CHINA, January 4, 2024 /EINPresswire.com/ -- A new method is introduced for the management of risks of complex investment products in the investment banking area. This method is based on modern machine learning techniques (specifically, deep contextual bandits) and addresses the risk reporting requirements and the availability of training data in real-world investment firms. While being simple, the new method is demonstrated to outperform benchmark systems in terms of efficiency, adaptability and accuracy under realistic conditions.

Artificial Intelligence (AI) is frequently touted as a silver bullet to solve complex modeling problems. Among its many applications, it has been investigated as a tool to manage risks of complex investment products—so-called derivative contracts—in the investment banking area. Despite the multiple positive reports in this area, concerns have been raised about their practical applicability.

In a new study published in The Journal of Finance and Data Science, a team of researchers from Switzerland and the US explored whether reinforcement learning RL agents can be trained to hedge derivative contracts.

"It should come as no surprise that if you train an AI on simulated market data, it will work well on markets that are reflective of the simulation, and the data consumption of many AI systems is outrageous," explains Loris Cannelli, first author of the study and a researcher at IDSIA in Switzerland.

To overcome the lack of training data, researchers tend to assume an accurate market simulator to train their AI agents. However, setting up such a simulator leads to a classical financial engineering problem: choosing a model to simulate from and its calibration, and making the AI-based approach much like the standard Monte Carlo methods in use for decades.

“Such an AI can also be hardly considered model-free: this would apply only if enough market data was available for training, and this is rarely the case in realistic derivative markets,” says Cannelli.

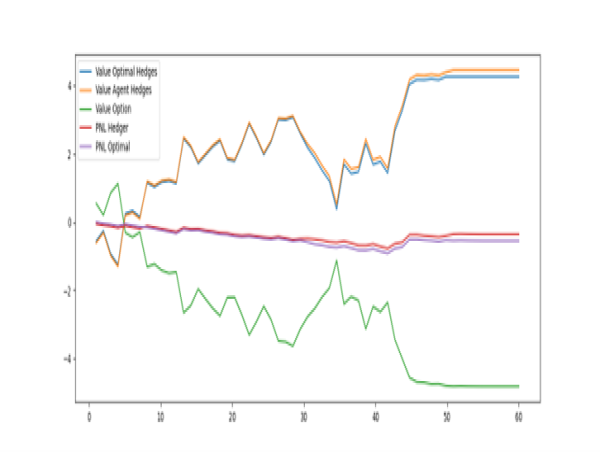

The study, a collaboration between IDSIA and investment bank of UBS, was based on so-called Deep Contextual Bandits, which are well-known in RL for their data-efficiency and robustness. Motivated by operational realities of real-world investment firms, it incorporates end of day reporting requirements and is characterized by a significantly lower training data requirement compared to conventional models, and adaptability to the changing markets.

"In practice, it's the availability of data and operational realities, such as requirements to report end-of-day risk figures, that are the main drivers that dictate the real work at the bank, instead of ideal agent training," clarifies senior author Oleg Szehr, whom, prior to his appointment at IDSIA, was a staff member at several investment banks. “One of the strengths of the newly developed model is that it conceptually resembles business operations at an investment firm and thus is applicable from a practical perspective.”

Although the new method is simple, rigorous assessment of model performance demonstrated that the new method outperforms benchmark systems in terms of efficiency, adaptability and accuracy under realistic conditions. “As often the case in real life, less is more—the same applies to risk management too,” concludes Cannelli.

DOI

10.1016/j.jfds.2023.100101

Original Source URL

https://doi.org/10.1016/j.jfds.2023.100101

Funding information

This work was supported by UBS project LP-15403 / CW-202427

Lucy Wang

BioDesign Research

email us here