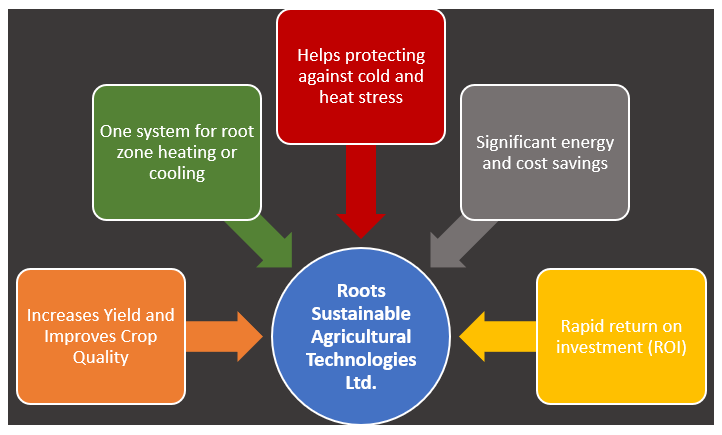

Established in 2012, Roots Sustainable Agricultural Technologies Limited (ASX: ROO) is an Israeli-based company that addresses the critical problems being faced by the agriculture today like plant climate management and the scarcity of water for irrigation. The key technologies of the company include - Irrigation By Condensation (IBC) and Root Zone Temperature Optimisation (RZTO).

The company announced today that it has received firm commitments to raise AUD 1.66 million through a placement of CDIs to sophisticated and professional investors. The company will issue 23,692,857 CDIs at AUD 0.070 per CDI (at a 20% discount to the 30-day volume weighted average price (VWAP) to 10th May 2019). The issue of the CDIs is subjected to prior shareholder approval to be sought at a future general meeting to be held on 23rd May 2019.

The company announced today that it has received firm commitments to raise AUD 1.66 million through a placement of CDIs to sophisticated and professional investors. The company will issue 23,692,857 CDIs at AUD 0.070 per CDI (at a 20% discount to the 30-day volume weighted average price (VWAP) to 10th May 2019). The issue of the CDIs is subjected to prior shareholder approval to be sought at a future general meeting to be held on 23rd May 2019.

For every three CDIs, one free-attaching option will be issued to investors in the placement at an exercise price of AUD 0.12 with a 36-month term.

The funds raised from the placement will be used for:

- Commercialisation of RZTO marketing and sales opportunities in various jurisdictions.

- Expansion of cannabis growers marketing and sales activity in the United States.

- Funding the pursuit of new cannabis and hemp opportunities.

- Providing ongoing working capital.

Roots CEO, Dr Sharon Devir informed that the directors of Roots and Everblu have also agreed to invest up to a total of $600,000 in the placement subject to prior shareholder approval.

The company reported on 7th May 2019 that its RZTO heating technology had improved the tomatoes yield in Spain by 19 per cent. From December 2018 to March 2019, the company undertook the commercial demonstration in greenhouses in Almeria, Spain. The RZTO heating system stabilised the crop root temperature at around 21 degrees even though greenhouse ambient air temperature was repeatedly falling to 10 degrees. The companyâs RZTO heating technology also increased Yardlong Beans yield by 40 per cent as reported by the company on 24th April 2019.

On 1st May 2019, the company notified that it had sold Root Zone Temperature Optimisation heating and cooling system for the third time in about a month in North Americaâs cannabis sector. This was the first time that the companyâs cooling technology was installed in greenhouse growbags in the US.

During the March quarter, the company received two sale and installation agreements from its exclusive distribution partner in China, Dagan Agricultural Automation. The company also secured the first sale of its RZTO technology in North Americaâs cannabis market in March. The RZTO technology was sold to industry leader Tim Blake. Roots had cash and cash equivalents worth US$563,000 at the end of quarter.

The companyâs stock closed lower at AUD 0.073 today, down by 7.6 per cent in comparison to the last closed price. The stock fluctuated between a high and low value of AUD 0.076 and AUD 0.072 respectively. Around 402,239 shares exchanged hands today. The companyâs market cap stands at AUD 5.44 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.