Morgan Advanced Materials Plc

Morgan Advanced Materials PLC (LON:MGAM), is a Windsor, United Kingdom-based engineering company. Incorporated in the year 1856, the Group is engaged in engineering of composites, carbon and ceramics and advanced material sciences. The company's business is differentiated geographically into three segments: North America, Europe and Asia/Rest of World. Its main products include seals and bearings, piezoelectric sensors, high technology composites, ceramic cores, crucibles for metals processing, insulating fibres, and electrical carbon transfer systems. The company operates 85 manufacturing facilities in more than 30 countries. The companyâs earlier name was The Morgan Crucible Company plc.

The shares of the company are identified and traded with the ticker name MGAM on the Premium main market segment of the London Stock Exchange, and the share are also part of the FTSE 250 Index.

Results Update

The company on 25 February 2020 came out with an update on the full-year financial results of the company for the year ended on 31 December 2019.

- The revenues of the company for the period were £ 1,049.5 million against a revenue of £ 1,033.9 million for the corresponding period ending on 31 December 2018, registering a growth of 1.5 per cent.

- Headline operating profit for the group came in at £2 million, up 7.5% year over year.

- The headline earning per share of the company for the period were 28.0 pence against a headline earning per share of 26.7 pence for the corresponding period ending on 31 December 2018, registering a growth of 4.9 per cent.

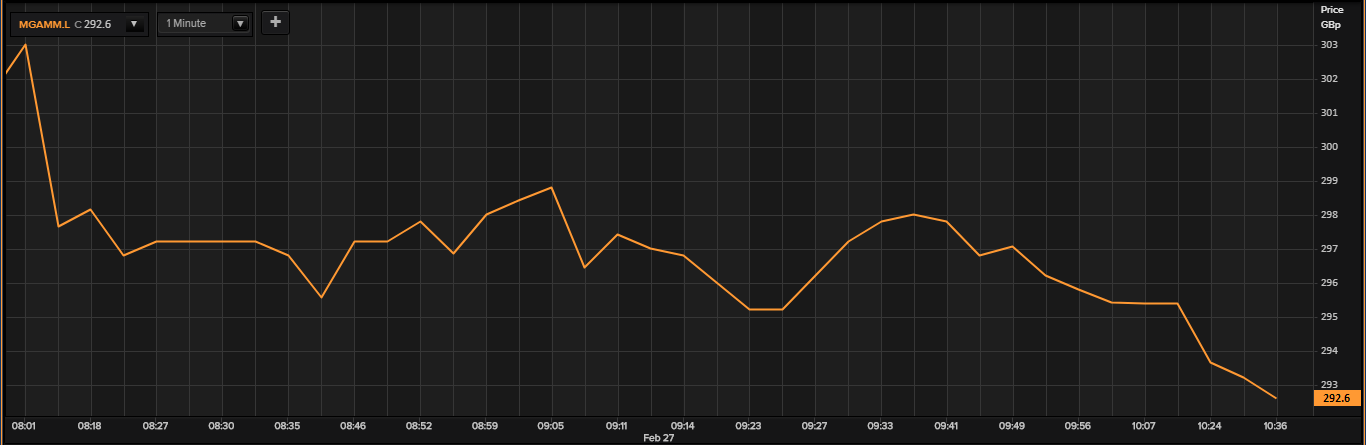

Morgan Advanced Materials Plc Stock Trading Performance at The London Stock Exchange

Source- Thomson Reuters

On 27 February 2020, the shares of the company were trading on the London Stock Exchange at GBX 292.60. At that time the market capitalisation of the company at the exchange was around £860.68 million.

The shares of the company have touched a price of GBX 339.4 on the higher side and a price of GBX 228.92 on the lower side in the past 52 weeks of trading on the exchange.

Outlook

Morgan Advanced Materials Plc has delivered a good financial performance for the year despite a challenging trading environment in the year. The company makes high tech parts for the automobile industry, which itself did not perform well during the year. The company expects to do better in 2020 as trading conditions improve.

Dalata Hotel Group Plc

Dalata Hotel Group Plc (LON:DAL) is an Irish hotel company. The company was formed in August 2007 and got listed as a public limited company in March 2014.The company has a portfolio consisting of 30 owned hotels, 11 leased hotels and three management contracts with a total of 9,205 bedrooms operating with a strategy of owning or leasing its hotels and also has a small number of management contracts. Currently the company is also in the process of developing eleven new hotels and has plans expand two of its properties to a total of 2,871 bedrooms which are due to come on board within the next three years, by which time the company will have a total portfolio of more than 12000 rooms. The companyâs shares trade both on the London Stock Exchange and the Dublin Stock Exchange.

The shares of the company are identified and traded with the ticker name DAL on the London Stock Exchange.

Results Update

The company on 25 February 2020 came out with an update on the full-year financial results of the company for the year ended on 31 December 2019.

- The revenues of the company for the period were ⬠429.2 million, registering a growth of 9.3 per cent over the revenues of the year 2018.

- Adjusted EBITDA came in at â¬162.2 million, up 35.6% year over year

- Profit before tax came in at â¬89.7 million, up 2.7% year over year.

- The adjusted basic earnings per share of the company for the period were 42.0 Euro cents, registering a de-growth of 1.9 per cent over the adjusted basic earnings per share of FY 2018.

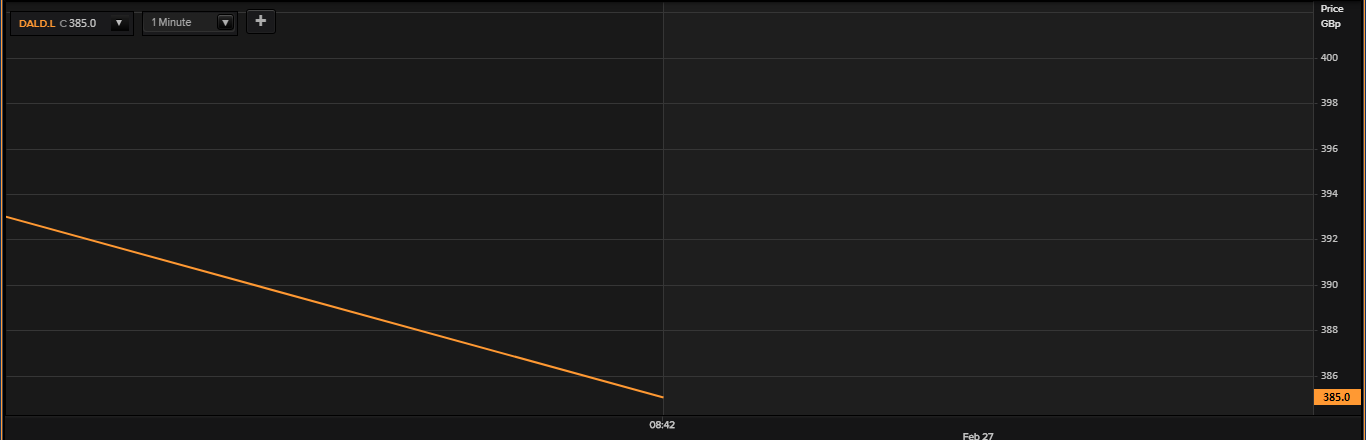

Dalata Hotel Group Plc Stock Trading Performance at The London Stock Exchange

Source- Thomson Reuters

On 27 February 2020, the shares of the company were trading on the London Stock Exchange at GBX 385.00. At that time the market capitalisation of the company at the exchange was around £740.67 million.

The shares of the company have touched a price of GBX 535.00 on the higher side and a price of GBX 376.50 on the lower side in the past 52 weeks of trading on the exchange.

Outlook

The company's business performed well during the year despite the hotel industry as well as the economy not doing well during 2019 on account of the Brexit turmoil. The company exercised strict cost control measures which have ensured that it remains in the black despite the weak trading environment. The company is expected to perform better as trading conditions improve in 2020.

Law Debenture Corporation Plc

Law Debenture Corporation Plc (LON:LWDB) is a prominent company in the investment trust industry of United Kingdom. Headquartered in London, the company provides investment trust and independent fiduciary services. The investment trust segment serves corporate trusts and pension trusts while the independent fiduciary services segment provides corporate services, governance services and a range of other financial and corporate services. The company operates and invests in industries including but not limited to Oil & Gas, industrial, consumer goods, healthcare, telecommunication, financial services and information technology sectors. The company also operates in multiple geographies including the United Kingdom, United States of America, Japan and several other South Asian and European countries.

The shares of the company are identified and traded with the ticker name LWDB on the Premium main market segment of the London Stock Exchange, and the shares are also part of the FTSE 250 Index.

Results Update

The company on 27 February 2020 came out with an update on the full-year financial results of the company for the year ended on 31 December 2019.

- The NAV total return of the company for the period with debt at par was at 19.4 per cent against the FTSE Actuaries All-Share Index benchmark return of 19.2 per cent.

- The NAV total return of the company for the period with debt at fair value was at 17.9% while share price total return came in at 24.5%.

- The final dividend proposed for the year is 19.4 pence per share, up 50% from that in the previous year.

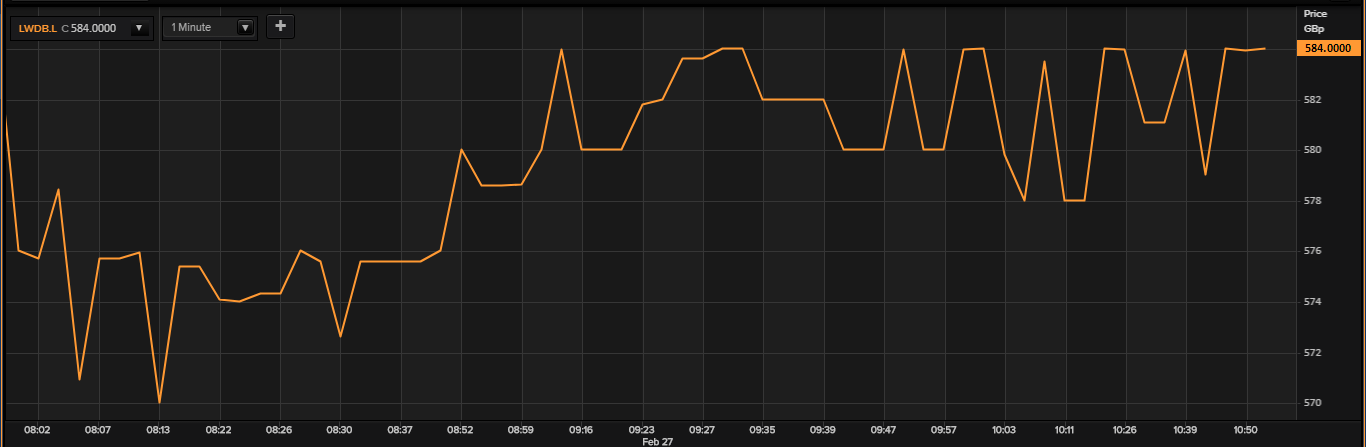

Law Debenture Corporation Plc Stock Trading Performance at The London Stock Exchange

Source- Thomson Reuters

On 27 February 2020, the shares of the company were trading on the London Stock Exchange at GBX 584.0. At that time the market capitalisation of the company at the exchange was around £691.64 million.

The shares of the company have touched a price of GBX 656.00 on the higher side and a price of GBX 528.00 on the lower side in the past 52 weeks of trading on the exchange.

Outlook

The year 2019 was a successful one for the company with its strong growth in dividend, reflecting its strong and profitable investment strategy. The company expects to continue to deliver on this strategy in 2020 and pay still higher dividends.