The Ava Risk Group Limited (ASX: AVA) is a global leader in providing technologies and risk management services. Catering to 6 continents, it provides the world leading technology divisions- the BQT Solutions and Future Fibre Technologies. Across the world, the company has commercial, industrial, military and government clients who are security vigilant.

AVA provides complementary solutions including perimeter intrusion detection, biometric control, card access control, pipelines and data networks. AVA focusses on innovation and has a complete range of premium services for the intricate and ever demanding markets along with technologies.

On 24th May 2019, the company announced that it had entered a US$3.5 million deal with India. The companyâs FFT Aura Ai-2 product had been chosen as part of a perimeter security upgrade program in India. The program would cover major air bases across India, as a result of its intensified security environment. The contract is set to begin in Q1 FY20 at 23 military airbases. It would be for a period ranging between 18 to 24 months.

The security system would be integrated and inclusive of "smart fences" where the Aura Ai-2 would be installed along with CCTV cameras, motion detectors, infra-red devices, anti-penetration along with thermal and other sensors. This would further be supported by surveillance devices and drones.

In a competitive on-site trial, Aura Ai-2 underwent tests with other intrusion detection technologies for instantaneous buried and fence straddled applications. The results of this test showcased that it was the only solution bearing the capability to meet the customer's strict detection requisites like fence cuts and climb, vehicle, walker and simultaneous events. The test also met with the integration prerequisites and depicted low nuisance alarm levels.

Commenting on the contract, the companyâs CEO Scott Basham stated that the contract is a depiction of the companyâs powerful platform and continuous improvements being made since 2017. The Aura Ai-2 is now a market leader with its characteristics and offerings.

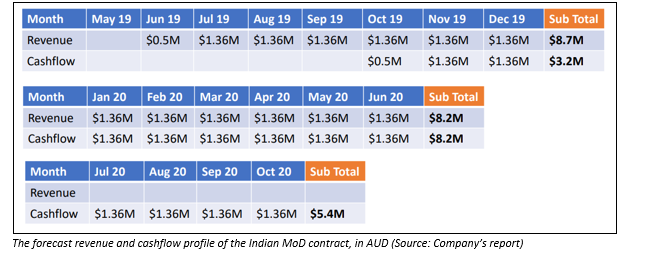

In its Investor MoD Presentation from May 2019, the company had stated that AVA along with SFO, had finalised contractual terms with India and SFO had received and formally accepted the Purchase Order from India. Further, the license fee value has gone up, and the company would receive US$11.9m in the coming fourteen months. In accordance with the present production rate and delivery schedules, the company expected to receive a revenue between US$0.35m and US$1.0m in FY19 and the remainder of US$11.55m and US$10.9m in FY20.

Post the initial 3-year warranty period, further revenue of US$3.4m was expected, from a subsequent seven- year maintenance and spares contract. The company would be paid on a 120-day term. It would also avail a benefit from the bank guarantee, which would be equivalent to 20% of total production volume.

Share Price Information:

Share Price Information:

As on 24th May 2019 the shares of AVA closed the dayâs trade at A$0.180 on ASX, up 9.091%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_07_02_2025_00_23_12_199043.jpg)