Summary

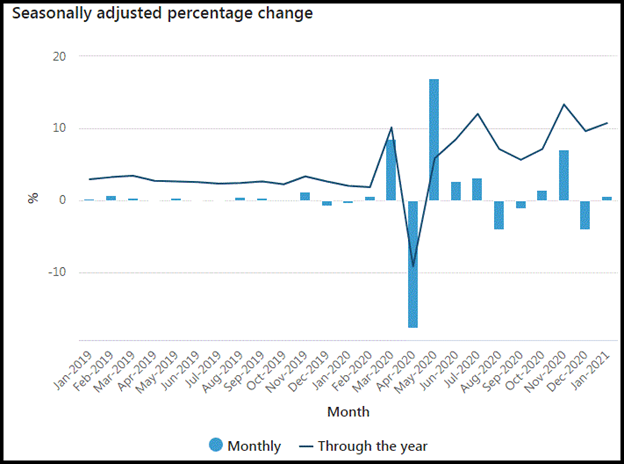

- The Australian retail turnover recorded a 0.6 per cent rise (seasonally adjusted), up 10.7 per cent from the corresponding period of last year, as per the preliminary retail trade figures released by the Australian Bureau of Statistics (ABS) Friday.

- While New South Wales led the rise with a growth of 1 per cent, Queensland was the only laggard with a contraction of 1.5 per cent due to a three-day lockdown.

- The food retailing led the surge in January 2021 as supermarkets recovered from a decline in December last year.

The Australian retail sales surged as coronavirus-induced restrictions in different states eased in January 2021. The national retail turnover recorded a 0.6 per cent rise (seasonally adjusted), up 10.7 per cent from the corresponding period of last year, according to preliminary retail trade figures released by the Australian Bureau of Statistics (ABS) Friday.

Commenting on the retail sales data, Ben James, Director of Quarterly Economy Wide Surveys, said that variations remained in the numbers between states and territories as COVID-19 restrictions were tightened or eased across the country.

Image Source: ABS update, 19 February 2021

States and territories

While New South Wales led the rise with a growth of 1 per cent, Queensland was the only laggard with a contraction of 1.5 per cent due to a three-day lockdown.

Sectors

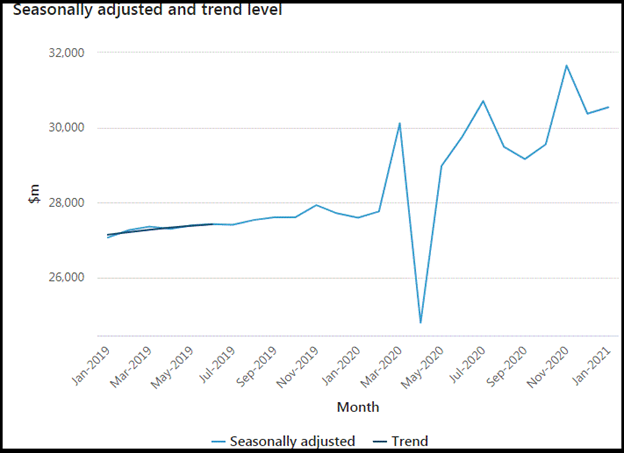

The food retailing led the surge in January 2021 as supermarkets recovered from a decline in December last year. However, a dip was recorded in clothing, footwear and personal accessory retailing, household goods retailing, and department stores. These sectors were under pressure due to the negative impact from the interrupted trade in Queensland.

The retail activity in the country has remained volatile in recent months amid lockdowns and massively popular online sale events. The spending rose 7.1 per cent in November only to dip by 4.1 per cent in December. The final estimate by ABS is scheduled to be released on 4 March 2021.

Image Source: ABS update, 19 February 2021

Meanwhile, the Australian economy plunged into its first-ever recession since the early 1990s after coronavirus-induced lockdowns started in March 2020. However, Australia has been relatively successful in returning to growth post lockdowns as the economy reopened and activities resumed. According to the Australian government’s growth projection, the GDP is expected to grow by 4.5 per cent this year after contracting 3 per cent in 2020.

.jpg)