Highlights

- Calima Energy has unveiled its inaugural 2021 Sustainability Report.

- The Company has adopted eight Sustainable Development Goals from the United Nations’ list of 17 Sustainable Development Goals.

- The Company has established an ESG committee to steer its ESG initiatives in the right direction.

ASX-listed oil & gas producer Calima Energy is committed to generating free cash flow from the responsible development of its high-quality assets in Western Canada.

In line with its focus, the company has released its inaugural 2021 environmental, social, governance (ESG) report. Calima carried out a materiality assessment in 2021 to establish its core ESG focus areas. The inaugural report for the period ended 31 December 2021 includes three-year performance metrics.

Recent update: Calima Energy (ASX:CE1) gets drill rods spinning for 4-well program at Brooks

Calima became a net oil & gas producer after the acquisition of Blackspur in April 2021. The Sustainability Report includes the comparative figures relating to 2019 and 2020, reflecting the combined results of Calima and Blackspur both before and after the acquisition.

Sustainable Development Goals

After reviewing 17 Sustainable Development Goals (SDG) of the United Nations, Calima’s recently established ESG committee identified eight SDGs that were most relevant to its business. The company also included the disclosure metrics from the Global Risk Institute (GRI) and the Task Force on Climate-related Financial Disclosure (TCFD).

Data source: Calima’s Sustainability Report

Climate Risk Consideration

Calima considers several factors that affect its business, including the risks and opportunities associated with climate change. As a Canadian oil & gas player, the company is subject to stringent regulations and taxation on its broader CO2 equivalent emissions, which lead to the identification of other risks posed by climate change.

Related read: Calima Energy (ASX:CE1) keeps eyes on the prize as oil remains on the boil

As a result, CE1 can better estimate the potential impact in the short, medium and long term. The Company is closely monitoring developments regarding the TCFD recommendations and plans to provide more comprehensive information in its future releases.

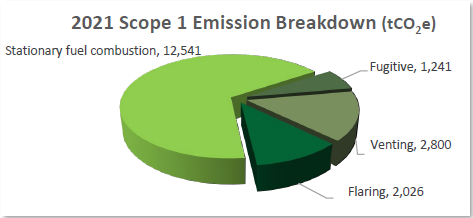

The greenhouse gas (GHG) emission is one of the primary focus areas of the Company under its ESG initiatives. GHG emissions are primarily produced during exploration, development and activities associated with oil & gas production from its assets in the Brooks and Thorsby areas.

Emission breakdown by process (Image source: Calima’s Sustainability Report)

Reducing direct and indirect fuel consumption and implementing low-cost clean technology solutions play a key role in ensuring a sustainable low-carbon energy sector. From 2019 to 2021, Calima reduced its emissions in total tonnage and intensity by 30% and 18%, respectively. The oil & gas explorer could reduce its GHG emissions mainly due to the implementation of emission reduction and flare reduction initiatives coupled with a lower overall output in 2021, partially offset by higher fuel consumption.

Calima is committed to the electrification of all new facility sites planned for 2022. It also plans to provide initial grid connectivity for new buffer site developments ahead of drilling programs.

As of 31 December 2021, Calima held working interests in 193 (net) wells. Nearly 52% of the wells are inactive and need proper rehabilitation and abandonment programs.

In Alberta, the company has been actively participating in the government-funded Site Restoration Program (SRP). The year 2020 saw abandonment operations on 18 (net) wells using the funds provided through the SRP. In 2021, the Company wrapped up the abandonment of 24 additional (net) wells using the funds.

Related read: Calima Energy (ASX:CE1) on high-growth path amid robust crude oil market

Calima expects to spend a minimum of $440,000 in 2022 under the program, which will enable the completion of abandonment operations on approximately 12-14 wells. The SRP funding is also expected to allow the Company to add three more wells under abandonment activities during the year.

To control hydrocarbon spills, Calima has an integrity program in place to help prevent, detect, and respond to leaks and spills from its surface and pipeline infrastructure. Annually, the Company also carries out emergency response plan drills to ensure it is ready to respond quickly and decisively in the event of an oil spill and other emergencies.

Social Initiatives

The Social factor in the ESG initiatives includes the health and well-being of Calima’s employees, contractors, and service providers on the job sites.

The Company boasts zero work-related fatalities to date. Most of its mineral rights fall below farmlands, and it works closely with over 300 surface and mineral rights holders across the Thorsby and Brooks asset areas.

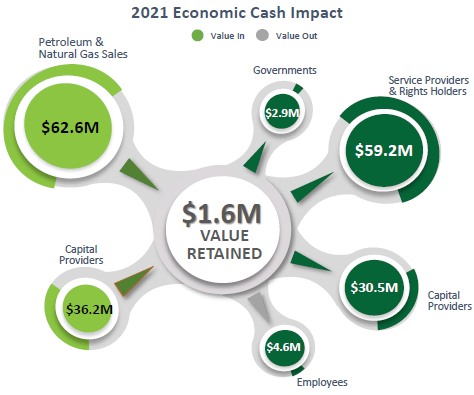

Calima also contributes to strengthening the communities in which it operates. Since 2019, Calima’s activities have generated US$6.2 million for municipal and provincial governments to fund public programs and services.

Image source: Calima’s Sustainability Report

Governance

Calima is committed to unlocking sustainable success by ensuring that it fulfils or exceeds the international standards for health, safety, the environment, and social responsibility in its active operations. The company's goal is to do everything it can to protect the health and safety of its workers and contractors, as well as the environment and the communities in which they work and live. Calima's defining policies are based on best practises from industry leaders.

Calima has formed an ESG committee to advance its ESG-related initiatives. The committee has members from operations, finance, and leadership.

In essence, Calima is committed to a number of ESG initiatives that ensure a long-term sustainable future for the organisation.

CE1 shares closed the day’s trade at AU$0.195 on 14 June 2022.