PORTLAND, OREGAON, UNITED STATES, April 1, 2024 /EINPresswire.com/ -- According to a new report published by Allied Market Research, titled, “Green Logistics Market Share, Size, Competitive Landscape and Trend Analysis Report by End Use, by Business Type, by Mode of Operation : Global Opportunity Analysis and Industry Forecast, 2023-2032,"

𝐆𝐫𝐞𝐞𝐧 𝐋𝐨𝐠𝐢𝐬𝐭𝐢𝐜𝐬 𝐚𝐧𝐝 𝐓𝐫𝐚𝐧𝐬𝐩𝐨𝐫𝐭𝐚𝐭𝐢𝐨𝐧 𝐌𝐚𝐫𝐤𝐞𝐭 𝐒𝐭𝐚𝐭𝐢𝐬𝐭𝐢𝐜𝐬 𝟐𝟎𝟐𝟑-𝟐𝟎𝟑𝟐 :

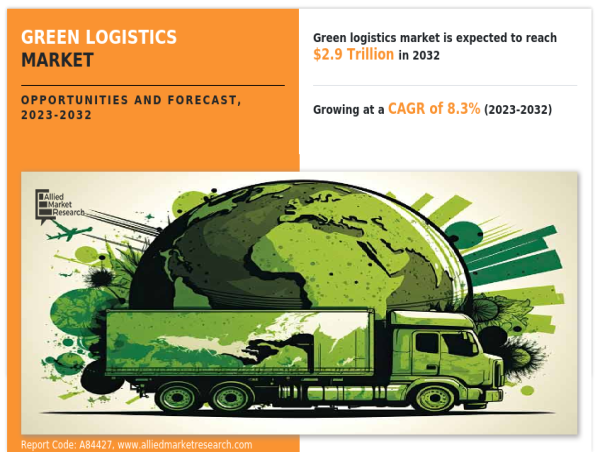

The global green logistics market size was valued at $1.3 trillion in 2022, and is projected to reach $2.9 trillion by 2032, growing at a CAGR of 8.3% from 2023 to 2032.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐚𝐠𝐞𝐬 : https://www.alliedmarketresearch.com/request-sample/84911

Asia-Pacific currently dominated the green logistics market in 2022. This was primarily due to China is actively promoting green practices, investing in EVs and clean energy sources. Japan is a leader in green technology adoption, while India and South Korea are focusing on improving infrastructure and promoting electric vehicles. North America is the second largest market for the green logistic in 2022. North America is a prominent region in the green logistics industry, comprising the U.S., Canada, and Mexico. The region has been witnessing a growing emphasis on sustainable practices, driven by environmental regulations and the increasing awareness of carbon footprint reduction. The U.S. leads the green logistics market in North America due to its large economy and advanced transportation infrastructure. U.S. based private logistic companies have invested in sustainable logistic project. For instance, in March 2021, FedEx Corporation announced that it invested $2 billion to achieve carbon-neutral operations by 2040. The first investments are projected to be made in fleet electrification, carbon separation, and renewable energy.

Canada has also made significant strides in adopting green logistics practices, with a focus on alternative fuels and efficient supply chain management. For instance, in November 2022, Air Canada made an announcement regarding Bolloré Logistics, becoming the inaugural Air Canada Cargo customer to participate in the Leave Less Travel Program. This program provides corporate and cargo customers with viable choices to mitigate or minimize their greenhouse gas (GHG) emissions linked to business travel or freight transportation, thereby reducing their carbon impact. Bolloré Logistics has made a commitment to offset a substantial portion of its projected GHG emissions resulting from its shipments with Air Canada Cargo by utilizing sustainable aviation fuel (SAF). This commitment translates to the purchase of 620,000 liters of SAF in 2022. Mexico, although still developing its green logistics sector, has investing in renewable energy sources and sustainable transportation solutions.

Distribution is major segment of green logistics market. One of the primary drivers for the distribution segment of the market is the growing emphasis on environmental sustainability. Businesses across various industries are recognizing the importance of reducing carbon emissions and minimizing their environmental impact. Green logistics solutions, such as using electric or hybrid vehicles, optimizing transportation routes, and implementing eco-friendly packaging, help companies achieve their sustainability goals and meet the increasing demand for environmentally responsible supply chains. For instance, in May 2023, Bolloré Logistics, a subsidiary of Bollore SE, extended its fleet in India with a commercial electric vehicle. It is ideal for last-mile deliveries due to its high mobility and low carbon impact. Moreover, in June 2022. FedEx Corporation expanded its delivery fleet with the addition of 150 electric delivery vehicles from BrightDrop, General Motors (GM) technology startup that is decarbonizing last-mile delivery. These developments further boost growth of the green logistics industy.

Moreover, implementation of stringent environmental regulations drives the growth of green logistics market. The implementation of stringent environmental standards and policies by governments and regulatory bodies worldwide has become a key driver of the market. These regulations cover various aspects of logistics operations, such as emissions control, waste management, energy efficiency, and sustainable sourcing. To comply with these regulations, logistic companies are adopting green practices and technologies in their operations. Improving logistics performance has become a crucial factor in effectively integrating into global value chains, sustaining economic growth, and boosting national competitiveness.

𝐏𝐫𝐨𝐜𝐮𝐫𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐍𝐨𝐰 : https://www.alliedmarketresearch.com/green-logistics-market/purchase-options

With growing global environmental concerns, companies and policymakers are facing high pressure to reduce the negative ecological impact of logistics activities and make them more environmentally sustainable. Recent instances highlight these efforts, for instance, in April 2023, the U.S. Environmental Protection Agency announced new exhaust emissions rules, which require 67% of new vehicles registered in the U.S. to be all-electric by 2032. In line with the European Union regulations, specific carbon emission guidelines have been implemented for different vehicle categories. These guidelines require a 15% reduction in carbon emissions for new cars and vans by 2025, relative to the levels recorded in 2021. Furthermore, a target of 55% reduction for cars and 50% reduction for vans by 2030 has been set, with the ultimate aim of achieving a 100% reduction in emissions by 2035.

Moreover, value added services are additional features or standalone offerings that enhance the user experience or provide additional value to customers. In the logistics industry, companies offer green value added services such as eco-friendly picking, packing, and quality control processes to minimize environmental impact.

Insurance, on the other hand, is a contractual arrangement where an entity receives financial protection from an insurance company against losses. Within the green logistics and transportation market size, cargo insurance plays a crucial role in safeguarding shipments from physical damage or theft. It covers any losses or damages incurred during transportation due to mishandling or other forms of harm. Common types of green cargo insurance include land cargo insurance for shipments transported on land, as well as marine cargo insurance for shipments transported via sea and air.

𝐂𝐎𝐕𝐈𝐃-𝟏𝟗 𝐈𝐦𝐩𝐚𝐜𝐭 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬 :

The COVID-19 crisis has created uncertainty in the market, owing to a massive slowing of the supply chain, falling business confidence, and increasing panic among the customer segments. Governments of different regions have already announced a total lockdown and temporary shutdown of industries, thereby adversely affecting overall supply chain operations. Countries around the globe have posed stringent restrictions ranging from days to months of lockdown periods. Owing to this pandemic, many businesses have been halted and are waiting for market conditions to improve. Attributed to the lockdown and social distancing impact, the demand for online retailing has increased compared to offline retailing. In addition, there has been increasing demand for healthcare and FMCG supplies such as hospital supplies, gloves, sanitizers, vaccinations, and perishable food items, propelling the growth of the green logistics during the pandemic.

𝐊𝐞𝐲 𝐅𝐢𝐧𝐝𝐢𝐧𝐠𝐬 𝐎𝐟 𝐓𝐡𝐞 𝐒𝐭𝐮𝐝𝐲 :

By end use, the manufacturing segment is anticipated to exhibit significant growth in green logistics market size in the near future.

By business type, the distribution segment is anticipated to exhibit significant growth in green logistics market in the near future.

By mode of operation, the storage segment is anticipated to exhibit significant growth in green logistics market in the near future.

By region, Asia-Pacific is anticipated to register the highest CAGR during the forecast period.

𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠 : https://www.alliedmarketresearch.com/purchase-enquiry/84911

𝐋𝐞𝐚𝐝𝐢𝐧𝐠 𝐌𝐚𝐫𝐤𝐞𝐭 𝐏𝐥𝐚𝐲𝐞𝐫𝐬:

FedEx Corporation,

DSV,

Agility Public Warehousing Company K.S.C.P. and Subsidiaries,

GEODIS,

Deutsche Post DHL Group.,

YUSEN LOGISTICS CO., LTD.,

Bollor SE,

CEVA Logistics, XPO Logistics, Inc.,

United Parcel Service of America, Inc.

𝐑𝐞𝐚𝐝 𝐌𝐨𝐫𝐞 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 :

Fifth-party Logistics Market :

https://www.alliedmarketresearch.com/fifth-party-logistics-solution-market-A14785

Reverse Logistics Market :

https://www.alliedmarketresearch.com/reverse-logistics-market

Energy Logistics Market :

https://www.alliedmarketresearch.com/energy-logistics-market-A07811

Warehousing and Distribution Logistics Market :

https://www.alliedmarketresearch.com/warehousing-and-distribution-logistics-market-A11526

Food Logistics Market :

https://www.alliedmarketresearch.com/food-logistics-market-A15470

Rail Logistics Market :

https://www.alliedmarketresearch.com/rail-logistics-market

David Correa

Allied Market Research

+1 5038946022

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

![]()