You may like them, hate them, but you cannot ignore them. Cryptocurrencies have taken the investment world by storm. They make regular news, and are sometime hailed as future of currency, or criticized as overpriced. Digital currencies gained steam over past one year after crypto ETFs and S&P indices sprung up.

Some of the biggest banks in the US too are allowing rich clients to invest in cryptocurrencies.

Even as the world talks more about popular digital currencies like bitcoin, dogecoin, and ether, let’s find out the ones that are more humbly priced. Below are a few digital currency assets that are priced one dollar or less, but have a whopping market cap.

Image Credit: Pixabay

1. NuCypher (NU)

An Ethereum token, NuCypher (NU) provides cryptography network services. It acts as a provider of ‘privacy-preserving’ services, which include data privacy and encryption keys.

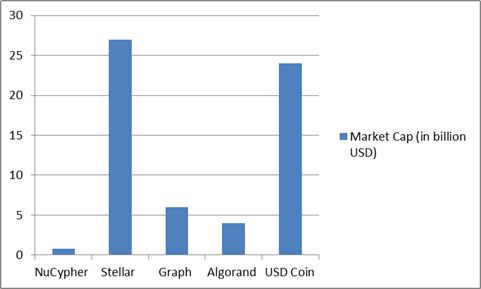

NuCypher price is US$0.22. The market cap is over US$800 million. It is categorized as application token with a total supply of 3.89 billion native units.

The NuCypher protocol set to merge with another decentralized encryption protocol, Keep, to bring synergies in operation and avoid any wastage of resources. The merger has been named ‘Keanu’. The two networks will use common distributed ledger infrastructure.

NuCypher price prediction is that it can return profits in the long-term depending on the kind of demand for its privacy-focused blockchain related services.

2. Stellar (XLM)

Stellar provides network services for storage and movement of money. It aims at connecting the global financial system through a single network where digital versions of USD and other currencies can be sent and traded.

Stellar’s cryptocurrency (XLM) price is US$0.26*. The market cap is over US$27 billion. It is categorized as currency with a total supply of over 105 billion native units.

Almost a month ago, Stellar Development Foundation invested US$15 million in Mexico-based digital wallet service provider, AirTM. The investment aims at making financial services in Latin American countries faster. The Foundation added it seeks to provide banking services to unbanked customers in this region.

Stellar’s cryptocurrency price prediction is that it can return profits in the short to medium term depending on how financial institutions react to its decentralized exchange services.

3. The Graph (GRT)

Graph provides decentralized network services for building open APIs. The data stored on Graph network can be organized and shared across multiple applications.

The Graph (GRT) price is US$0.59*. The market cap is over US$6 billion. It is categorized as application token with a total supply of over 101 billion native units.

A few days ago, The Hawai’i Theatre Center sought donations in cryptocurrency to fund an upcoming event, and graph was one of the currencies, besides bitcoin and Ether, that was accepted.

Graph cryptocurrency price prediction also relies on how its decentralized protocol for querying is availed in the future by players seeking to adopt blockchain.

Market Cap (in billion USD)*

4. Algorand (ALGO)

Algorand or ALGO is a provider of distributed ledger services that it says can bridge the gap between decentralized finance and traditional financial ecosystem.

Algorand price is US$0.83*. The market cap is over US$4 billion. It is categorized as a software program with a total supply of over 5 billion native units.

In June 2021, Six Clovers, a financial infrastructure network led by former PayPal executives, was launched on Algorand. It will enable stablecoin adoption in traditional financial world comprising of banks and payment service providers. Before this development, a US$100 million Algorand fund was launched by Arrington Capital Management, a digital asset management firm.

Algorand price prediction remains positive considering the global financial system is eagerly looking to adopt decentralized finance network to make best use of blockchain.

5. USD Coin (USDC)

Launched in 2018, USD Coin (USDC) is an Ethereum network-based stablecoin, which is pegged to the US dollar. It is said to be fully backed by a fiat currency with a strong blockchain underpinning.

USD Coin price is nearly US$1*. The market cap is over US$24 billion. It is categorized as a stablecoin with a total supply of over 24 billion native units.

It is interesting to note that the Facebook-backed Diem network is also looking to launch stablecoins pegged to a fiat currency in near future. USD Coin has already experimented with this idea.

USD Coin price prediction can also be optimistic given financial intermediaries warm up to its blockchain-based stablecoin services.

All cryptocurrencies cannot be categorized as a single entity with similar characteristics. Many digital currencies and their networks promise a futuristic distributed ledger services, and hence investors must look at their credentials before making investment decisions.

Investor appetite for digital currencies like bitcoin and Ether has turned a little weak over past few weeks. It is time to look beyond the famous and park money intelligently in some cheaper constituents that can create wealth for investors.

*Details as on June 24, 2021

Please note: The above constitutes a preliminary view and any interest in cryptocurrencies or digital tokens and coins should be evaluated further from an investment point of view.