Highlights

- Holista Colltech has ended the first half of FY22 on a positive note with record revenue.

- Interim revenue was up 26%, driven by double-digit growth registered by the two largest business segments - Supplements and Food Ingredients.

- Easing macroeconomic headwinds, launch of new innovative products, and other favourable factors are likely to help deliver strong FY22.

Holista Colltech Limited (ASX:HCT) has released results for the first half FY22 (1H22) ended 30 June 2022. Due to an encouraging rebound from the impact of the global pandemic, the Group marked the first six months of the ongoing fiscal year with a solid performance.

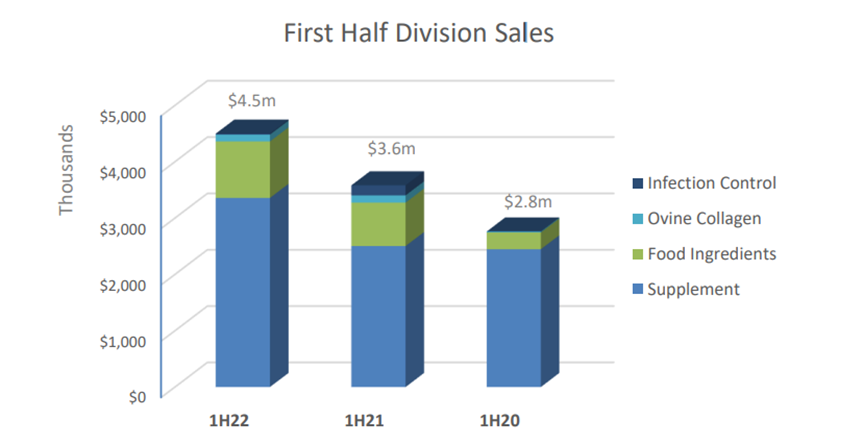

The ASX-listed company registered a record interim revenue of about AU$4.5 million, representing a remarkable increase of 25.6% on the previous corresponding period (pcp).

The innovative natural products for health and wellness developed by Holista have been winning a huge customer base in the United States, Australia, and Asia. The ASX-listed company is putting in huge investments in building its inventory to fulfil the soaring demand and expand its market reach far and wide across the globe.

Headwinds that contributed to the Group’s impressive growth in 1H22

Image Source: Company Announcement

The smash-hit performance of the Group in the first half of the year can be attributed to the great success across its two largest divisions, which managed to score a double-digit growth in sales.

The sales for the Dietary Supplements business alone surged to AU$3.4 million with a 34% increase on pcp.

For its Healthy Food Ingredients division, revenue from the sale of its low glycaemic index (GI) premix GI LiteTM and sugar substitute 80LessTM reached over AU$1 million with a rise of 30% as compared to the previous corresponding period.

The positive growth in the Group sales is mainly because of ease in restrictions after the pandemic and growing consumers’ interest in living healthier life. The latest addition in the Group’s product range, the water-soluble vitamin D product Hydro D, further boosted the overall performance. More new innovative launches are in prospect for the forthcoming quarters.

Major events that drove 1H22 performance

In the month of April, Holista received the receipt of the first order from Country Farms Sdn Bhd for its products, GI LiteTM and 80LessTM.

Country Farms is owned by Malaysian conglomerate Berjaya Corporation, which hosts numerous international franchises across Malaysia, such as 7-Eleven and Starbucks. The newly built association will help the Group in building on its relationship with Berjaya. It is expected to unleash multiple growth opportunities for the firm.

During the first half of the year, Holista also received positive results from independent tests demonstrating that its all-natural Super Bio Nano Silver disinfectant kills 99.99% of the human coronavirus (ATCC VR-740) within 30 to 60 minutes. The test was conducted by SGS (Malaysia) Sdn Bhd.

Holista’s outlook for FY22

Holista is confident to secure better performance for the full year. The company expects to carry forward the momentum in the second half of the financial year FY22.

Image Source: © 2022 Kalkine Media®, Data Source: Company Announcement

Health Supplements, the largest division of the Group is likely to secure positive results with the ongoing market demand.

Also, there are multiple growth prospects in the Healthy Food Ingredients segment as the demand from current customer base is expected to stay strong.

For the Group’s olive collagen products, the sales to Behn Meyer Thailand are expected to scale up in 1H22 as the binding sales contract between two firms needs to be fulfilled by the end of 2022.

Meanwhile, new product launches are expected to contribute positively to Holista’s Infection Control division.

Stock information: HCT shares last traded at AU$0.042 on 31 August 2022.