Iron ore and steel prices have shown promising recovery across the international markets post and in the middle of the Golden Week holiday session in China, respectively, which in turn, is now diverting all the eyes toward the ASX-listed iron ore and steel stocks.

Also Read: Iron Ore Prices Subdued Ahead of National Holidays in China

The iron ore January 2019 future series rose during the session today to the level of RMB 667.5 (as on 8 October 2019 3:34 PM AEST, which in turn, marks an uptick of approx. 5.50 per cent from its previous low of RMB 633.00 before the National holidays in China on the Dalian Commodity Exchange.

Iron Ore and Steel Scenario

The iron ore prices witnessed a sharp surge as mills instigated aggressive buying in the iron ore market post a weekâs holiday amid depleted inventory due to the market close during the National holiday week.

The absence of Chinaâs steel from the global market, during the National holidayâs session, supported the steel prices in the international market, which, further supported the steel manufacturers across the globe.

The prices of steel rebar near month series on the London Metal Exchange surged from the level of USD 395 per contract on 1 October 2019 to the level of USD 411 per contract on 7 October 2019 (or during National holidays in China), which underpinned the growth of over 4 per cent.

The high steel prices in the international market provided cushion to the falling share prices of steel manufacturers amid opaque steel demand in the global market; however, the re-entry of Chinese steel manufactures and exports in the supply chain after a week-long hiatus could exert some pressure on the steel prices.

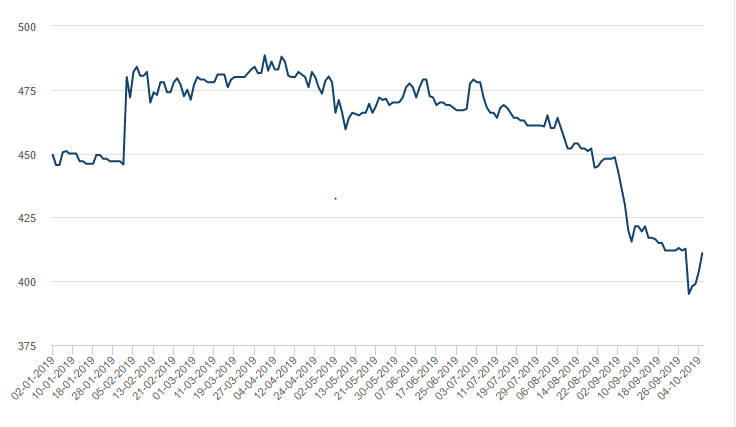

The steel prices on the London Metal Exchange that spiked substantially in April 2019 took a jolt and fell to USD 395 per contract from its Aprilâs 2019 peak of USD 488.5 per contract, which marks a downturn of almost 24 per cent.

The steel price plunge exerted pressure on ASX-listed steel manufacturers, and the National holidays in China from 1 October 2019 to 7 October 2019 provided their stocks with a respite; however, the investors are now again keeping the steel manufactures under the radar to notice if the stock prices of these miners would continue the plunge or would they take a detour?

Steel Rebar Historical Price Chart (Source: LME)

Chinaâs Steel Scenario

Chinaâs steel production remained robust from January to August 2019 to meet the high domestic demand amid infrastructure push provided by the government. As per the data from the China Iron and Steel Association (or CISA), China produced 55.51 million metric tonnes of more iron and steel in the initial eight months of the year 2019 as compared to the previous corresponding period in 2018.

The higher production was consumed domestically during the period, and the net exports from China dropped by 952,000 metric tonnes against the previous corresponding period in 2018.

The steel production in China during the initial eight months period of January 2019 to August 2019 remained as below:

- Crude steel production stood approx. 665 million metric tonnes, up by 9.1 per cent against the previous corresponding period in 2018.

- The production of iron and steel among the members of CISA surged by 5.91 per cent during the initial eight months period; while production across non-CISA members expanded by 19.38 per cent in the same period against the previous corresponding period in 2018.

- However, the higher production led the prices of steel down in China as well, and the average China Steel Price Index (or CSPI) dropped by 5.33 per cent on a yearly basis to stand at 108.89 in the period from January to August 2019.

Chinaâs Steel Dominancy and the Environmental Curbs

Apart from topping the production of crude steel and iron products, the stainless-steel production, which utilises nickel as a raw material also witnessed a surge in China.

As per the latest figures posted by the International Stainless-Steel Forum on 3 October 2019, the global stainless steel melt shop production witnessed a 1.9 per cent yearly surge to stand at 26.1 million metric tonnes during the first half of the year 2019, of which China produced 14.4 million metric tonnes of stainless steel, up by 8.5 per cent against the previous corresponding period production.

China which dominated the global steel production during the first half of the year 2019 and later till August, faced the pressure from the escalated trade tussle between China and the United States, which reduced the steel demand in China.

Apart from that, the falling steel prices dragged the profit margins of the steel mills in China, and in turn slowed the production since August 2019; however, the recovery in Steel prices coupled with eased out environmental curbs could again prompt the steel mills to hit the throttle.

In the status quo, China removed the orange alert (when air quality index passes 200 reading for three consecutive days) from the highest steel making provinces of Tangshan, which was implemented ahead of the National holidays.

Apart from Tangshan, other steel making northern provinces such as Hebei, Shanxi, Shandong, Henan, Anhui and Jiangsu also witnessed the lifted alert.

ASX-Listed Iron Ore and Steel Miners

The big miners such as BHP Group (ASX: BHP), Rio Tinto (ASX: RIO), and Fortescue Metals Group Limited (ASX: FMG) all started the todayâs session higher against their previous close on ASX.

BHP started the dayâs session at $35.425, up by 0.12 per cent against its previous close of $35.380. The stock remained in the green during the session to mark a high of $35.735 before finally settling at $35.610, up by 0.65 per cent against its previous close (as on 08 October 2019).

Likewise, Rio Tinto started the session at $88.150, up by 0.62 per cent against its previous close on ASX. The stock remained in the buying zone and rose to mark a high of $88.855 before ending the session at $88.580, up by 1.11 per cent from its previous close (as on 08 October 2019).

Also Read: Australian Giant Miners-Rio And BHP To Curb Value Chain Emission

FMG started the session up by 0.44 per cent from its previous close at $8.910; however, the stock lost momentum during the session to end at $8.740 down by 1.91 per cent from its previous close (as on 08 October 2019).

Bluescope Steel Limited (ASX:BSL), the ASX-listed steel manufacturers, which felt the pressure of the falling steel prices and dropped recently from the level of $13.630 (Dayâs high on 11 September 2019) to the level of $11.890 (Dayâs low on 3 October 2019) has establish a support around $11.500 over the rising steel prices and trading at $11.66 as on 08 October 2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.