Mobecom Limited (ASX:MBM), based in North Sydney, Australia, provides end-to-end (B2B) technology solutions for businesses to engage with their customers including blue-chip firms based in Australia, Singapore, South Africa, the UK and Europe.

Its primary focus is to offer liquidity for digital assets through its two key B2B products- Paid by Coins and airBux, which is a cloud-based digital currency platform offering liquidity-for-loyalty. According to Mobecomâs recent company update released on 16th, April 2019:

On 13th May 2019, Mobecom released an update pursuant to its announcement dated 20th June 2018 regarding a memorandum of understanding that it executed with Lakeba Group Pty Ltd on 13th May 2018 and amended on 19th November 2018, for the development of a blockchain and cryptocurrency exchange platform (AirCrypto Platform). The AirCrypto Platform was developed to enable users of the airBux app to convert cryptocurrency holdings into airBux (the Mobecom's digital rewards currency), which can then be spent on goods and services in-store and in-app across the airBux participating merchants.

As per the terms of the MoU, Lakeba developed the AirCrypto Platform in a special purpose vehicle (AirCrypto Pty Ltd, the JVCo) and it was contemplated that if Lakeba successfully developed the Platform, Mobecom would have the right but not the obligation to acquire an equity interest in JVCo equal to 51% of the shares in JVco for $ 51.00. The Company agreed to pay Lakeba a development fee of $ 1 million in cash or scrip.

Now, Lakeba has successfully developed the AirCrypto Platform and informed that Mobecom has exercised its right to acquire the JV Interest and pay the development fee and has satisfied these payment obligations by issuing 9,945,650 ordinary shares to Lakeba at a deemed issue price of $ 0.101 per share.

Following acquisition of the JV Interest, the Company and Lakeba would enter into a formal agreement to regulate the running and operations of JVCo, after which Lakeba would earn royalty fees equal to 50% of the gross revenue of the AirCrypto Platform. In addition, Mobecom would maintain the right to acquire the remainder of interest in JVCo from Lakeba within 12 months after the platform is officially launched.

Recently, Mobecom reported that it had received firm commitments from professional and sophisticated investors to raise in excess of the maximum subscription amount of $ 2.5 million via a private share placement of 33 million fully paid new shares at an issue price of $ 0.075 per share. The funds received would be utilised to complete the integration with recently announced partnerships, and to provide continued support for the rollout of the airBux technology, Paid by Coins, research, development and working capital.

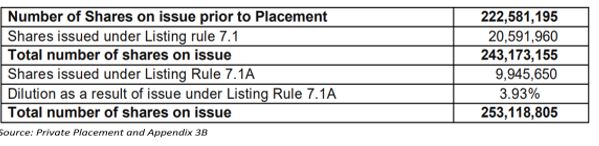

On 13th May 2019, the company announced to have received the first tranche of the capital raising as per a recent cleansing prospectus whereby the company issued around 20,591,960 Shares (Placement Shares), each at an issue price of $ 0.075, to raise $ 1,544,396.98 before costs. Besides, the company has proposed, subject to shareholder approval, to also issue one free attaching option for each Placement Share being a total of 20,591,960 options (Placement Options), to investors acquiring Placement Shares.

Meanwhile, around 9,945,650 Shares have been issued to Lakeba Ventures Pty Ltd under ASX Listing Rule 7.1A. Details are as follows:

Mobecom closed the quarter ended 31st March 2019 with a net cash of AUD 641K. On 13th May 2019, the MBM stock settled the dayâs trading at a last price of $ 0.070.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.