Highlights

- Medibank Limited, on Wednesday (16 November), updated its FY23 outlook.

- The firm stated that the cybercrime event overshadowed its key achievements and performance in FY22.

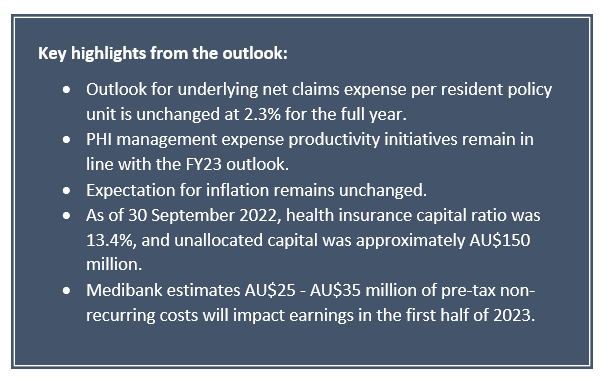

- Medibank estimates AU$25 – AU$35 million of pre-tax non-recurring costs will impact earnings in the first half of 2023.

Private insurer Medibank Private Limited (ASX:MPL), on 16 November 2022, stated that there is no change in its 2023 guidance after it downgraded the same last month. The company held its annual general meeting today.

Meanwhile, at 11:57 AM AEDT, the share price of MPL was quoted 0.711% higher at AU$2.830 apiece on the ASX today.

The company shared via the ASX release that the cybercrime incident has overshadowed many of Medibank’s key achievements and performance in FY2022.

In its release today, the firm stated that in FY22, Medibank grew its health insurance operating profit and health segment profit; however, there was a loss of AU$24.8 million in net investment income because of volatility in financial markets. This reduced the net profit after tax by 10.7% to AU$393.9 million.

In its FY22 financial results, Medibank shared that its capital position stayed strong and it will provide a fully franked ordinary dividend of 7.3 cents per share to its shareholders. This is an increase of 5.5% from the last year’s. This brings the total full-year dividend to 13.4 cents per share, fully franked.

The company informed that initially forecasted FY23 policyholder growth of around 2.7%. However, Medibank announced that an uncertain impact of cybercrime had forced the company to withdraw this outlook. Medibank will share an update on the same in February half-year results.