As per the media reports, property sellers at Sydney and Melbourne are facing long delays to sell their dwellings. Many are being forced towards expensive sales campaigns, which has increased the duration to four-fold. As per the CoreLogic, the national median times to sell a dwelling have increased to 60 days from 43 days.

Privately negotiated deals and successive auction campaigns have increased the average spending by the seller and resulted in long duration for any final closing of the deals.

As per the Australian Bureau of Statistics, the residential property prices (weighted average) of eight capital cities decreased by 2.4% in December quarter as compared to the previous quarter and decreased by 5.1% Y-o-Y. Housing prices at Sydney, Melbourne, Brisbane, Perth, Darwin, and Canberra decreased by 3.7%, 2.4%, 1.1%, 1%, 0.6%, and 0.2%, respectively in the December quarter as compared to the September quarter. However, residential prices at Adelaide and Hobart increased by 0.1%, and 0.7%, respectively in the December quarter as compared to the September quarter. [Result for March Quarter is expected to release by ABS on June 18, 2019]

Despite declining residential prices, easing regulatory compliances and improving home loan credits, sellers are finding it difficult to locate buyers. This can be understood from the purchasing priorities of the demographics.

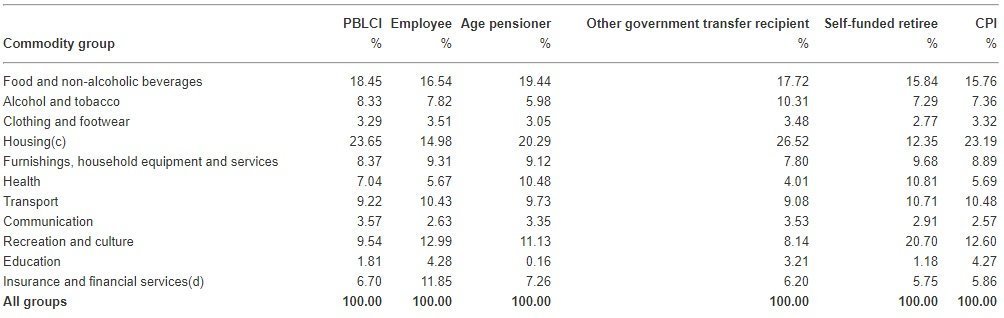

Selected Living Cost Metrics (Source: Australian Bureau of Statistics)

Selected Living Cost Metrics (Source: Australian Bureau of Statistics)

As per the stats, 116,427 people in the 2016 Census were classified as being homeless (up from 102,439 in 2011 Census). The homeless rate was 50 out of every 10,000 people in 2016 Census (up from 48 in 2011 Census, and 45 in 2006 Census).

The current situation would affect stocks under sectors such as Real Estate Investment Trusts (REIT). Top three companies under REIT in terms of market capitalisation are Scentre Group (ASX: SCG), Dexus (ASX: DXS) and GPT Group (ASX: GPT)

At market close on 9th April 2019, the stock of Scentre Group (ASX: SCG) was trading at A$3.89, with a market capitalisation of ~A$20.84 billion. Its current PE multiple is at 9.1x, and its last EPS was noted at A$0.431. Its annual dividend yield has been noted at 5.65%. Its absolute return for one year, six months and three months are 0.26%, 0.26%, and -0.25%, respectively.

At market close on 9th April 2019, the stock of Dexus (ASX: DXS) was trading at A$12.5, with a market capitalisation of ~A$12.64 billion. Its current PE multiple is at 8.67x, and its last EPS was noted at A$1.433. Its annual dividend yield has been noted at 4.13%. Its absolute return for one year, six months and three months are 32.66%, 21.39% and 17.71%, respectively.

At market close on 9th April 2019, the stock of GPT Group (ASX: GPT) was trading at A$6.01, with a market capitalisation of ~A$10.88 billion. Its current PE multiple is at 7.5x, and its last EPS was noted at A$0.804. Its annual dividend yield has been noted at 4.22%. Its absolute return for one year, six months and three months are 26.95%, 18.47%, and 13.13%, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.