Highlights:

- Maiden Mineral Resource Estimates (MRE) at the KR1 and KR2 deposits has delivered a total resource of 103 Mt at 10.4% Mn.

- Previously, the Company announced Flanagan Bore MRE of 171 Mt at 10.3% Mn.

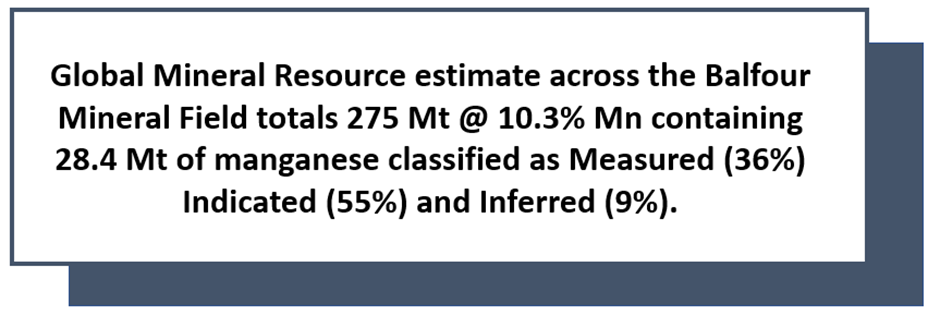

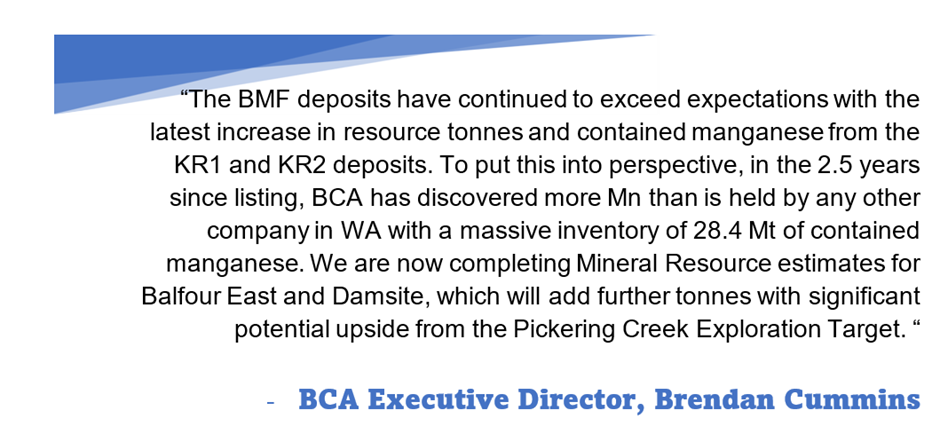

- The combined Global MRE discovered across the field stands at 275 Mt at 10.3% Mn.

- The Company expects MRE updates for Balfour East and Damsite to add further tonnes.

- BCA shares traded higher by over 21% in the early trading hours on 27 November.

Black Canyon Limited (ASX: BCA) has announced a significant milestone in manganese exploration within its Balfour Manganese Fiel.

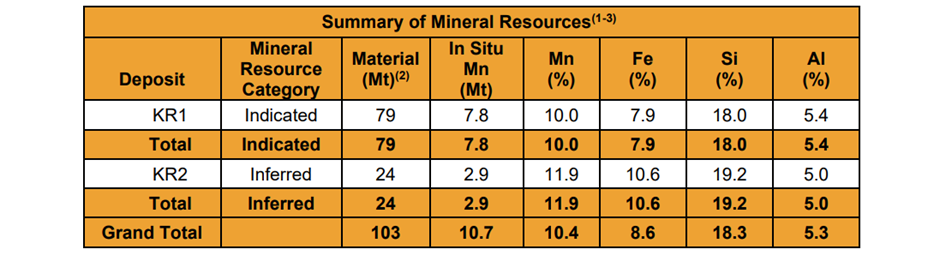

The Company has released a Maiden Mineral Resource Estimate (MRE) of 103 Mt @ 10.4% Mn containing 10.7 Mt of manganese at the KR1 and KR2 deposits within the Balfour Manganese Field.

This manganese MRE is in addition to the current Flanagan Bore MRE of 171 Mt @ 10.3% Mn containing 17.7 Mt of manganese.

Data source: company update

Furthermore, the Australian manganese explorer and developer will be releasing update MRE’s for Damsite and Balfour East, along with an Exploration Target Estimate at Pickering Creek.

KR1 and KR2 Maiden Mineral Resource Estimate

The Company completed the review of RC drill findings for 112 holes over 3,419m at the KR1 and KR2 prospects that was conducted in July this year. The results were validated for the initial Mineral Resource Estimates. The review was completed under the supervision of Greg Jones, a specialist consultant in Mineral Resource Estimates, metallurgy, and processing technology. He works with IHC Mining.

Mineral Resource Summary (Data source: company update)

As per KR1 and KR2 drill results, the manganese enriched shale geology and grades are continuous downhole and across strike.

More

According to the management, the higher MRE for BMF will let BCA reanalyse the Scoping Study of the Flanagan Bore Project, which delivered a pre-tax NPV8 of AU$134 million and pre-tax IRR of 67%.

Black Canyon has showed the BMF deposits’ amenability to generate High Purity Manganese Sulphate (HPMSM) for batteries for EVs. The deposits hold the potential for production of a 30 - 33% Mn concentrate for the Mn alloy steel market through simple beneficiation by use of washing/scrubbing and dense media separation.

With various mineral resources, BCA will be able to study a multi-pit operation with single processing site or a single pit/plant operation along with reviewing throughput size.

Concurrently, HPMSM hydrometallurgical testwork is in process while BCA conducts larger-scale processing with the delivery of 400kg of sample material from the KR1 and KR2 deposits.

“This next round of testwork will help to optimise the test parameters across the leaching and purification stages and crystallisation processes that can be used for further design refinement for a planned Pilot Plant,” added Cummins.

As BCA advances the development and feasibility studies, the company believes that having access to shallow high-grade manganese Mineral Resources holds the potential to add significant value.

Shares soar

Triggered by the update, BCA share price jumped by over 21% to trade at AU$0.170 in the early trading hours on 27 November 2023.

BCA shares closed the day’s trade at AU$0.140 on 27 November 2023.