Highlights

- Manifestos framed by political parties have significant impact on stock markets. If parties talk about economic growth and slashing taxes, the market may rise.

- In debates and manifestos, whichever industries the parties talk about is likely to boom.

- Patience, emergency funds, in-depth knowledge of current political scenarios and diversification help in times of market volatility.

In Australia, the federal elections are set to take place on May 21. There are just a few days left to know whether Scott Morrison will continue as the Prime Minister or Anthony Albanese will take up the seat. As history tells us, pre-election and post-election times are highly volatile for the share markets.

How do elections affect markets?

Like other domestic and global factors, elections impact the stock market. For instance, if the current government wins, chances are higher for the market to go up as consistency in government shows political stability.

Secondly, the manifesto framed by parties has a significant impact on the stock market. If the parties talk about economic growth and slashing taxes, the market may rise. Additionally, the government's ideology plays a crucial role in market volatility. For instance, if a party that supports extensive economic growth wins in exit polls (the mock polls conducted before elections), the stock market rises instantly.

In the debates and the manifestos, whichever industries the parties talk about ought to boom. For instance, if one party says they want to reduce taxation and provide incentives for the tourism industry, travel stocks would rise.

The market tends to get more volatile before, during, and post the elections. Therefore, investors need to be extra cautious to minimise risk and optimise stability and profit.

GOOD SECTION: Which policies are unveiled by the Australian opposition ahead of elections?

Source: © 2022 Kalkine Media®

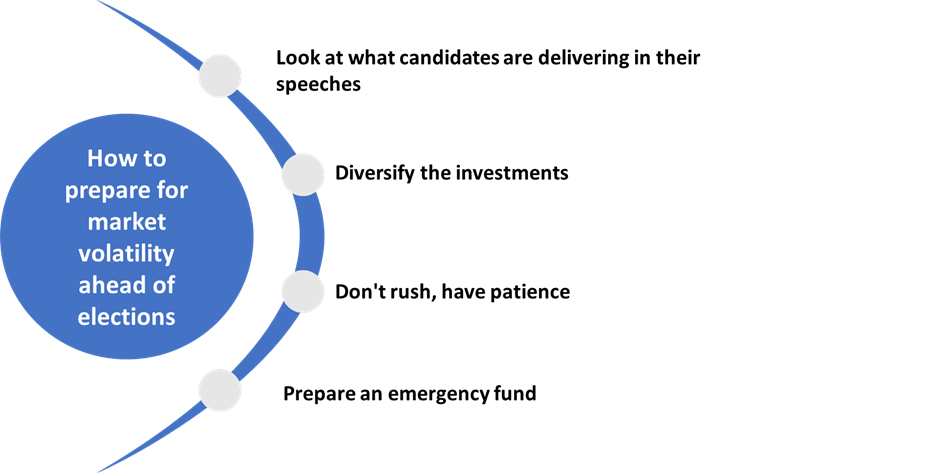

How to prepare for market volatility ahead of elections?

- Look at what candidates are delivering in their speeches: This is the time when Aussies should look at what Morrison and Albanese are talking about. For instance, during the second round of their debates, they specifically talked about a few industries their respective parties would support more. Thus, investors should pay more heed to such enterprises to ensure gains.

- Diversify investments: The golden way of protecting oneself against high market volatility is to diversify the portfolio. It helps if a particular industry falls immensely, the investor remains protected because they didn't invest a lumpsum amount in only one sector, rather chose to diversify.

- Don't rush, have patience: Amid market volatility, many people make the mistake of pulling all their money out, and there are high chances of making losses in such cases. Thus, one should study the market correctly and not feed the beast significantly when they have invested for the long term.

- Prepare an emergency fund: In times of uncertainty, the one golden rule of investing is to prepare an emergency fund. The emergency fund will keep investors afloat even if the portfolio doesn’t yield much income.

INTERESTING READ: Australia Federal Elections 2022: Will Covid wave see Aussies cast their vote via phone?

All in all, the stock market is likely to oscillate for some more time till the dust settles down. As these sinusoidal trends continue, investors can think long-term and maintain a strong temperament without letting fear or greed impact their investment decisions.

_09_03_2024_01_03_36_873870.jpg)