Automotive Software Market Size, Share, Key Players Analysis, Growth Factors and Forecast 2024 to 2031

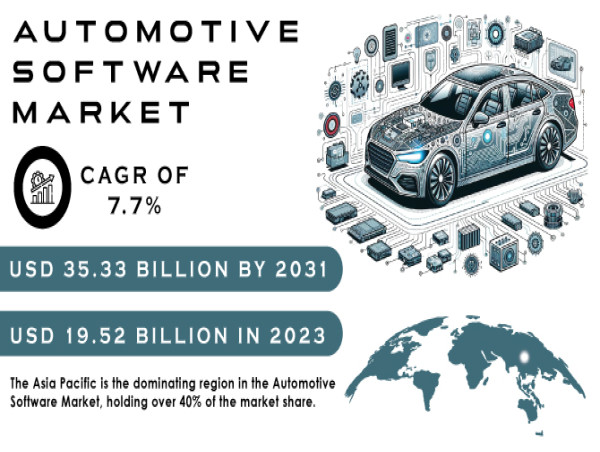

AUSTIN, TEXAS, UNITED STATES, May 23, 2024 /EINPresswire.com/ -- According SNS Insider, The Automotive Software Market Size was assessed at USD 19.52 billion in 2023 and is predicted to reach USD 35.33 billion by 2031, growing at a 7.7% CAGR during the forecast period 2024-2031.

The automotive software market has experienced rapid growth driven by advancements in automotive technology, increasing demand for connected and autonomous vehicles, and a shift towards electric vehicles (EVs). However, the market faces several challenges, including regulatory complexities, cybersecurity concerns, and the impact of global economic and geopolitical factors such as the recent recession and the Russia-Ukraine war. This report provides a comprehensive analysis of the market dynamics, the impact of significant events, regional trends, and recent developments.

Download Free Sample Report of Automotive Software Market @ https://www.snsinsider.com/sample-request/1056

Top Key Players of Automotive Software Market

-Robert Bosch (Germany)

-Green Hills Software (US)

-Wind River Systems

-Renesas Electronics (Japan)

-Airbiquity (US)

-BlackBerry (Canada)

-NVIDIA (US)

-Autonet Mobile Inc. (USA)

-Elektrobit (US)

-NXP (Netherlands)

Market Segmentation

By Application:

-ADAS & Safety Systems

-Body Control & Comfort System

-Remote Monitoring

-Powertrain System

-Communication System

-Infotainment System

-Biometrics

-Vehicle Management & Telematics

-Connected Services

-Autonomous Driving

-HMI Application

-V2X System

By Software Layer:

-Operating System

-Application software

-Middleware

By Solution:

-Autopilot Software

-Navigation Software

-Car safety Software

-Entertainment Software

By Vehicle Type:

-Passenger car (PC)

-Heavy commercial vehicle (HCV)

-Light commercial vehicle (LCV)

Market Dynamics

Drivers

The rapid evolution of automotive technologies, including Advanced Driver Assistance Systems (ADAS), autonomous driving, and vehicle-to-everything (V2X) communication, is significantly boosting demand for sophisticated automotive software. Additionally, growing consumer preference for in-car connectivity and infotainment systems is driving the need for robust software solutions. The global shift towards electric vehicles (EVs), which require complex software for battery management, powertrain control, and energy efficiency, further fuels this demand. Stricter safety and emissions regulations worldwide also necessitate advanced software solutions for compliance, reinforcing the market's growth.

Want Detailed Insight on this Research, Drop your Enquiry Here @ https://www.snsinsider.com/enquiry/1056

Restraints

The development and integration of advanced automotive software are capital-intensive, posing a significant barrier for small and medium-sized enterprises (SMEs). Additionally, the increasing connectivity in vehicles makes them vulnerable to cyber-attacks, necessitating stringent cybersecurity measures. Navigating the complex and varying regulatory landscapes across different regions further complicates matters for automotive software providers. These factors collectively present substantial challenges in the market, impacting the ability of companies, especially SMEs, to innovate and compete effectively.

Opportunities

Integrating Artificial Intelligence (AI) and Machine Learning (ML) into automotive software can significantly enhance functionalities like predictive maintenance, driver assistance, and autonomous driving. Moreover, rapid urbanization and increasing vehicle ownership in emerging markets offer substantial growth prospects for automotive software vendors. Collaborations between automotive Original Equipment Manufacturers (OEMs) and software companies are pivotal, fostering innovation and expediting the development of advanced software solutions. These strategic partnerships leverage complementary expertise to address evolving market demands, driving competitiveness and accelerating technological advancements in the automotive software sector.

Challenges

The integration of diverse software systems within a vehicle's architecture poses a significant challenge due to complexity, necessitating seamless compatibility and interoperability. Additionally, as connected vehicles collect more data, ensuring data privacy and compliance with regulations becomes paramount. This presents a considerable challenge for automotive software providers. Moreover, the growing demand for skilled professionals in software development, AI, and cybersecurity highlights a concerning shortage of talent, which could impede market growth. Addressing these issues requires strategic planning, investment in talent development, and robust cybersecurity measures to navigate the evolving landscape of automotive software integration and data privacy.

Impact of Recession

The global recession has led to reduced consumer spending on automobiles, impacting vehicle sales and, consequently, the demand for automotive software. Budget constraints have forced manufacturers to prioritize essential software features over innovative, high-cost developments. However, the focus on cost-efficiency and the need for operational optimization during the recession have also spurred demand for software solutions that enhance productivity and reduce costs.

Impact of Russia-Ukraine War

The Russia-Ukraine war has disrupted global supply chains, leading to shortages of critical components required for automotive software development. Sanctions and economic instability in the region have further complicated the market landscape. Additionally, the geopolitical tension has shifted the focus of software security, emphasizing the need for robust cybersecurity measures to protect against potential cyber warfare targeting automotive infrastructure.

Regional Analysis

1.North America: The region is a leader in automotive innovation, with significant investments in autonomous driving and EV technology. Strong regulatory support and a high adoption rate of advanced automotive technologies drive market growth.

2.Europe: Europe is characterized by stringent environmental regulations and a strong focus on safety, driving the adoption of advanced automotive software. Countries like Germany and the UK are at the forefront of automotive software development.

3.Asia-Pacific: Rapid urbanization, increasing vehicle ownership, and significant investments in automotive technology in countries like China, Japan, and South Korea make this region a high-growth market for automotive software.

4.Rest of the World: Regions such as Latin America and the Middle East are gradually adopting advanced automotive technologies, presenting new opportunities for market expansion.

Recent Developments

1.Collaboration between Volkswagen and Microsoft: Volkswagen's collaboration with Microsoft to develop a cloud-based platform for autonomous driving is a significant step towards advancing automotive software capabilities.

2.Launch of Tesla's Full Self-Driving (FSD) Beta: Tesla's rollout of its FSD beta software has garnered attention, showcasing advancements in autonomous driving technology.

3.Acquisition of Argo AI by Ford and Volkswagen: This strategic acquisition aims to bolster the development of autonomous driving systems through collaborative efforts and resource sharing.

Conclusion

The automotive software market is poised for continued growth, driven by technological advancements and increasing demand for connected and autonomous vehicles. However, challenges such as high development costs, cybersecurity risks, and regulatory complexities need to be addressed. The impact of global events like the recession and the Russia-Ukraine war underscores the need for resilience and adaptability in the market. Regional trends and recent developments indicate a dynamic and evolving landscape, presenting both opportunities and challenges for industry stakeholders.

Access Detailed Research Insight with Full TOC and Graphs @ https://www.snsinsider.com/reports/automotive-software-market-1056

Our Related Report

Electric Bicycle Market

E-bikes Market

Ultra High-Performance Tire Market

Akash Anand

SNS Insider Pvt. Ltd

+1 415-230-0044

[email protected]

Visit us on social media:

Facebook

Twitter

LinkedIn

Instagram

YouTube

![]()