Highlights

- Radiopharm secured AU$7.5 million as initial equity investment from Lantheus under a strategic agreement.

- Lantheus retains the option for an additional AU$7.5 million investment in Radiopharm within six months.

- Transfer and development agreement grants Lantheus rights to a TROP2 targeting nanobody and a LRRC15 targeting mAb for AU$3.0 million

- Proceeds will fund drug manufacturing, clinical trials, and general working capital.

Radiopharm Theranostics Limited (ASX: RAD), an Australia-based biotechnology company, has announced a significant strategic investment from Lantheus Holdings, Inc. (NASDAQ:LNTH) and its affiliates. This move marks a pivotal moment for Radiopharm as it accelerates its growth and development initiatives in the radiopharmaceuticals space.

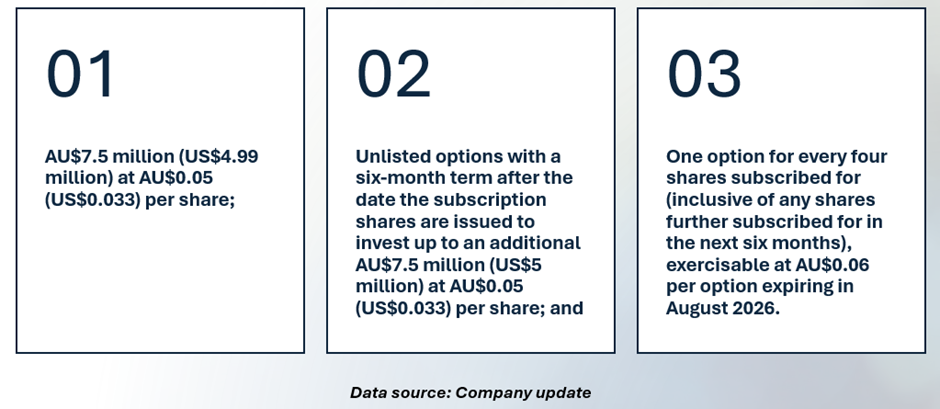

Under the terms of the agreement, Lantheus will make an initial equity investment of AU$7.5 million, with an option to invest an additional AU$7.5 million within six months, both at an offer price of AU$0.05 per share. This price represents a generous 47% premium over Radiopharm's closing price of AU$0.034 on 19 June 2024.

In addition to the equity investment, Lantheus will pay AU$3.0 million upfront to acquire two early preclinical assets from Radiopharm, including a TROP2 targeting nanobody and a LRRC15 targeting mAb. This is pursuant to a separate transfer and development agreement.

Radiopharm will utilise the net proceeds of this investment for critical activities such as advancing clinical trials, drug manufacturing, and bolstering general working capital. These initiatives are expected to enhance the company’s capabilities in delivering innovative radiopharmaceutical solutions to address unmet medical needs.

Under the subscription agreement, Lantheus has subscribed for up to:

- Riley Securities acted as the exclusive financial advisor to Radiopharm Theranostics in this transaction.