Brazilian iron ore mammoth Vale S.A. has reached a deal with the state of Minas Gerais and prosecutors to settle the claims concerning the Brumadinho disaster.

The iron ore major will now address the environmental and social damage resulting from the Brumadinho Dam collapse that killed 270 people in January 2019. The Court of Justice of Minas Gerais conducted the mediation process.

Source: Copyright © 2021 Kalkine Media Pty Ltd.

Compensation and Reparation

The economic value of the settlement is estimated at R$ 37.7 billion (approximately USD 7 billion), which will be paid to affected people and invested in environmental projects.

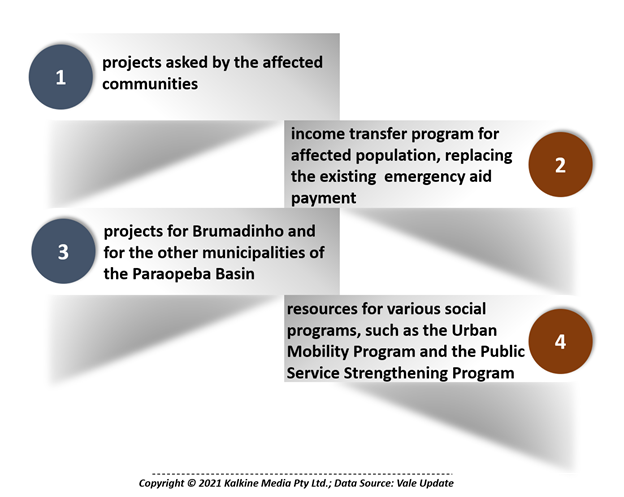

The socioeconomic settlement primarily comprises -

Furthermore, the settlement establishes the guidelines related to the socio-environmental reparation. It paves way for the governance concerning the execution of the reparation plan along with the projects required to be implemented as compensation for the environmental damage.

The global settlement aims to be a quick solution to mitigate the impacts of the dam rupture in the state of Minas Gerais and surrounding areas.

To fulfill the agreed obligations, the Company needs to complete the obligations to pay and the obligations to do, as per the governance of the global settlement.

Under the obligations to pay, Vale is required to complete the payment of commitments with defined values and schedule. Meanwhile, the state of Minas Gerais and Institutions of Justice would be managing the corresponding projects, including both socio-economic and socio-environmental compensation projects.

Under the obligations to do, Vale would commit to both socio-environmental and socio-economic projects, whose estimated values are part of the economic value of the global settlement but are not subject to the global cap of the settlement.

The Company has estimated an additional expense of ~ R$ 19.8 billion, to be recognised in the FY2020 results. Of the total estimated expense, ~ R$ 5.4 billion would be settled upon the release of judicial deposits while R$ 14.4 billion would be added to liabilities.

.jpg)