or 0.81% to 15,495.98, the wider share barometer S&P 500 shed 4.82 points, or 0.10% to 4,788.72.

US Market News: Amid the blue-chip constituents of Dow Industrials, shares of Intel, Walmart, Merch & Co, Honeywell International, Verizon, Walt Disney, Caterpillar, Dow, Boeing, IBM, Walgreens Boots Alliance, Coca-Cola and Chevron gained 1-5%, emerging as the lead gainers. On the other hand, shares of Salesforce.com and Microsoft dropped the most with the stocks plunging 2-5%.

The rising treasury bond yields has materially hammered the tech stocks in the recent past with the Nasdaq Composite remaining away from the respective record highs. Shares of Intel, Qualcomm, T-Mobile US, Pinduoduo, Honeywell International, Illumina, JD.com, Micron Technology, Biogen, Dollar Tree, Comcast, Paccar, Mondelez International, CDW, Walgreens Boots Alliance, Xcel Energy, Baidu, eBay, American Electric Power, and Workday stood as the major gainers.

These stocks surged 1-5%, while shares of MercadoLibre, Adobe Systems, Atlassian Corporation, Okta, Xilinx, DocuSign, Trip.com Group, Advanced Micro Devices, Moderna, Nvidia, Lululemon Athletica, Match Group, Cintas, Alphabet, ASML, Microsoft, Broadcom, Align Technology, CrowdStrike Holdings, Autodesk, Starbucks, Dexcom, Intuit, Splunk, Costco Wholesales, Netflix, Regeneron Pharmaceuticals, and Facebook lost 1-5%, effectively counterbalancing the positive points provided by the aforementioned gainers.

UK Markets: London equities were mostly range-bound on Wednesday with the domestic benchmark FTSE 100 gaining slightly over the recently acclaimed psychological level of 7,500. The market index registered a fresh 23-month high of 7,529.97, largely propelled by heavyweight shares of GlaxoSmithKline, Royal Dutch Shell, Rio Tinto, BP, Glencore, BHP Group, Anglo American, London Stock Exchange Group, and Lloyds Banking Group.

Shares of Ocado Group emerged as the biggest gainers, while the stock of Scottish Mortgage Investment Trust stood as the biggest loser among the 101 components of the headline FTSE 100. The market index has been on a rising spree since 20 December 2021, as it has amassed a gain of more than 4.4% since then. In the last two trading sessions of 2022 itself, the index has jumped 1.8%.

FTSE 100 gained 11.72 points, or 0.16% to finish at 7,516.87, while the mid-cap heavy FTSE 250 slipped 125.47 points, or 0.53% to conclude at 23,771.18.

FTSE 100 (05 January)

Source: REFINITIV

Market Snapshot

Top 3 volume leaders:, Vodafone Group, Lloyds Banking Group, and BP

Top 3 sectoral indices: Industrial Metals, Industrial Transportation, and Retailers

Bottom 3 sectoral indices: Electricity Generation and Distribution, Precious Metals and Life Insurance

Crude oil prices: Brent crude up 1.68% at $81.34/barrel; US WTI crude up 1.90% at $78.45/barrel

Gold prices: An ounce of gold traded at $1,824.55, up 0.55%

Exchange rate: GBP vs USD - 1.3579, up 0.34% | GBP vs EUR - 1.1975, down 0.07%

Bond yields: US 10-Year Treasury yield - 1.675% | UK 10-Year Government Bond yield - 1.0895%

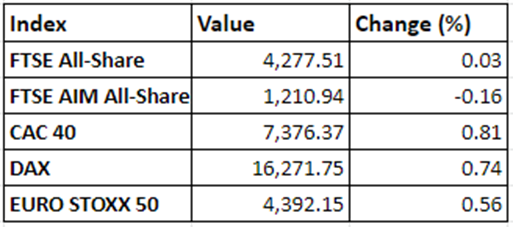

Markets @ 16:50 GMT

© 2022 Kalkine Media®