Highlights:

- MRG Metals (ASX:MRQ) announced a AU$2 million equity raising program

- The Placement will be led by Peak Asset Management, a boutique investment and portfolio management company in Melbourne

- The funds will be raised via a placement of fully paid ordinary shares, with two-for-three free attaching options, to raise AU$0.84 million and a three-for-five pro-rata non-renounceable entitlement offer of options for raising AU$1.17 million

- MRG plans to use the funds to test high VHM Azaria and Cihari targets to increase its Corridor Sands HMS Project economics towards Feasibilty and to Explore its Rare Earth Elements, Uranium and other HMS Projects once they are granted.

MRG Metals Limited (ASX:MRQ), an Australia Stock Exchange-listed Heavy Mineral Sands (HMS) company, has announced an equity raising program of AU$2 million (before costs).

MRG will raise funds via a AU$840,000 Placement (“Placement”) and a AU$1.17 million Options entitlement offer.

MRG plans to use the funds to test high VHM Azaria and Cihari targets and progress through the Rare Earth Elements project.

AU$840,000 Placement (“Placement”) offer

The funds will be raised via a Placement of fully paid ordinary shares, with two-for-three free attaching options raising AU$0.84 million. The Placement will include an issue of 210 million fully paid ordinary shares at AU$0.004 per share (22% below the 15-day volume-weighted average of the Company's share price).

Additionally, it will include the issuance of 140 million free attaching options to sophisticated and professional investors, exercisable at AU$0.008, expiring 31 December 2025. Also, the Company seeks to list the options.

The Company's Board will seek the approval of its shareholders at the General Meeting, scheduled for 13 January 2023 to take up AU$60,000 under the same terms as the Placement.

AU$1.17 million Options entitlement offer

The fundraising will also include a three-for-five pro-rata non-renounceable entitlement offer of options to raise AU$1.17 million. These options will be offered at AU$0.001, exercisable at AU$0.008, and valid till 31 December 2025.

These options will have the same terms as placement shares.

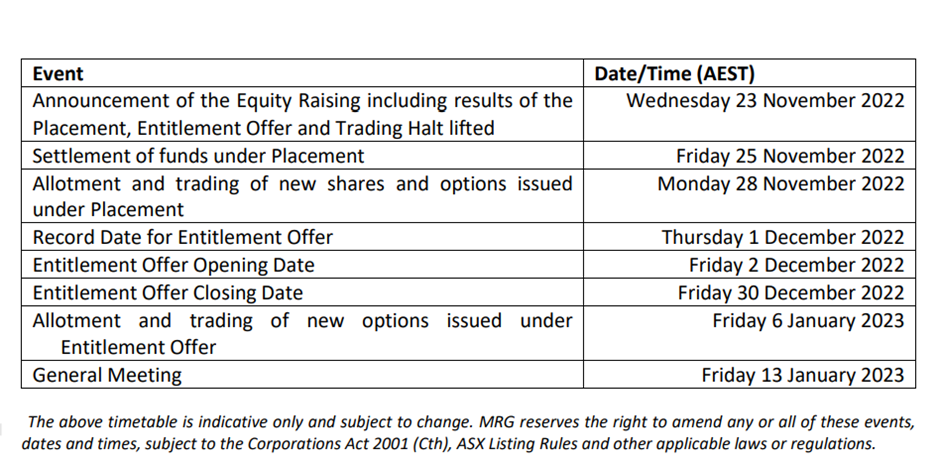

The proposed timetable and the equity raise details of the fundraising are as follows:

(Image source: company update, 23 November 2022)

Application of funds

MRG has planned to use the funds for the following development and exploration activities of its projects:

- The Company will deploy a portion of these funds for the Corridor Sands HMS Project, including improvement programs. These programs will target enhanced project economics towards feasibility. In addition, the fund will be used for follow-up drilling, mineralogy, and metallurgy to test high VHM Azaria and Cihari targets.

- For the Jangamo HMS Project, the Company is looking to exercise the option if due diligence confirms and develops the pathway to production.

- For exploration at HMS, REEs and uranium projects should these Exploration Licences be granted.

- For working capital, placement costs, and other offer expenses.

MRG shares were trading at AU$0.005 apiece in the early hours of 24 November 2022, and its market capitalisation stood at AU$8.73 million.