Summary

- COVID-19 has created significant opportunities in the tech sector, for big and small players alike.

- Small tech-based companies have noticed a substantial growth in demand for their offerings that has also helped their respective stocks to surge on the ASX.

- The sudden rise in demand created the need to scale-up the businesses to tap the growth prospects.

- Following a debt facility worth GBP25 million, Openpay issued ~14 million shares to raise A$33.77 million to accelerate its businesses.

- QFE raised US$7.5 million via a placement to fund its growth opportunities while Yojee rolled out its SaaS logistics platform in the Philippines.

While the COVID-19 pandemic has adversely several industries, the technology sector is amongst those that witnessed multiple prospects arise from the crisis. Tech-based companies left no stone unturned to make the most of the opportunities that came during this period.

INTERESTING READ: Technology has changed the way we work amid the COVID-19 crisis: A look at in-demand technologies

Not only did the big players from the industry benefit, but some small tech players also tapped the opportunity and saw their respective performance get a big push.

In this article, we would be looking at three such small-cap technology companies that have reported a significant growth in their share price driven by the improved operational performance amid the growing opportunities in the tech space.

Openpay Group Ltd (ASX:OPY)

Openpay is an omni-channel solution that offers with flexible, interest-free payment plans, in-store, online and via the Openpay App.

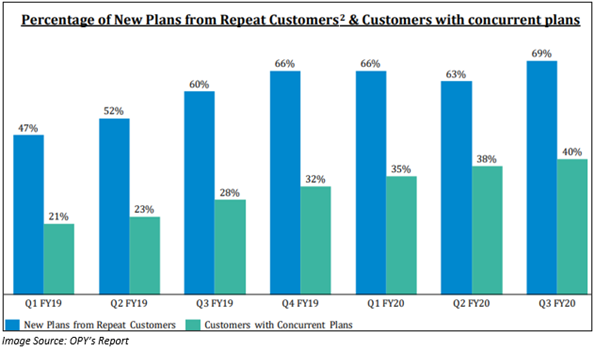

During Q3 FY2020, Openpay delivered strong growth in Active Plans and has maintained strong momentum for it BNPL business across all key operating metrics despite the global economic slowdown due to COVID-19. The number of active plans which was 198,749 in Q3 FY2019 increased to 602,559 by the end of Q3 FY2020, representing a growth of 203%. The number of active customers increased by 113% to 250,381 as compared to the previous corresponding period.

Its UK BNPL business was a significant contributor to the Company’s strong top-line result during the third quarter of FY2020.

The number of active plans in the UK improved by 111% while the number of active users by 66%.

In the quarterly update released on 30 April 2020, OPY also pointed on its investment in growth and key areas. It made new investments in its growth capabilities during the third quarter.

OPY’s Growth Plan:

On 1 June 2020, the Company announced that it secured UK funding facility for £25 million from Global Growth Capital. Out of this amount, £10 million would be used to support the fast-growing UK business.

OPY achieved a significant milestone with the launch of JD Sports in the UK.

Also, the active plan in May 2020 increased by 220% to 739,000, active customers by 131% to 293,000, and active merchants by 50% to 2,096 on pcp. Total Transaction Value surged 95% to A$170 million. These growths were because of the Merchant marketing initiatives across all industry verticals during ‘OpenMay’.

Support Received from New and existing institutional investors for 14,069,742 shares:

On 4 June 2020, the Company announced that it received keen inbound interest and binding commitments to raise ~A$33.77 million. The fund raised via Placement would support the Company to accelerate its Australian and UK businesses. These funds would also aid in further geographical expansion and extending its platform capabilities.

Stock Information:

OPY shares ended the day’s trade at A$2.260 on 26 June 2020, an increase of 0.444% from the previous close. The Company has a market cap of A$242.7 million and ~107.87 million outstanding shares.

In the last three months and last six months, OPY shares have delivered impressive returns of 516.44% and 85.85%, respectively.

Yojee Limited (ASX:YOJ)

Yojee is a cloud-based Software as a Service logistics platform that effortlessly & uniquely handles, monitors & improves freight changes along the complete logistics chain.

During Q3 FY2020 ended 31 March 2020, the revenue from the ordinary activities improved by 21% to A$225,000. A drop was seen in the cash receipt in Q3 FY2020. In Q2 FY2020, the cash receipt which was A$141,000 slipped and reached A$121,000.

During the quarter, two companies Hub Express Singapore Pte Ltd and Magic Hand Car Wash Franchisor Pty Ltd signed an agreement with Yojee for its SaaS platform. Further, the Company strengthened its board with the appointment of new Chairman and Non-executive Director, David Morton.

YOJ’s Progress:

Agreement with Kuehne + Nagel in the Philippines:

On 18 May 2020, YOJ announced that it signed a three-year agreement with Kuehne + Nagel Logistics Solutions, Inc to roll out its SaaS logistics platform in the Philippines.

On 24 June 2020, Yojee’s subscription-based SaaS logistics platform went live in the Philippines. There were 10,000 transactions in the country on the first day of business.

Stock Information:

YOJ shares ended the day’s trade at A$0.087 on 26 June 2020, an increase of 8.75% from the previous close. The Company has a market cap of A$78.83 million and ~985.34 million outstanding shares.

In the last three months and last six months, YOJ shares have delivered impressive returns of 370.59% and 50.94%, respectively.

QuickFee Limited (ASX:QFE)

QuickFee is a financial technology company that has funded more than US$250 million in fees for clients of professional service firms globally.

During Q3 FY2020 ended 31 March 2020, the Company experienced a limited impact of COVID-19 on its business. QFE noted a modest increase in arrears on payment plans three weeks before the release of the announcement on 6 April 2020.

The lending in the third quarter in the US increased by 61% to US$3.6 million and 19% to A$11.6 million in Australia. There was an increase in the demand for the payment plans from large professional services firms for their clients, given business disruption. The transaction in the US during the period increased by 118% to US$66.7 million.

QFE’s Progress:

Third performance milestone completed

On 30 April 2020, QFE attained third & final performance milestone for the issue of deferred consideration shares under its agreement for the acquisition of QuickFee Group LLC.

As per the prospectus, the Company raised capital to drive expansion of the QuickFee business throughout the US professional services market. One milestone needed that QuickFee US attain a total value of currently held loans made to users of the QuickFee US service over US$6 million by 9 July 2021. On 27 April 2020, QFE exceeded the US$6 million milestones which would allow QFE to issue further 3,049,544 shares to the vendors of QuickFee US as per the terms and condition in the prospectus.

Completion of US$7.5 million Share Placement:

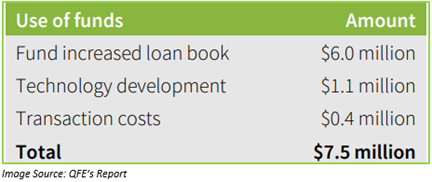

On 6 May 2020, QFE announced the successful completion of US$7.5 million share placement to sophisticated and professional investors. The raised funds would be used to support growth opportunities.

The breakdown is as per the below table:

Stock Information:

QFE shares ended the day’s trade at A$0.530 on 26 June 2020, a decline of 2.752% from the previous close. The Company has a market cap of A$102.6 million and ~188.26 million outstanding shares.

In the last three months and last six months, QFE shares have delivered remarkable returns of 289.29% and 67.69%, respectively.