GA, UNITED STATES, June 24, 2025 /EINPresswire.com/ -- This study is pleased to present a seminal study examining reserve management strategies across 45197 company-line-year observations from 2000-2012. The research pioneers line-of-business-level analysis to disentangle insurers' multidimensional incentives—tax optimization versus solvency management—through structural reserve adjustments. Employing two-way clustered fixed-effects models and regulatory policy shocks, the study establishes causal evidence of strategic reserve allocation patterns previously undocumented in actuarial literature.

A new study published in the KeAi journal Risk Sciences examined how insurance companies manage reserves. Specifically, the researchers investigated how managerial incentives affect insurers' reserving practice across lines of business (LOBs) and accident years (AYs).

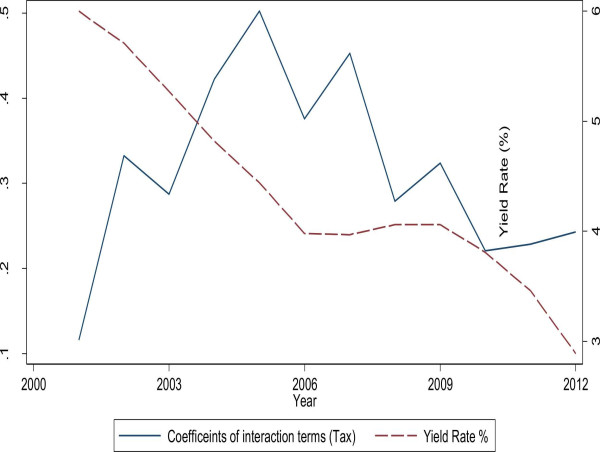

"Because the tax discount factor the tax authority assigns varies across LOBs and AYs, insurers with stronger tax-saving incentives will be inclined to manage reserves across both LOBs and AYs," explains lead author Pingyi Lou from Fudan University. "In contrast, since the Risk Based Journal Pre-proof Capital (RBC) regime specifies different industry worst-case factors across LOBs, insurers with stronger incentives to increase their RBC ratio will be inclined to manage reserves across LOBs."

Regarding income-smoothing incentives, only the overall level — and not the composition — of reserves is of consequence. Thus, the authors predict that there will be no similar systematic patterns in reserve manipulation by insurers based on income-smoothing incentives.

"Using a Firm-LOBYear sample, we found that both tax incentives and RBC incentives affect the level of reserve errors (REs) and the composition of Res," adds Lou. "These results enable us to infer different managerial incentives from insurers' reserving behavior."

The findings serve as actionable insights for Solvency II and NAIC frameworks, emphasizing the need to monitor reserve distribution patterns rather than aggregate levels.

"Practitioners will benefit from evidence-based guidance on balancing tax deferral benefits against regulatory capital requirements," says Lou. "Based on the results, we advocate for enhanced audit independence and refined RBC risk factors to mitigate systemic reserve management risks."

References

DOI

10.1016/j.risk.2025.100014

Original Source URL

https://doi.org/10.1016/j.risk.2025.100014

Funding information

We are grateful for the helpful comments from the editor, two anonymous referees, George Zanjani (Discussant) and the seminar participants at ARIA 2019 Annual Meeting. We acknowledge the financial support from the National Natural Science Foundation of China (72403056, 72173005), the Major Grant of Social Science Foundation of China (23&ZD178). All errors are our own.

Lucy Wang

BioDesign Research

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()