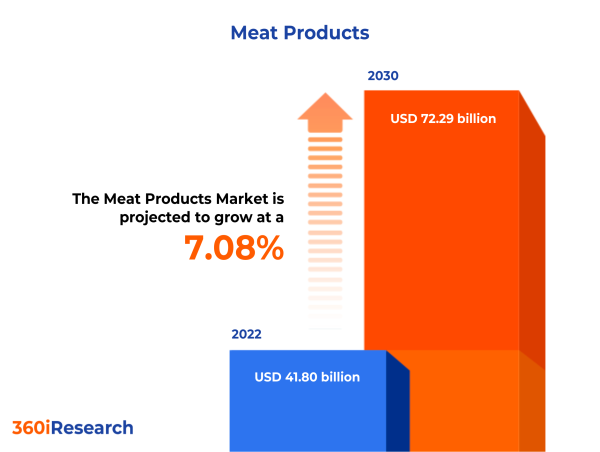

The Global Meat Products Market to grow from USD 41.80 billion in 2022 to USD 72.29 billion by 2030, at a CAGR of 7.08%.

PUNE, MAHARASHTRA, INDIA , December 6, 2023 /EINPresswire.com/ -- The "Meat Products Market by Animal Type (Beef, Pork, Poultry), Type (Canned, Chilled, Fresh), Production Type, Distribution Channel - Global Forecast 2023-2030" report has been added to 360iResearch.com's offering.The Global Meat Products Market to grow from USD 41.80 billion in 2022 to USD 72.29 billion by 2030, at a CAGR of 7.08%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/meat-products?utm_source=einpresswire&utm_medium=referral&utm_campaign=sample

Meat products refer to a broad category of food primarily sourced from animal processing and typically stem from the butchering of mammals, poultry, fish, or other edible animals. They can include a variety of forms, ranging from raw cuts to more highly processed forms. The term encompasses diverse items, including fresh, frozen, or refrigerated cuts such as steaks, chops, and filets, and smoked, cured, or otherwise preserved products such as ham, bacon, sausages, terrines, and pâtés. Furthermore, meat products may be processed to different extents, including minced and ground meat, which can be used to make products such as burgers and meatballs. Various factors, including cultural preferences, dietary habits, economic conditions, and health considerations, influence the production and consumption of meat products. These products are a significant source of protein, vitamins, minerals, iron and zinc, and essential amino acids for bodily functions. The meat products market has witnessed significant growth in recent years due to evolving preferences, dietary trends, and environmental concerns. Moreover, rising consumer health consciousness and intake of nutritional food, consumer inclination toward flavored meat products, and increasing demand for ready-to-eat products contribute to the expanding adoption of meat products. However, the market faces certain challenges, such as stringent government regulations for food safety, and side effects and allergens associated with meat products hinder the market growth. Furthermore, technological advancements in the production of meat products and rising government funding for expanding meat and poultry processing present potential opportunities for the growth of the meat products market in the coming years.

Production Type: Growing preference for natural and free-from additives-based unprocessed beef

Processed meat undergoes certain procedures to enhance its flavor, increase its shelf life, or make it more palatable. These methods to produce processed meats include smoking, curing, salting, and adding preservatives. Processed meats include hot dogs, bacon, sausages, and lunch meats. Processed meats have a significant market share due to their convenience, taste, and long shelf life. However, their health impact is a constantly debated topic due to the high levels of sodium and preservatives. Unprocessed meats are raw or fresh meat from livestock, poultry, and others that do not undergo any added procedures beyond basic butchery. Unprocessed meats are greatly valued for being natural and free from additives, and their nutritional content is generally higher than processed meats.

Animal Type: Rising popularity of poultry meat among quick-service restaurant chains

Beef is a popular protein source, especially noted for its taste and richness in nutrients such as iron and vitamin B12. Demand for beef is subject to various factors, including cultural preferences, dietary trends, and economic conditions. Premium cuts of beef have witnessed increased demand in specific markets, driven by a rise in consumer spending and interest in high-quality meat products. Pork is the most extensively consumed meat globally, with a significant presence in Asian and European diets. The versatility of pork and its cost-effectiveness contribute to its popularity. Various pork products, such as bacon, sausages, and ham, have a strong market presence. Health trends have affected the pork industry, with consumers increasingly seeking leaner options. Poultry, primarily chicken, is increasingly preferred in several regions due to its lower cost, health connotations, and adaptability in various cuisines. The poultry market has benefited from quick-service restaurant chains and the rise in consumption of convenience food. The increasing adoption of organic and free-range poultry indicates a shift toward more ethically produced and perceived healthier options.

Distribution Channel: Increasing sales of meat products through supermarkets & grocery stores

Offline distribution channels represent the traditional and most prevalent route through which meat products reach consumers. Some meat producers sell directly to consumers through on-farm stores, farmer's markets, and community-supported agriculture (CSA) programs. Wholesalers purchase meat products in bulk from producers and sell them to various retailers. Supermarkets play a significant role in the meat product distribution landscape. Retailers propose a wide range of products and can provide valuable shelf space and exposure to diverse consumers. In addition, butcher shops offer expert services and can cater to consumers seeking specific cuts or higher-quality options. Specialty stores may focus on organic, local, or exotic meats and provide a knowledgeable staff to assist customers. Restaurants, hotels, and catering companies work with specialized distributors that can meet their specific needs for volume and quality. However, the expansion of eCommerce has witnessed a corresponding growth in the online distribution of meat products. These eCommerce platforms enable direct-to-consumer sales through company websites or third-party marketplaces, providing convenience and accessibility paired with detailed product information and reviews. Subscription services offer scheduled deliveries of meat products, frequently focusing on themes such as organic, grass-fed, or curated selections. Moreover, dedicated online grocery stores have emerged, offering the full range of traditional supermarket products, including meat, through an online interface, with delivery to the homes of consumers. Mobile apps that offer grocery delivery or meal-kit services include meat products as part of their assortments, catering to tech-savvy consumers seeking meal-planning assistance.

Type: Growing adoption of frozen meat products owing to its extended shelf life

Canned meat products offer convenience and a longer shelf life, which appeals to consumers seeking easy meal solutions and those with limited access to fresh food retailers. These products are cooked and preserved in airtight containers, including traditional items such as corned beef and spam and gourmet options such as canned duck confit. Chilled meat products are stored and transported in a cold and non-frozen state, which helps maintain freshness, ensuring a longer shelf life than unfrozen fresh meats. This category includes fresh sausages, marinated meats, and ready-to-cook selections. They are popular in grocers' fresh meat sections and appeal to consumers seeking quick yet fresh meal components. Fresh meat products encompass a variety of meats such as beef, poultry, pork, and lamb that have not been frozen or subjected to any preservative processes other than refrigeration.Fresh meat requires strict temperature control to prevent spoilage and maintain safety. Frozen meat products consist of quickly frozen meat to preserve their fresh nutritional value and significantly extend shelf life. This category includes individual cuts of meat and bulk packs used in food service. The advantages of frozen meat are convenience and waste reduction, as consumers can use the quantities they need and store the rest for a prolonged period. Processed meat products are altered through various methods, including smoking, curing, or adding preservatives and flavorings to enhance taste and extend shelf life.

Regional Insights:

The meat products market in North America is witnessing diverse trends across different regions and meat types. The appetite for meat products remains robust despite shifts in consumer preferences with a substantial consumer base and the emergence of alternative protein sources. Consumer preferences in the Americas are becoming more sophisticated, with demands for specific cuts, types of meat, and preparation methods evolving. In addition, there is heightened awareness and concern over animal welfare and ethical farming practices, influencing purchasing decisions. South America, particularly Brazil and Argentina, are significant countries contributing to the global meat market, with a strong focus on beef. These countries are large consumers of meat products and among the top beef exporters worldwide. The market is supported by advanced agribusiness expertise and abundant natural resources, allowing for large-scale production. Europe presents a diverse market landscape, with variations in consumption patterns and preferences across the region. Western Europe demonstrates a high demand for processed meats like sausages and deli meats, while Eastern Europe tends to consume fresher meat. The European market is experiencing a rising trend in the demand for certified meat products that assure higher animal welfare and sustainability standards. The Middle East is known for its high consumption of lamb and poultry, with religious dietary laws influencing meat consumption patterns. Halal certification is paramount in meat products for this region. The African meat products market is relatively smaller but is gradually expanding as the consumption pattern varies greatly between regions, with North Africa exhibiting a preference for lambs and Sub-Saharan Africa preferring goats and poultry. The market potential is significant; however, challenges such as inadequate cold chain infrastructure and fragmented markets impede rapid growth. The APAC region is experiencing rapid growth in the meat products market, primarily driven by increasing incomes and changing dietary habits, especially in China and India. Pork is highly consumed in China, whereas India is strongly inclined toward poultry owing to the cultural and religious constraints on beef consumption. Moreover, the expansion of the retail chain and cold storage facilities is aiding the growth of the meat products market in this region.

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Meat Products Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Meat Products Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Meat Products Market, highlighting leading vendors and their innovative profiles. These include Allanasons Private Limited, Australian Meat Company, Beauvallet, Believer Meats (Future Meat Technologies Ltd.), Canada Meat Group Inc., Cargill, Incorporated, China Yurun Food Group Limited, Clemens Food Group, COFCO Corporation, Fortune Fish & Gourmet, Foster Farms, Hormel Foods Corporation, JBS SA, Kerry Group PLC, Marfrig Global Foods S.A., Meat Products of India Ltd., Meatable B.V., Minerva S/A, Müller Fleisch GmbH, Nestle SA, NH Foods Ltd., Perdigão by BRF S.A., Qatar Meat Production Company LLC, Redefine Meat Ltd., Sysco Corporation, Tyson Foods, Inc., Tönnies Holding ApS & Co. KG, Upside Foods, Inc., Venky's (India) Limited, Vion N.V., WH Group Limited, and Wholesome Foods, Inc..

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/meat-products?utm_source=einpresswire&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the Meat Products Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Animal Type, market is studied across Beef, Pork, and Poultry. The Beef is projected to witness significant market share during forecast period.

Based on Type, market is studied across Canned, Chilled, Fresh, and Frozen. The Canned is projected to witness significant market share during forecast period.

Based on Production Type, market is studied across Processed and Unprocessed. The Unprocessed is projected to witness significant market share during forecast period.

Based on Distribution Channel, market is studied across Offline and Online. The Offline is further studied across Butcher Shops & Specialty Stores, Direct Sales, and Supermarkets & Grocery Stores. The Offline is projected to witness significant market share during forecast period.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Europe, Middle East & Africa commanded largest market share of 36.23% in 2022, followed by Americas.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Meat Products Market, by Animal Type

7. Meat Products Market, by Type

8. Meat Products Market, by Production Type

9. Meat Products Market, by Distribution Channel

10. Americas Meat Products Market

11. Asia-Pacific Meat Products Market

12. Europe, Middle East & Africa Meat Products Market

13. Competitive Landscape

14. Competitive Portfolio

15. Appendix

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Meat Products Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Meat Products Market?

3. What is the competitive strategic window for opportunities in the Meat Products Market?

4. What are the technology trends and regulatory frameworks in the Meat Products Market?

5. What is the market share of the leading vendors in the Meat Products Market?

6. What modes and strategic moves are considered suitable for entering the Meat Products Market?

Read More @ https://www.360iresearch.com/library/intelligence/meat-products?utm_source=einpresswire&utm_medium=referral&utm_campaign=analyst

Mr. Ketan Rohom

360iResearch

+1 530-264-8485

[email protected]