Highlights

- Carbonxt has launched a Share Purchase Plan (SPP) to raise up to AU$2.0 million at AU$0.06 per share.

- The September 2024 placement raised AU$3.02 million.

- In December 2024, Carbonxt raised AU$1.0 million in a placement at AU$0.06 per share.

- Funds will support working capital and continued development of the Kentucky facility.

- Carbonxt has increased its ownership in the Kentucky facility to 40.3%.

Carbonxt Group Limited (ASX:CG1) has announced a Share Purchase Plan (SPP) to raise up to AU$2.0 million at AU$0.06 per share. Eligible shareholders may apply for up to AU$30,000 worth of new shares under this SPP.

This SPP follows the successful completion of two capital raises in the fourth quarter of 2024.

- In September 2024, Carbonxt completed a placement of AU$3.02 million at AU$0.065 per share. The proceeds were used for the next installment payment to NewCarbon Processing LLC for the construction of the company’s flagship Activated Carbon production facility in Kentucky, the USA, and for general working capital.

- In December 2024, Carbonxt raised AU$1.0 million in a placement at AU$0.06 per share. The funds supported the company’s working capital needs and helped advance the development of the Kentucky facility, where Carbonxt has increased its stake to 40.3%. The company also has the option to increase its stake to 50%.

These capital raising programs received good support from institutional and sophisticated investors, further strengthening the company’s financial position as it advances its strategic initiatives.

Reflecting on the development, Carbonxt’s Managing Director Warren Murphy commented: “We are pleased to offer this Share Purchase Plan following strong investor support in our recent placements. This initiative allows all shareholders to increase their stake in Carbonxt under the same terms as institutional investors. With our Kentucky facility advancing towards commercial output and growing demand for activated carbon, we are well-positioned to deliver long-term value. Entering the US water treatment market, supported by regulatory changes, presents a major growth opportunity. Additionally, our joint venture with Kentucky Carbon Processing enhances supply chain security and strengthens our ability to meet rising industrial demand. We appreciate your continued support and look forward to an exciting period ahead.”

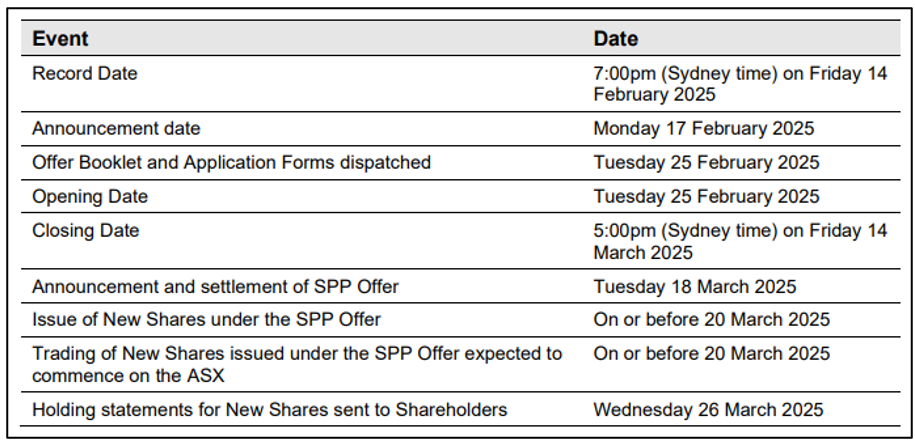

Details of the new SPP

The SPP is underwritten for AU$1.0 million by two major shareholders.

Data source: Company update

The share price of CG1 was AU$0.061 at the time of writing on 17 February 2025.