UK Market: The UK stock market has extended gains on Wednesday as investors hope for a diplomatic solution to the rising tension between Russia and Ukraine firmed up. The blue-chip FTSE 100 index was up by 0.60%, led by Barclays Plc (4.85%), which announced upbeat earnings.

Eve Sleep Plc (LON:EVE): The mattresses and sleep wellness firm was up by over 77%, with a day’s high of GBX 3.40 after the company announced a new retail partnership with DFS Furniture Plc, a market leader in upholstered furniture in the UK.

Evraz Plc (LON: EVR): The industrial metal and mining company was down by over 6.5%, with a day’s low of GBX 260.50. The stock price continues to trade lower amid rising tensions between Russia and Ukraine. The share price has slumped over 47% since 1 February 2022.

Barclays Plc (LON: BARC): The financial service provider were up by over 4.5%, with a day’s high of GBX 199.64 following the announcement of its financial results for the year ended 31 December 2021. The total income of the company was at £21.9 billion.

US Markets: The US market is likely to see a recovery with a positive start, as indicated by the futures indices. S&P 500 future was up by 31 points or 0.72% at 4,330, while the Dow Jones 30 future was up by 0.65% or 221 points at 33,753. The technology-heavy index Nasdaq Composite future was up by 1.09% at 14,015 (At the time of writing – 8:50 AM ET).

US Market News:

The automotive components maker Tenneco (TEN) was up by over 91% in the premarket trading after the company agreed to a USD 20 per share takeover bid from affiliates of Apollo Global Management. The deal is expected to be complete by mid-2022.

The cybersecurity software firm Palo Alto Networks (PANW) was up by over 7% after the company announced upbeat quarterly revenue, which was above the market forecast.

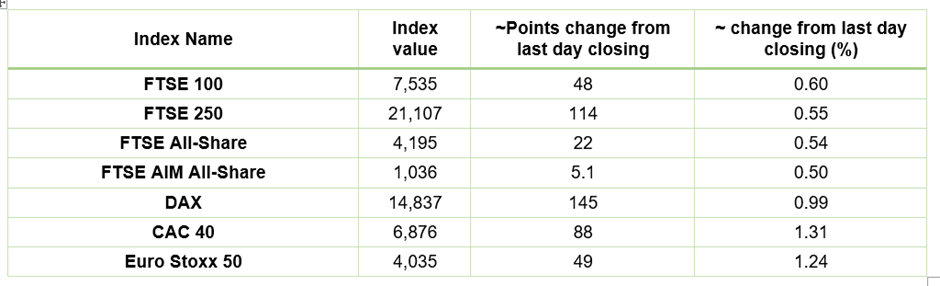

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 23 February 2022)

(Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group plc (LLOY), Vodafone Group Plc (VOD), Barclays (BARC)

Top 3 Sectors traded in green*: Financials (1.23%) Consumer Non-Cyclicals (0.96%), Industrials (0.86%).

Top 2 Sectors traded in red*: Energy (-0.56%), Basic Materials (-0.52%),

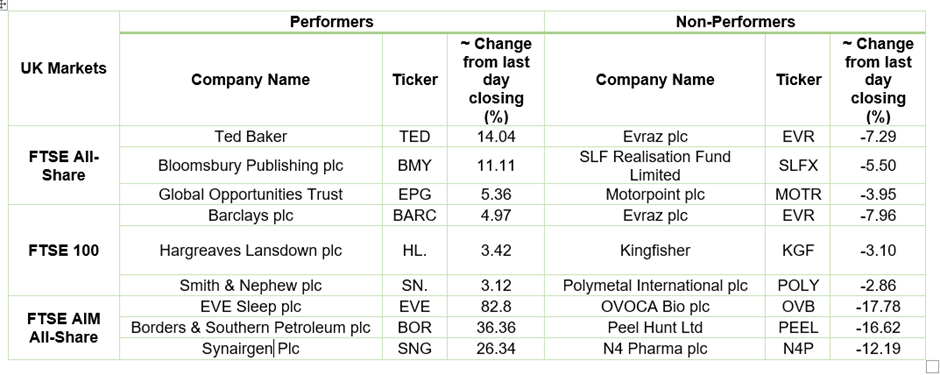

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $94.13/barrel and $92.13/barrel, respectively.

Gold Price*: Gold price quoted at US$ 1,903 per ounce, down by 0.19% against the prior day’s closing.

Currency Rates*: GBP to USD: 1.3606; EUR to USD: 1.1351.

Bond Yields*: US 10-Year Treasury yield: 1.970%; UK 10-Year Government Bond yield: 1.4715%.

*At the time of writing

.jpg)