Highlights

- In the September quarter, Carbonxt Group secured a 4-year, AU$24 million contract extension with Reworld for premium PAC products.

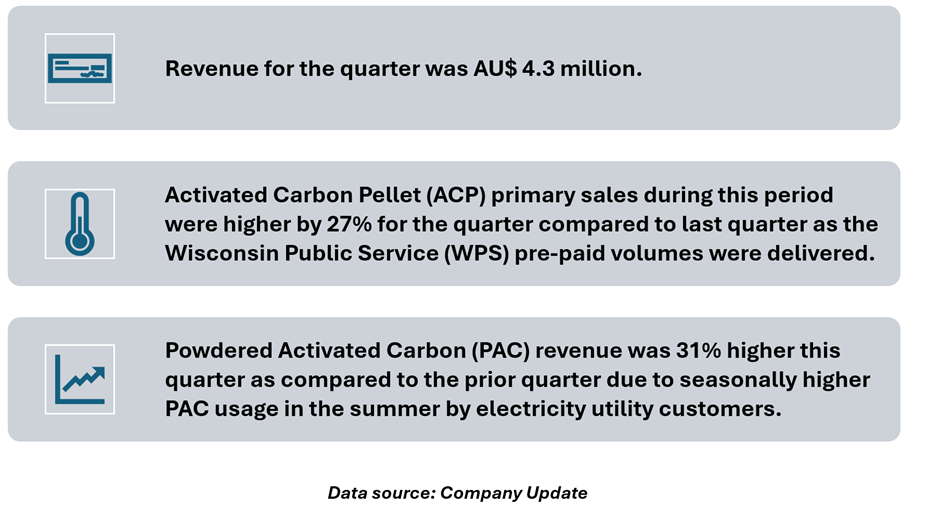

- Quarterly revenue reached AU$4.3 million, with Powdered Activated Carbon (PAC) sales up 31% and Activated Carbon Pellets (ACP) sales up 27%.

- Completed an AU$3.02 million capital raise, supported by high-net-worth investors.

- Invested an additional AU$0.625 million in NewCarbon for the Kentucky production facility.

Carbonxt Group Ltd (ASX:CG1), a US-focused cleantech company, has reported increased sales for the quarter ended 30 September 2024. The company, specialising in activated carbon products, released its activities report for the three-month period.

The quarterly revenue reached AU$4.3 million, driven by a 31% increase in Powdered Activated Carbon (PAC) sales and a 27% rise in Activated Carbon Pellets (ACP) sales.

Contract Extension

Carbonxt secured a 4-year, AU$24 million contract extension to supply premium PAC products to Reworld, an existing customer. Following the quarter end, full-scale deliveries from the Black Birch facility commenced as per the contract terms.

Capital Raise Success

Carbonxt completed a capital raise of AU$3.02 million through the placement of 46.4 million fully paid ordinary shares at AU$ 0.065 each. This initiative received strong support from sophisticated and high net-worth investors.

Investment in NewCarbon

The company invested an additional AU$0.625 million in NewCarbon Processing, LLC, which is developing a state-of-the-art activated carbon production facility in Kentucky. A further AU$0.625 million investment is expected to be finalised this quarter. By the end of the September quarter, Carbonxt’s ownership stake in NewCarbon stood at 38%.

Facility Commissioning

Key construction activities at the flagship activated carbon production facility in Kentucky were completed during the quarter. Commissioning of the plant is imminent, with business development and operational processes ramping up. Kiln startup is anticipated shortly, with the production of continuous, saleable GAC anticipated in early Q3FY25.

The start-up of the Kentucky plant comes at a crucial time, as new regulations from the U.S. Environmental Protection Agency (EPA) require utilities to address PFAS contamination more aggressively.

Reflecting on the September quarter, the company’s Managing Director Warren Murphy commented: “The September quarter was highlighted by continued momentum across all our key growth drivers, with increased sales from existing operations complemented by the forthcoming commissioning of our state-of-the-art production facility in Kentucky.” “With commissioning of the Kentucky facility now imminent, Carbonxt continues to execute on its strategy to deliver a step-change in growth and earnings, significantly scaling up its production capacity to meet the growing demand for premium Activated Carbon production in the US market.”

Additionally, Carbonxt’s new business in the waste-to-energy market commenced on 1 October 2024, with increased revenues expected to be seen in the next quarter, highlighted the company update.

Shares of CG1 last traded on 30 October 2024 at AU$ 0.062.