Highlights

- Saunders International shares have surged significantly in the last six months amid growing economic activity.

- The strong investor interest can be attributed to the Company’s robust financial performance and recent contract wins.

- SND expects revenue in the range of AU$115-130 million and EBIT to remain in the range of 6.5%-7.5% for FY22.

Saunders International Limited (ASX:SND) has been on the investors’ radar with its share price gaining over 55% in the last six months. The multi-disciplined engineering and construction company has been making waves on the stock market for the last six months, with investors beginning to appreciate its solid growth potential.

Saunders’ solid growth potential

Saunders’ recent contract wins and robust financial figures for 1H FY22 are two key factors driving its share price higher. In March 2022, the Company secured new infrastructure projects valued at AU$17 million in the New South Wales region.

Late last year, the Company laid its hands on the largest contract in its history when it won a AU$165 million defence contract from Crowley Solutions for designing and constructing 11 jet fuel storage tanks in the Darwin region.

The fuel tank project will be constructed mostly using Australian resources and materials with a focus on local content wherever possible. Work has commenced on the project, and as per the Company’s last update, tank foundation work is already in progress.

Related read: What is powering Saunders’ (ASX:SND) bullish outlook for 2022 and beyond?

Saunders’ impressive order book

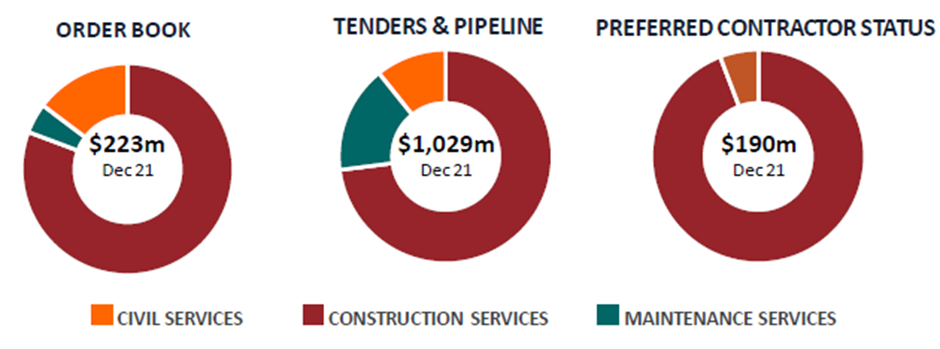

The Group boasts a robust order book comprising AU$223 million of work in hand, as at December 2021. What’s more, the sectors in which the Company operates continue to witness growth. With major public and private infrastructure investment, Saunders is expected to tap further exciting growth opportunities.

Image source: Company update, 24 February 2022

Related read: What sets Saunders International (ASX:SND) apart from other contractors?

Government’s initiatives auguring well for Saunders

The Federal Government’s “Boosting Australia’s Diesel Storage Program” is presently open for awarding eight projects. Similarly, the defence sector is experiencing increased spending by the government, enabling Saunders to broaden its service offerings in the fast-growing industry. The Group is also tapping the NSW Government's "Fixing Country Bridges" program.

Besides, the Group’s tendering activity shows a total value of A$513 million in active tenders. Also, it enjoys preferred contractor status with AU$190 million in contracts.

Related read: Saunders International (ASX:SND) strengthens NSW foothold, wins $17M in infra projects

The Group has over 70-year-long successful history of project execution and on-time delivery. The cost-effective and innovative solutions offered by Saunders had enabled it to become a brand of trust and innovation.

SND shares were trading at AU$1.170 in the early hours of 2 May 2022.