Highlights

- CV Check concludes the June 2022 quarter with good operational and financial performance.

- The ASX-listed firm generated AU$1.0M cash from operating activities during Q4 FY22, up 452% on pcp.

- The revenue recorded for the full year was 50% higher as compared to the revenue in the preceding year.

- CV1 brought about some substantial changes to its existing range of products.

One of the leading Australian RegTech companies, CV Check Limited (ASX:CV1) is set to enter FY23 with a strong foundation as it transforms from a pure screening and verification provider to a global aggregator of combined RegTech services.

The company’s report for the last quarter of the fiscal year ended 30 June 2022 (Q4 FY22) reveal details about some significant process improvements and product expansion during the period.

CV1 attributes its success to its three-pronged CGI growth strategy for bringing in promising signs of growth in the company’s performance. CGI strategy to Consolidate the base, Grow new revenue, and Innovate has helped CV1 in building a strong foundation for a year of transformation.

The impressive results of the June quarter spurred the Company’s stock price by nearly 10% on Tuesday. Building on yesterday’s gains, CV1 shares are up 9% and trading at AU$0.120 on the ASX with a market capitalisation of AU$47.76 million (as on 27 July 2022).

Strong revenue metrics

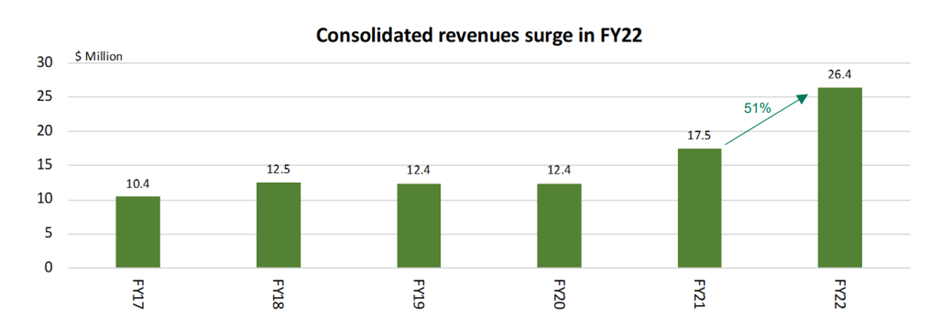

Image source: Company Announcement

Strong revenue growth

The company clocked a revenue of AU$6.7 million in the final quarter of the year, registering strong revenue growth of 17% on previous corresponding period (pcp).

Also, overall revenue for the CV1 group for FY22 grew 51% as compared to FY21. The total revenue of AU$26.4 million includes AU$2.4 million of SaaS revenue, of which AU$0.6 million was generated in Q4 FY22.

The company secured customer receipts worth AU$7.4 million in the last quarter, up 17% over the previous corresponding period. As at the end of FY22, CV1 had customer receipts of AU$29.1 million, up 71% on pcp. The gross margin at the end of the year was recorded at 64%, 5% higher than the equivalent prior year figure.

CV1 generated AU$1.0 million cash from operating activities during its Q4 FY22, registering a massive 452% uptick on pcp, while the full year operating cashflow stood at AU$3.1 million, up 193% as compared to the preceding year. The company holds a debt-free balance sheet with cash and cash equivalents of AU$12.2 million at the end of FY22.

Transformative changes in CV1’s product suite over FY22

- CV Check launched its digital credentials passport, OnCite in the June quarter. The company expects the game-changing mobile app to act as an impetus for strengthening its position in the global RegTech space. The app can be downloaded from Google Play and Apple’s App Store at free of cost. Using the OnCite app, employees can store and share their digital identity and verified credentials with organisations securely. The app encourages the non-conventional mode of collaborative workforce compliance across critical operators. It eliminates the need to have silos of information.

Image Source: Company Announcement

- During the June quarter, some impressive modifications were introduced by the company in its product, Cited. The product has been improved with the feature allowing real-time monitoring. It will further enhance the product’s value as a SaaS innovation for clients who look for a simple, easy-to use workforce compliance solution. Alongside, the Cited website (cited.com.au/) has been remodeled to match up with the changing digital trends. It was launched in early July 2022.

- The company has recently wrapped up an investment program that was operational throughout FY22. to enhance automation and service scalability across its entire product range. Major part of the investments is directed towards building, expanding and strengthening the company’s automation and service scalability across its entire product range.

Moreover, CV Check recently appointed Geoff Hoffmann as its new Global Sales Director. His tenure at the firm began early in the June quarter of FY22. He holds years of experience of building and operating international sales teams and delivering revenue which tones well with CV1’s operational goals and overall business model.

Enters FY23 on a strong footing

CV1 had a strong June 2022 quarter, both in terms of financial as well as operational perspective. It helped the company to conclude the fiscal year FY22 on a high note. With phenomenal developments during FY22, CV1 is anticipating the next year to unfold an exceptional growth potential of the monitored compliance product.