News Corporation (ASX:NWS) has duly filed its March 2019 quarterly report with the United States Securities and Exchange Commission (SEC) in Form 10-Q.

Globally diversified media player, News Corporation comprises of business across a wide array of media including subscription video services in Australia, news and information services, book publishing and digital real estate services.

Image: News Corp media brands; source: companyâs website

Image: News Corp media brands; source: companyâs website

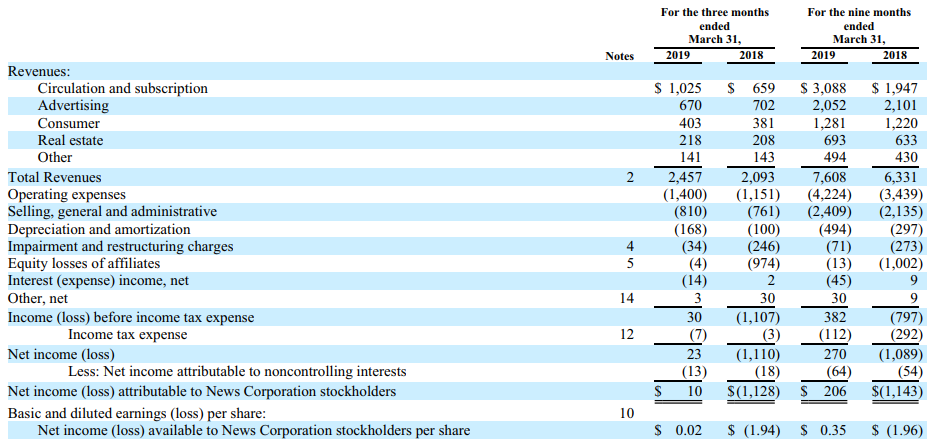

The Groupâs revenue for nine months to 31 March 2019 increased to $7.608 billion, compared to $6.331 billion in the previous corresponding period. The major portion of the companyâs revenue was driven by circulation and subscription business that includes newspaper subscription, pay television broadcast subscription revenues, single-copy newspaper revenue among others.

Advertising revenue has been another important source of revenue for the company. The nine months to 31 March 2019âs advertising revenue was $2.05 billion including $1.801 billion revenue from news and information services. Consumer segment revenue stood at $1.28 billion and Real Estate revenue at $693 million.

On the back of acquisition-driven strategy, News Corp joined hands with Telstra in April 2018 to form a new entity ânew Foxtelâ comprising of Telstraâs 50% interests in Foxtel and News Corpâs 100% interest in FOX SPORTS Australia. Following the transaction, News Corp owns the majority 65% interest in a merged entity with Telstra holding the remaining 35%.

In October 2018, the company acquired a market-leading real estate technology platform, Opcity Inc at a total transaction value was ~$210 million. The platform provides matching of qualified home buyers and sellers in real time.

The bottom line of the company turned to positive, i.e., net income of $270 million for the nine months ended 31 March 2019 compared to the loss of $1.089 billion in the prior corresponding period.

Â Image: News Corp Consolidated Statements of Operations; Source: Companyâs Website

Image: News Corp Consolidated Statements of Operations; Source: Companyâs Website

News Corp recorded restructuring charges of $25 million for three months ended 31 March 2019, taking a year to date restructuring charges to $62 million in Fiscal 2019. This is in comparison to $48 million and $21 million of restructuring charges for nine months and three months ended 31 March 2018.

The company has also worked on the reclassification of revenue as it believes that reclassification would reflect the nature of those revenue streams more accurately. It reclassified Merchandising revenues at News America Marketing as well as Conference Sponsorship revenues at its Dow Jones in the first quarter of Fiscal 2019.

Cash balance of the company stood at $1.64 billion, representing a net cash outflow of $363 million during nine months to 31 March 2019 compared to the opening balance of $2.03 billion at the beginning of the period.

NWS stock price edged up by 0.478% to last trade at $16.830 on 13 May 2019. Over the past 12 months, the stock has established a negative price change of 24.96% including a dip of 5.58% recorded in the past three months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.