Gold is considered a safe haven in the international market due to its ability to provide a hedge against systematic risk and non-systematic risk. Due to this, many investors take a huge interest not only in gold but also in gold production companies.

Bassari Resources Limited (ASX: BSR), a small-cap gold company is currently focussed on the development of the Makabingui Gold Project, which is located in Senegal an attractive gold exploration country with a stable, democratically elected government and highly prospective geology.

Merits of Makabingui Gold Project

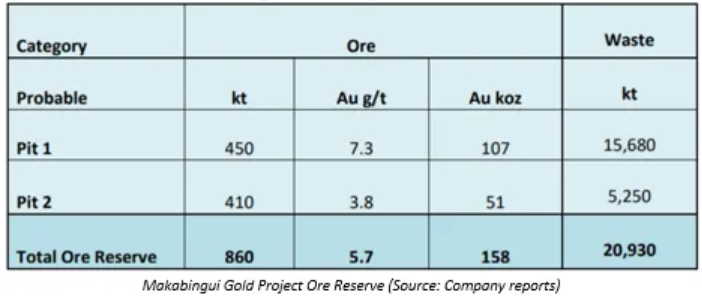

- Project hosts a Mineral Resource, which comprises 11.9 million tonnes averaging 2.6 g/t Au for a contained 1 million ounces of gold classified into the Indicated and Inferred Resource categories, with 158,000 ounces classified as reserves;

- Well located tenements in a +60 million ounce gold province hosting world-class deposits;

- Multiple prospects identified along 60km of partially drilled mineralised strike;

- Open Pit Feasibility Study for the initial open-pit mining phase delivered outstanding results as depicted below

The company has already completed permitting and funding requirements for its Makabingui Gold project. It has refined its project execution plan and has secured people and resources necessary to kick start the project development.

Bassari is now focused on bringing this project into the production stage as soon as possible.

Last year in July, the company appointed a specialist Construction Manager, Mr Anand Santha, who along with other staff members and the Australian Mining Engineers was assigned the following development work:

- Douta to Makabingui haul road upgrade;

- Reparation of the 500 megalitre freshwater dam;

- Clearance of the mine area - Upgrade of kitchens, accommodation and workshops to cater to the substantial increase in production staff;

- Development of operational procedures;

- A detailed review of power supply including the use of solar power;

- Finalising the list of equipment required and identifying suppliers and costs;

- Preparation of the cash budget for project development amounting to approx. 7 billion FCFA (USD 12.1 million) and a detailed monthly chronogram for drawdowns from the Coris Bank project finance facility.

Further, with the inflow of Coris project finance fund, the company was well positioned to undertake the following activities:

- Provide development funds to Project Manager, Mr Andrew Goode;

- Appoint Mining Plus of the UK to provide conservative detailed planning for the mining of the high-grade Pits 1 and 2 instead of mining all four proposed pits;

- Place equipment orders;

- Upgrade site security in readiness for construction and production;

- Commence the tender preparation to appoint a mining contractor;

- Commence discussions with European gold refineries to process its gold production.

The company has made significant progress in bringing the Makabingui Gold Project into production.

Recent Development

Equipment purchases- Project financing has helped the company to purchase significant equipment. In the past few months, the company purchased Ball Mill, Tertiary crusher, Agitators, Cyclones, Screens, Air compressors, Furnace and calcine ovens, Elution, electrowinning, Magnets and metal detectors heaters and kilns, Bolted CIL tanks and welded tanks, 60T mobile crane and Fabricated steelworks.

(Source: Company Reports)

Mine Plan- The company has completed a new mine design which includes block modelling, pit optimisation, mine design and mine scheduling. As per the new mine design, the company will commence mining with starter pit two followed by pit one.

Mine site preparation and mine layout- Bassari has completed the Clearing process of the mine permit boundary and has also finalised the Mine ROM pad and mine waste dump locations. In addition, the company has also completed the important dam repairs.

Grade control Drilling â Bassari has also completed the First pass grade control drill hole planning in accordance with the new starter pits design was completed.

Accommodation and Access Roads- Bassari Resources has completed the security accommodation for the 30-man security team and is now focusing on increasing the current 120-person capacity at Douta camp by a further 20 places. The company is also planning to upgrade and increase the kitchen and laundry capacity.

Plant and processing facilities construction â Bassari Resources has completed the clearing of the tailings dam storage facility. The Contractor for the partial dismantling of gravity circuit has been agreed, with a purchase order placed for these works and Power load estimations for the camp. Further, the processing plant generators have been finalised to allow purchase orders to be prepared.

Security supervisorâs office at the camp completed (Source: Company reports)

Makabingui road, culvert masonry works completed (Source: Company Reports)

The company has estimated a cash outflow of $400k on development activities and $250k on Administration and corporate costs for the September quarter. Total estimated cash outflow for the September quarter is around $2.7 million.

At market close on 24 September 2019, BSRâs stock was trading at a price of $0.015 with a market capitalisation of circa $34.56 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.

_06_24_2025_03_45_59_650550.jpg)