Summary

- Private equity firm Bain Capital has signed a Sale and Implementation Deed with Virgin Australia’s Administrators to secure the ownership of the airline.

- Qantas has disclosed a three-year plan to fast-track recovery from coronavirus crisis, build a robust platform for future profitability, preserve as many jobs as possible and deliver long-term shareholder value.

- While Australian air carriers are desperately scrambling to revive what they have lost in COVID-19 era, it still seems to be a long way for them to recoup to pre-pandemic levels.

- However, nascent demand for domestic travel, government’s vital support and airlines’ strategic initiatives can grease the wheels of the aviation sector while mitigating the damage.

No wonder, COVID-19 pandemic brought global aviation industry to its knees amid widespread travel bans enforced to contain virus spread. While Australia has mostly suppressed coronavirus, the nation’s air carriers are experiencing considerable misfortunes with pandemic-induced lockdowns that kept their fleets grounded. On a tough road to recovery, Australian air carriers are leaving no stone unturned to survive through coronavirus crisis.

Meanwhile, two Australian airlines - Qantas Airways Limited (ASX:QAN) and Virgin Australia Holdings Limited (ASX:VAH) - have been garnering considerable attention over their strategic moves to weather the coronavirus storm.

A Quantum Leap: Virgin Australia Gets a New Owner

The battle to takeover the struggling air carrier Virgin Australia Holdings Limited (ASX:VAH) has finally come to an end, with Bain Capital carrying the day.

Virgin Australia notified in its latest ASX update that private equity firm Bain Capital has signed a Sale and Implementation Deed with its Administrators (Deloitte) to secure the ownership of the airline. The Company would now operate closely with Bain Capital on its vision for the airline business going forth.

Virgin Australia perceives this move as a crucial step forward towards its goal of bringing airline out of administration in a stronger financial position as quickly as possible. Besides, the Company believes Bain’s investment would shape its future as a major Australian airline, secure wide array of direct and indirect jobs and ensure healthy competition to millions of customers in coming years.

While Bain is committed to seeing a competitive, sustainable and strong Virgin Australia in the coming future, the recovery timeline and growth story of the grappling airline to stand back on its feet will deserve closer attention in near to mid-term. Sustenance of federal government support would be crucial to this fore.

Qantas Unveils Post-COVID Recovery Plan & Future Outlook

In a significant development, Qantas Airways Limited (ASX:QAN) has lately disclosed a three-year plan to fast-track recovery from coronavirus crisis, build a robust platform for future profitability, preserve as many jobs as possible and deliver long-term shareholder value.

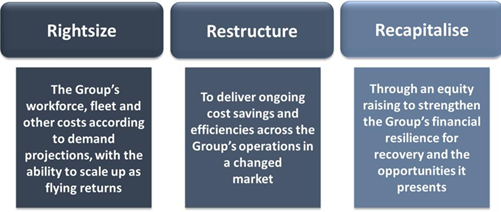

The plan comprises three immediate actions (3 R’s) to protect the airline’s future and numerous jobs it supports.

The three R’s are the immediate focus of Qantas’ Post-COVID recovery plan, while subsequent phases of the plan would focus on bolstering ramp up of flying and pursuing fresh opportunities – including the airline’s objective for further non-stop international flights. The recovery plan targets $15 billion in benefits over three years, encompassing:

- $2.4 billion of ‘restructuring’ benefits, with certain benefits to continue to flow in coming years

- Initial $2.6 billion ‘right sizing’ initiatives to lower the supplier costs and workforce while there is low activity

- $4.0 billion in direct savings from activity reductions

- $6.0 billion of activity-based fuel savings

Moreover, the annual ongoing ‘restructuring’ benefits are estimated to be $1 billion from FY23 onwards from the recovery plan. As a part of the plan, the Company has also announced an equity raising of up to $1.9 billion to better position for new opportunities and accelerate recovery.

However, Qantas’ post-COVID recovery plan would weigh heavily on thousands of Company’s workforce as key actions of plan involve:

- Lowering the Company’s pre-crisis workforce by at least 6,000 roles throughout all parts of the business.

- Continuing the stand down for 15,000 employees, especially those connected with international operations, till flying returns.

Outlook: Qantas expects to report a breakeven to small Underlying PBT, cash flow from operations of $1.2 billion and statutory one-off charges of approximately $2.8 billion in FY20. Though the Company anticipates solid recovery for domestic flights, it is likely to keep its international flights cancelled through to late October 2020.

Besides, the Company anticipates its earnings to revive at a faster pace than international peers, backed by robust domestic market share, solid demand for domestic flights and Qantas Loyalty earnings.

As on 26th June 2020, QAN has delivered a return of over 61 per cent in the last three months.

Resumption of International Travel Can be a Game Changer

While these air carriers are making every possible effort to breeze through coronavirus storm, resumption of international travel seems instrumental for these businesses to regain their profitability. Execution of trans-Tasman travel bubble between New Zealand and Australia is vital in this direction!

Though Qantas expects this travel bubble to proceed in the coming months, Australian Health Minister Mr Greg Hunt’s latest indication over closure of international borders until the development of coronavirus vaccine has dashed hopes of sooner commencement of overseas travel. Besides, fresh cases emerging in New Zealand and Victoria may delay implementation of travel bubble despite easing of domestic border restrictions.

On the bright side, Indonesia and Fiji are also eyeing travel bubbles with Australia amidst latter’s remarkable success in containing the virus spread with its suppression approach. However, evasion of second wave of infections and opening of state borders across Australia would play a crucial role here.

While Australian air carriers are scrambling desperately to recover what they have lost in COVID-19 era, it still seems to be a long way for them to recoup to pre-pandemic levels. However, nascent demand for domestic travel, government’s vital support and airlines’ strategic initiatives can grease the wheels of the aviation sector while mitigating the damage.