Andromeda Metals Limited (ASX: ADN) is a company from metals and mining sector and is engaged into exploration for economic gold, lithium and copper deposits.

On 17 May 2019, Andromeda Metals provided additional information related to the defined resource as described earlier in the investor presentation (released on 16 May 2019).

Defined Resource for Careyâs Well (Source: Investor Presentation)

The company further announced that the JORC 2012 Mineral Resource estimate for Careyâs Well of 20.2 Mt of âbright whiteâ kaolinised granite, with minimum raw kaolin ISO brightness (R457) of 75 consists of :

- Measured Resources at 7.4 Mt with a -45µm recovery rate of 52.8%.

- Indicated Resources at 9.2 Mt with a -45µm recovery rate of 51.9%.

- Inferred Resources at 3.6 Mt with a -45µm recovery rate of 56.9%.

The JORC 2012 Mineral Resource estimate for the halloysite content of 9.7Mt within the Careyâs Well âbright whiteâ kaolinised granite Mineral Resource, with minimum raw kaolin ISO brightness (R457) of 75 consists of:

- Measured Resources at 5.2 Mt.

- Indicated Resources at 3.8 Mt.

- Inferred Resources at 0.8 Mt.

The estimations of both the kaolinised granite and halloysite content were calculated using the most up to date average dry bulk rock density of 1.44 tonnes/m3.

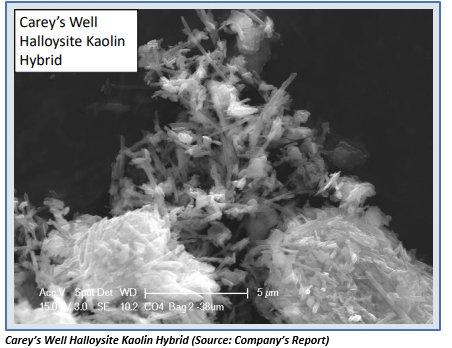

Halloysite is a rare âtubular shapedâ derivative of kaolin which has a wide industrial application. Product & Target Markets for halloysite kaolin comprises of:

- Ceramics - for high-quality porcelain and Catalysts - for Fluid Catalytic Cracking (FCC) for Mature markets.

- High Purity Alumina Production (HPA) and Halloysite Nanotube Technologies for new and emerging markets.

South Australia has one of the largest resources of halloysite kaolin in the world, which is a relatively high-value industrial mineral. The global demand for this mineral is increasing. However, its global production is decreasing. Presently, ADN is well positioned to become one of the top producers of this mineral in the world. The company has huge blue-sky potential in HPA as well as nano-technology

The emerging applications of halloysite kaolin include:

- Batteries and Super-Capacitors

- Water Purification

- Carbon Dioxide Capture - Storage and Conversion to Fuel

- Medical Delivery of Drugs

- Construction â Delivery of Biocides

- Agriculture â Delivery of Pesticides and Fertilizers

The indicative relative commercial values of pure Kaolin are A$300/t. Kaolin/Halloysite Hybrid value ranges from A$500/t to A$1000/t.

Pure Halloysiteâs commercial value is more than US$3000/t, and HPA 4N is in the range of US$30,000/t to US$35,000/t.

The shares of ADN have generated a decent YTD return of 28.57%. By the closure of the trading session on 17 May 2019, the closing price of the shares of ADN was A$ 0.009, down by 1% as compared to its previous closing price. Today, on 20 May, the shares are trading flat at A$ 0.009 (As at 12:40 PM AEST). ADN holds a market cap of A$12.2 million and approximately 1.36 billion outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.