The United Kingdom IPO Market

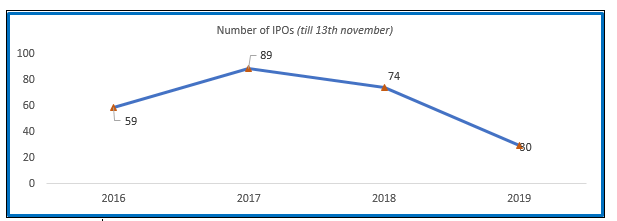

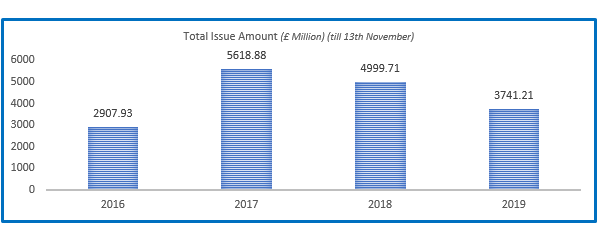

There has been a dearth witnessed for companies getting themselves listed on the United Kingdomâs London Stock exchange this year. The biggest reason that perhaps understandably given would be Brexit-induced volatility. Around 30 companies have floated their shares in an initial public offering on the London Stock exchange so far in 2019, compared with 74 in the same period in 2018 and 89 in 2017, excluding listings classified as international offerings, where stocks arenât available to retail investors. Out of the total listings this year, 23 companies have chosen the UKâs Main Market (LSE) with only seven choosing to be listed on the Alternative Investment Market (AIM). Compared to the same period last year, when 36 companies chose to be listed on the AIM while 35 got listed on the UK Main Market. Most notably, only two companies have been listed on the International Main Market this year as compared to previous one, when 4 international companies were floated on the London Stock Exchange, while this number was up to 7 by the end of the whole of 2018. There also has been a lack of big names floating in the UK with only four IPOs (initial public offerings) for companies worth more than £1 billion have come out this year as compared to seven in 2018 and seven in 2017 as well. Various financial experts and fund managers reportedly have suggested that there could be three reasons as to why the United Kingdom is witnessing lack of new issues this year. First, the onus lies on the low valuation of UK markets at the moment, both historically and relatively to the rest of the world. If companies are looking to raise money for growth, doing so in the United Kingdom is looking not a good option to do it given the lesser ratings that the local stocks are likely to get. Companies may be willing to wait until political and economic risks such as Brexit, trade wars and economic downturns have receded and, there is the hope of achieving better valuations in the future. The second reason, as suggested by experts, could be the United States market which has levelled by grabbing big-name IPOs because thatâs where many of the high-profile technology disruptors are based. The United Kingdom market currently doesnât have these sorts of organisations at the right stage in their economic cycles to attract big money from investors.

The third and foremost reason could be called the uncertainty around Brexit, which has led companies to delay big Investment and financial decisions that includes the likes of placing and floating. Even when the confidence returns to the management of these organisations, the UK may not necessarily remain the listing choice with the slowdown in the economy as expected by the Bank of England in the near future.

There could be some other constraints too, that the companies prefer to stay private for longer as well as private equity companies being flushed with cash and making the acquisition of businesses off-market that might have been considering an IPO for a better exit. The poor performance from some of last yearâs IPOs, notably Aston Martin (AML) and Funding Circle (FCH), might have also reduced the investor confidence for the companies to consider not placing their stocks on the market. Some of the trends leading up to this can be found in the figures below.

Source: FTSE NEW AND FURTHER ISSUES Statistics

Source: FTSE NEW AND FURTHER ISSUES Statistics

There are a few major IPOs in the pipeline for the UK Market, such as the likes of Longboat Energy Limited.

Longboat Energy Limited

Longboat Energy has been built up by the previous supervisory group of Faroe Petroleum lc to Fasttrack the making of another full-cycle North Sea oil and gas organisation. The system to accomplish this will at first be through the procurement of benefits where the supervisory crew can include an incentive through the subsurface and operational enhancements, follow-up bargain openings and close field investigation; and by value creation through the bore. The Directors accept that there is a novel open door at present to manufacture a significant North Sea E&P on a generally short span of time scale. Ongoing separation in the oil and gas industry has caused noteworthy ways out from the North Sea.

As per the Chief Executive Officer (CEO) of the company Mr Helge Hammer, the company is looking to target excellent procurement openings in Norway and the United Kingdom with the point of optimising the advancement of another, full-cycle, mid-top E&P. The company will use its robust industry connections and profound resource information to target resources where the company can open value and hope to recreate Faroe's reputation of conveying an incentive through investigation. The capital being raised through the companyâs IPO will empower Longboat with due constancy on focused potential arrangements and reserve the business until the company can make its first acquisition.

Admission of Longboat Energy in the Alternative Investment Market

On 13th November 2019, it was announced that the management crew behind the Faroe Petroleum achievement are propelling another organisation, Longboat Energy, which is going to the Alternative Investment Market (AIM) of the London Stock Exchange for a £10 million initial public offering. The company plans to fast-track the making of another full-cycle North Sea oil and gas business, beginning with the procurement of assets where the group can include value by means of subsurface and operational upgrades. That would be caught up with further chances to procure near field exploration and extraction projects. Longboat reported that there's currently a remarkable chance to assemble an important North Sea exploration and production on a comparatively brief time scale, as disengagement in the business has activated noteworthy exits from the sector altogether.

Graham Stewart, whoâs been appointed as the chairman of the board in Longboat Energy, who was also the previous CEO at Faroe, said that the company had been built up to profit by the flow opportunity in the North Sea and proceed with the system that the people at Faroe started with, that will help the investors in generating value through a mix of inventive and specific Mergers and Acquisitions, driving operational efficiencies into its assets, and making the company into a world-class exploration and production company. Faroe's previous Chief Executive Officer Helge Hammer will join Longboat as the CEO. Mr Stewart also highlighted that Mr Hammer was extremely instrumental in driving Faroe's operating performance and world-leading E&P track record. Mr Hammer was himself reported saying that the company is currently focusing on excellent acquisition openings in Norway and the United Kingdom with the point of optimising the improvement of another, full-cycle, mid-top E&P.

He also mentioned that the company would use its robust industry connections and profound resource knowledge to target resources where the company can add value and hope to duplicate Faroe's reputation of delivering value through E&P processes. Norwegian oil firm DNO took control of Faroe recently by means of hostile takeover, getting the organisation at the cost of GBX 160 per share which valued the organisation at £641 million. Faroe's board surrendered to the hostile offer in January; however, at that time they didn't trust what it spoke to a reasonable value for the organisation's assets were worth.

The capital being raised through the companyâs IPO will empower Longboat to do due diligence on potential focused agreements and finance the business until the company can make its primary acquisition. Longboat also reported that the £10 million that is expected to be raised through the stock market listing would help the organisation's legitimacy with resource merchants and it expects that extra capital will be raised nearby the first purchase of an asset that it makes. The companyâs shares are expected to start trading on 29th November 2019.