Highlights

- FYI Resources and Alcoa of Australia have signed a binding term sheet.

- The Term Sheet Agreement formalises the intent of both parties to jointly develop FYI’s HPA project.

- The development of the project is planned in three phases with 35% of the project development undertaken by FYI & the remaining 65% by Alcoa.

Australia-based High Purity Alumina (HPA) producer, FYI Resources Limited (ASX:FYI, OTC:FYIRF) has entered into a binding term sheet with Alcoa of Australia for the joint development of its HPA project. The term sheet paves the way for a future joint venture which is subject to final investment decisions (FID) by both parties.

The execution of the Binding Term Sheet Agreement, which formalises the intent of both parties to jointly develop FYI’s HPA project, comes in the wake of the finalisation of the MOU review.

Related Article: FYI Resources Limited (ASX:FYI) and Alcoa agrees to extend HPA JV Exclusive Agreement

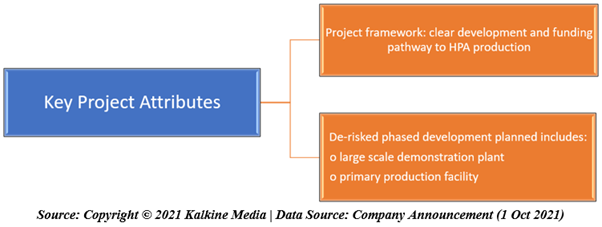

FYI considers the joint development of the project with Alcoa as the best way to de-risk and progress the development of the project. The key project attributes are as follows:

Three-phase project development

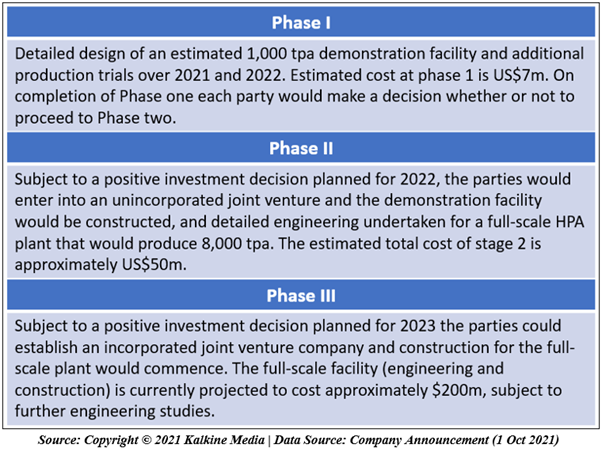

The term sheet envisages the development of the project in three phases. 35% of the project development would be undertaken by FYI, while the remaining 65% would be carried by Alcoa. The parties would fund their pro-rata share of project development and capital costs.

Alcoa is expected to make additional contributions as construction costs for the demonstration and construction facility, subject to the final investment decision.

The overall development of the project is divided into three phases. Phase I of the project development would entail the detailed design of an estimated 1,000tpa demonstration facility.

During the Phase II of project development, both parties would enter into an unincorporated joint venture. Also, Alcoa would contribute the initial US$5 million of FYI’s funding requirements for Phase 2 construction costs. Alcoa will also fund the first US$14 million of costs associated with the construction of the demonstration facility.

Related Article: FYI Resources Limited (ASX:FYI) extends the HPA JV Exclusive Agreement with Alcoa for one month

Upon completion of Phase 2, both parties will decide on entering into the next phase.

Phase III of the project development would see Alcoa contributing the initial US$68 million funding required by FYI for Phase 3 construction costs by sole funding the first US$194 million of costs associated with the construction of the full-scale facility.

The three development phases of the project are summarised below:

Both parties will finalise the formal agreements as part of phase two final investment decision that will include the Joint Venture Management Agreement, a Shareholders Agreement, the Joint Venture Agreement, and other supporting agreements.

Exploring new opportunities

As a part of HPA growth and product development, both parties will explore new opportunities in the HPA product and downstream sector to enhance market prospects through the evaluation of customer requirements of potential customers. The parties will also look for the innovation, commercialisation, and production of broader HPA applications.

Project de-risking and commitment to ESG reporting

Both parties have agreed to clear the development path that includes the development of the demonstration plant and primary production facility, which will be based on FYI's proven HPA process flow sheet design. Both parties can assess the strategy for the proposed JV and growth options based on the outcomes of FID.

The HPA producer will demonstrate its disclosure progress by continuing to provide separate Environmental, Social, and Governance (ESG) updates and publishing its disclosures in the public domain.

Must Read: FYI Resources establishes a world-renowned ESG reporting platform

Shares of FYI last traded at AU$0.545 as of 1 October 2021.