Fremont Petroleum Corporation (ASX:FPL) was founded in 2006. With FPL Head Quarters in Florence, Colorado in the USA, the company is operational in Kentucky and in Colorado.

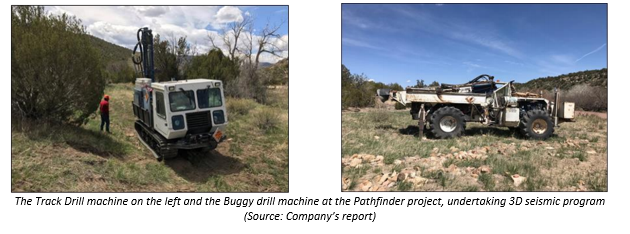

The company is laser-focused on developing an oilfield, which is the second oldest, in the United States, in Fremont County. Discovered in 1881, The Florence Oil field hosts FPLâs 19,417-acre Pathfinder project. Its producers were Standard Oil & Continental Oil. Backed up with the new technology, this is an extremely economic field and is way larger and very prolific compared to how it was initially understood.

On 21st May 2019, the company provided an executive summary related to the evaluation, which was completed on the Niobrara Formation in the J.W. Powell #23-25 well. The update was given to the company by Schlumberger, who conducted the independent petrophysical evaluation.

The oilfield services industry regards Schlumberger is the industrial world leader. It was evaluating the Niobrara Formation at Pathfinder Property for the company. The J.W. Powell #23-25 well was logged by Schlumberger on 13th January 2019. In the hole, the Platform Express integrated wireline logging tool and ran a Sonic Scanner acoustic scanning platform. The Platform Express tool consists of an electrical induction log along with gross gamma, bulk density, thermal neutron, caliper and Pe. The Sonic Scanner platform, on the other hand, comprises compressional slowness and Stoneley slowness, along with fast and slow shear slownesses.

The results of the petrophysical evaluation were laid down to Fremont Petroleum on 17th January 2019. The result depicted that in the DJ Basin/Wattenberg Field, the Niobrara formation in this well, is analogous to examples that had been analysed in the past by Schlumberger. The formation has been said to be quite calcareous with most of its section being organic-rich.

Three intervals were in the limelight for stimulation. These intervals were chosen upon their reservoir quality and, vitally on the completion quality, which has been based on the triple combo results. These highlighted intervals showed good reservoir quality and were stated to have low Neutron Porosity and Clay Volumes. Schlumberger concluded that the higher clay leads to difficulties in the process of drilling and to keep an open hydraulic fracture adjacent to the well.

In another announcement by the company on 21st May 2019, the company reported that it issued 67,188,217 ordinary shares at $0.013 per share via placement of shares for the following purposes:

- To finalise the drilling process and further undertake all works for the completion of the Amerigo Vespucci vertical

- To assess new production zones at the Pathfinder Field

- For funding J.W Powell well and Amerigo Vespucci well Reserve and Resources report.

- To aid FPLâs gas sales strategy and

- Funding additional working capital

Share Price Information:

The market capitalisation of FPL stands at $14.32 million. The stock is trading at $0.010, up by 11.111% as of 21st May 2019. The stock has delivered a 50.00% return in six months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_07_01_2025_00_35_15_412895.jpg)