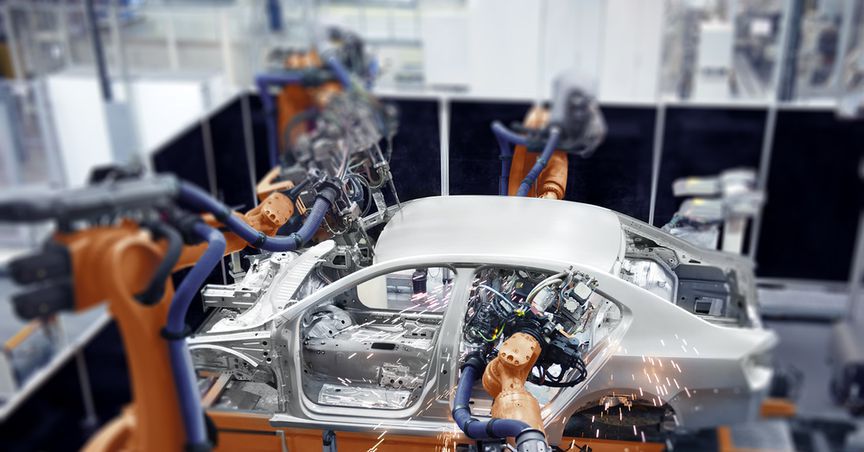

Source:Jenson, Shutterstock

Summary

- The Detroit 3 automakers - Ford Motor, General Motors, and Fiat Chrysler Automobiles - posted robust earnings in their fourth quarter ended 31 December 2020.

- Ford’s adjusted EPS during the three months jumped to 34 cents from 12 cents in the fourth quarter 2019.

- GM recorded an adjusted EPS of USD 1.95 in the quarter against the adjusted loss of 16 cents per share during the year-ago period.

- Fiat Chrysler Automobiles, which merged into Stellantis with French carmaker Peugeot in January, reported a 21% year-over-year growth in its adjusted EPS to €1.17 from 97-euro cents.

After a major hit in the first half of 2020 due to imposed lockdowns, the automobile industry was in rough waters, touching its historical lows. But a change in the consumer outlook of preferring own transport over the public and shared mode of travel is helping the auto industry revive sooner than expected. Though remaining cautious, automobiles executives are optimistic that the USA vehicle sales will return to normalcy in 2021.

The Detroit 3 carmakers, namely, Ford Motor, General Motors, and Fiat Chrysler Automobiles, have posted robust Q4 numbers.

One of the major highlights was Ford’s announcement that it will be selling only fully electric passenger cars by 2030. Meanwhile, General Motors was trading at all-time high as of 11 March 2021, gaining from a new generation of investors, which are raising industry valuation in response to the quick shift to electric vehicles. Mary Barra, the General Motors CEO, has committed billions of dollars to the production of 30 fully electric vehicles by 2025.

Details about FCA merger; Read here: FCA-PSA Merger Stellantis Makes A Splash On Stock Market Debut

Financial update for the period ended 31 December 2020

In the fourth quarter GM’s revenue grew to USD 37.52 billion from USD 30.83; FCA’s revenue slipped 4% year-over-year to €28.58 billion, and Ford’s sales dropped by USD 36 billion from USD 39.7 billion.

For the full year 2020, Ford and FCA saw their adjusted EPS plunge 65.5% and 56%, respectively, while GM booked a slight increase of 1.6%. Ford’s adjusted EPS in 2020 was 41 cents compared to USD 1.19 in 2019. FCA’s adjusted EPS came in at €1.19, while GM’s EPS grew to USD 4.90 from USD 4.82.

Despite quarterly gains, revenue for all the three companies for full year 2020 witnessed a decline when compared to the previous year 2019. Ford’s revenue declined to USD 127.14 billion from USD 155.90 billion. GM reported revenue of USD 122.49 billion in 2020, down from USD 137.24 billion in 2019. FCA’s revenue also dropped 20% to €86.65 billion.

GM saw its sales drop 11.8% year over year in 2020 to 2.55 million units in the US while Ford posted a 15.6% year-over-year decline in sales to 2.04 million units. FCA also recorded 17.4% decline in its sales to 1.82 million units.

“GM’s 2020 performance was remarkable by any measure, and even more so in a year when a global pandemic caused companies around the world – including GM – to temporarily suspend manufacturing operations to keep employees safe,” said GM CEO Mary Barra.

Please also read: General Motors to bid adieu to Gasoline and Diesel-powered Vehicles by 2035

Ford CFO John Lawler said the company targets 2021 adjusted EBIT in the range of USD 8 billion to USD 9 billion, including USD 900 million non-cash gain on its investment in electric vehicle startup Rivian.

However, Lawler noted that the global semiconductor shortage is creating uncertainty and will influence the company’s operating results this year. “Right now, estimates from suppliers could suggest losing 10% to 20% of our planned first-quarter production,” he said.

Meanwhile, in their race to lead in the electric vehicle revolution, Ford and GM have raised their electric vehicle commitments.

GM, which recently revealed a new brand identity, aims to offer 30 all-electric models globally by mid-decade. The company plans to invest USD 27 billion in electric and autonomous vehicles by 2025.

Ford, which is ending its manufacturing in Brazil, doubled down on its electrification push by raising the electric vehicle investment to USD 22 billion through 2025 as well as USD 7 billion investment in autonomous vehicles.

Ford plans to launch an all-electric version of its popular Transit delivery van in late 2021, while GM looks to launch Ultium-powered GMC Hummer electric vehicle and produce Brightdrop EV600 commercial van later this year.

Also read: The EV race has begun: Why are automakers going electric?