Highlights:

- Ramelius’ share price rose by over 5% during the early trading hours on Thursday.

- The company registered highest gold production during the June quarter for the financial year 2022.

- The gold miner has cash and gold of AU$172.9 million.

Australian gold miner, Ramelius Resources Limited (ASX:RMS), on Thursday, shared the quarterly activities report via ASX announcement. The report revealed that the company reported the highest gold production during the June quarter for the financial year 2022 (FY22). Moreover, the group production during FY22 was in line with the guidance.

Backed by the quarterly update, Ramelius shares were trading 5.34% higher on the ASX today. AT 10:23 AM AEST, the shares were quoted at AU$1.09 apiece.

The shares are performing in line with its benchmark index, ASX 200 Materials (INDEXASX:XMJ) which was up by 1.402% around the same time.

Production during the June quarter and FY22

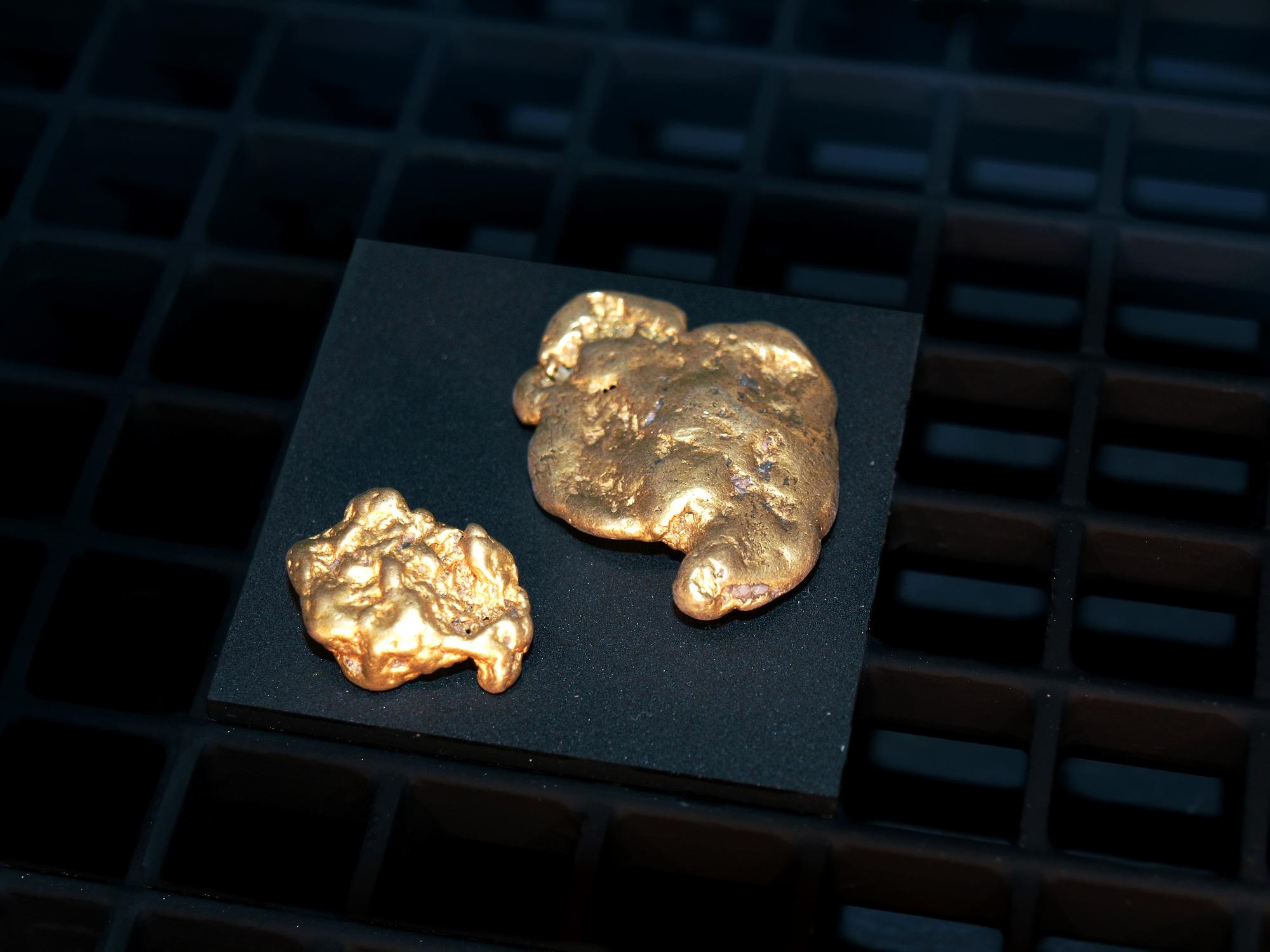

Image source: © Mihalcin | Megapixl.com

- In the June quarter, Ramelius recorded gold production of 67,418 ounces at an all-in sustaining cost (AISC) of AU$1,564 per ounce. The company delivered the highest quarterly production in FY22 despite encountering Covid-19-related impacts.

- In three months, the company sold 67,632 ounces of gold at an average price of AU$2,508 per ounce, registering sales revenue of AU$169.6 million.

- The company ended the quarter with AU$147.7 million in cash and AU$25.2 million in gold bullion.

- After exploration and development expenditure, the company generated cash flow of AU$11.9 million from operations.

- The forward gold sales stood at 196,000 ounces at an average price of AU$2,512 per ounce for the period September 2022 to December 2024.

- The group production in FY22 was 258,625 ounces at an AISC of AU$1,523 per ounce.

Production guidance for FY23

Ramelius expects group gold production of 240,000 to 280,000 ounces in FY23 at an AISC of AU$1,750 to AU$1,950 per ounce. The estimated gold production at Mt Magnet is 150,000 ounces and at Edna May is 110,000 ounces.

The estimated project development and capital expenditure are around AU$58 million. The company expects to spend AU$24 million on underground mine development at Penny, AU$22 million on galaxy underground mine development at Mt Magnet and AU$12 million at Marda.

About Ramelius

Western Australian gold explorer and producer Ramelius Resources was listed on ASX in 2003. The company owns Penny, Tampia, Marda, Vivien, Edna May, and Mt Magnet gold mines. It also operates Rebecca gold project, which was acquired in January 2022.

As per the ASX announcement, the Penny project would move to production with the first ore at the beginning of FY23.

_07_28_2022_02_14_27_672219.jpg)