Catch the latest updates from Australia's premier stock exchange & market indices.

Hey ! We have sent you a verification e-mail.

Please follow the instructions on the e-mail to complete your registration. If you can't find it, Please check your spam folder

EXPLORE KALKINEMEDIA.COM

Hong Kong's Digital Banking User Experience Survey 2025

July 07, 2025 10:45 AM AEST | By Cision

ASX 200 Opens Flat as Gold Results Roll In and Trade Tensions Lin...

July 07, 2025 10:42 AM AEST | By Team Kalkine Media

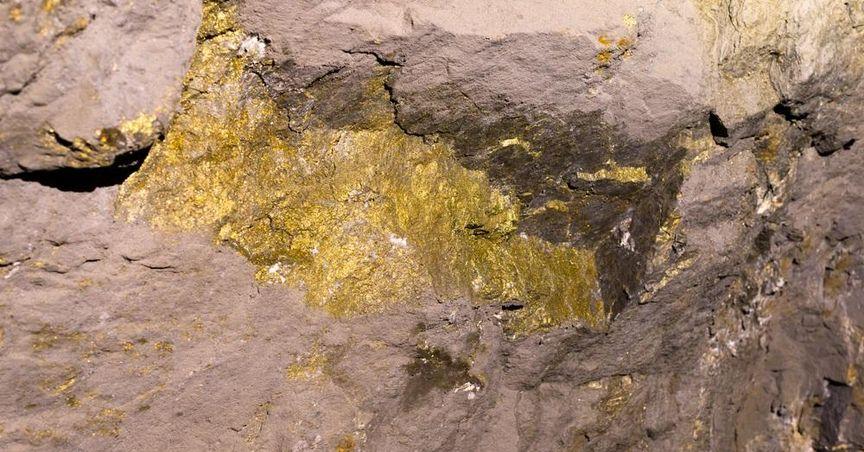

Australian Mines Eyes Strategic Gold Expansion in Brazil with Boa...

July 07, 2025 10:41 AM AEST | By Team Kalkine Media

Gold’s Rally in 2025: Shining Bright Amid Global Turmoil

July 07, 2025 10:40 AM AEST | By Team Kalkine Media

Why WiseTech Global (ASX:WTC) Remains a Standout in Logistics Tec...

July 07, 2025 10:38 AM AEST | By Team Kalkine Media

Data provided by CoinMarketCap.com. & delayed by few minutes. Read Disclosure

ASSETS

| Index | Price(USD) | Change |

|---|

Welcome to Kalkine Media Pty Ltd. website. Your website access and usage is governed by the applicable Terms of Use & Privacy Policy.

Welcome to Kalkine Media LLC website. Your website access and usage is governed by the applicable Terms and Conditions & Privacy Policy.

Welcome to Kalkine Media New Zealand Limited website. Your website access and usage is governed by the applicable Terms and Conditions & Privacy Policy.

Welcome to Kalkine Media Incorporated website. Your website access and usage is governed by the applicable Terms and Conditions & Privacy Policy.

Welcome to Kalkine Media Limited website. Your website access and usage is governed by the applicable Terms of Use & Privacy Policy.

Welcome to Kalkine Media Limited website. Your website access and usage is governed by the applicable Terms of Use & Privacy Policy.

Welcome to Kalkine Media Limited website. Your website access and usage is governed by the applicable Terms of Use & Privacy Policy.

Welcome to Kalkine Media Limited website. Your website access and usage is governed by the applicable Terms of Use & Privacy Policy.

Welcome to Kalkine Media Limited website. Your website access and usage is governed by the applicable Terms of Use & Privacy Policy.

Welcome to Kalkine Media Limited website. Your website access and usage is governed by the applicable Terms of Use & Privacy Policy.

Welcome to Kalkine Media Limited website. Your website access and usage is governed by the applicable Terms of Use & Privacy Policy.

Welcome to Kalkine Media Limited website. Your website access and usage is governed by the applicable Terms of Use & Privacy Policy.

Welcome to Kalkine Media Limited website. Your website access and usage is governed by the applicable Terms of Use & Privacy Policy.

Welcome to Kalkine Media Limited website. Your website access and usage is governed by the applicable Terms of Use & Privacy Policy.

Welcome to Kalkine Media Limited website. Your website access and usage is governed by the applicable Terms of Use & Privacy Policy.

Welcome to Kalkine Media Limited website. Your website access and usage is governed by the applicable Terms of Use & Privacy Policy.

Welcome to Kalkine Media Limited website. Your website access and usage is governed by the applicable Terms of Use & Privacy Policy.

Welcome to Kalkine Media Limited website. Your website access and usage is governed by the applicable Terms of Use & Privacy Policy.

Welcome to Kalkine Media Limited website. Your website access and usage is governed by the applicable Terms of Use & Privacy Policy.

Welcome to Kalkine Media Limited website. Your website access and usage is governed by the applicable Terms of Use & Privacy Policy.

مرحبًا بكم في موقع Kalkine Media Limited. يخضع الوصول إلى موقع الويب الخاص بك واستخدامه لما هو معمول بهشروط الاستخدام & سياسة الخصوصية.

Bienvenue sur le site Web de Kalkine Media Limited. L'accès et l'utilisation de votre site Web sont régis par les Conditions d'utilisation & Politique de confidentialité.

Bienvenido al sitio web de Kalkine Media Limited. El acceso y el uso de su sitio web se rigen por los Términos de uso y Política de privacidad.

Willkommen auf der Website von Kalkine Media Limited. Der Zugriff und die Nutzung Ihrer Website unterliegen den geltenden Nutzungsbedingungen & Datenschutzerklärung.

Willkommen auf der Website von Kalkine Media Limited. Der Zugriff und die Nutzung Ihrer Website unterliegen den geltenden Nutzungsbedingungen & Datenschutzerklärung.