Lithium Australia NL (ASX: LIT) has a portfolio of projects throughout Australia, which includes Bynoe Project, Kangaroo Island project, Cape York Project and many more. The company is focused on identifying potential lithium development opportunities so that it can establish itself as a leading provider of lithium to the battery industry.

The companyâs strategy is focused on below-mentioned activities:

- Sourcing of appropriate raw materials.

- Advancing its 100%-owned SiLeach® and LieNA® technologies, both of which are capable of converting mine waste into lithium chemicals.

- Advancing its recycling technology to recover valuable metals while protecting the environment in the process.

- Employing its VSPC technology for converting lithium chemicals into superior quality lithium-ion battery cathode materials.

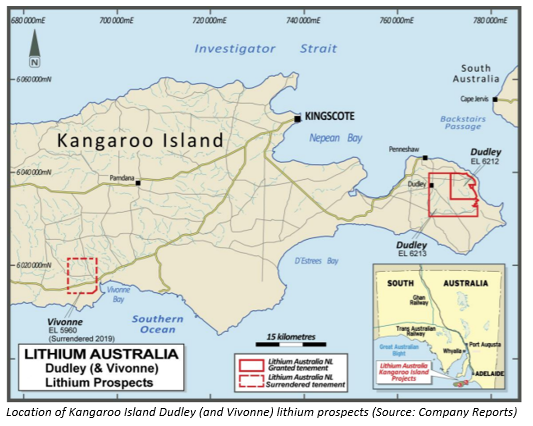

The company recently came up with an encouraging announcement stating that it has located lithium-anomalous pegmatite dykes at its Dudley prospect at the Kangaroo Island Project, which is located in South Australia.

The location of Kangaroo Island Dudley (and Vivonne) lithium prospects can be seen in the image below.

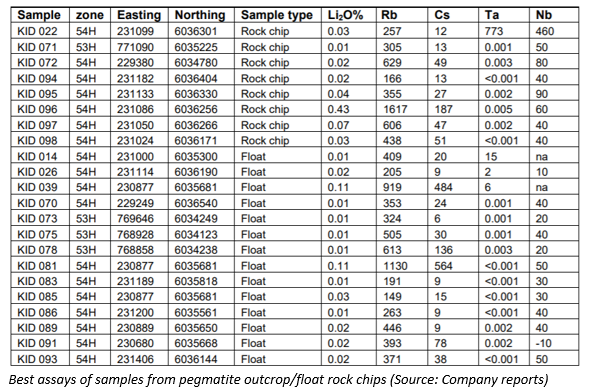

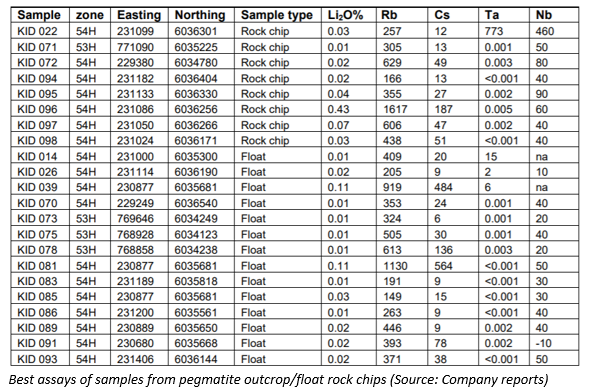

The sample results are indicating the presence of lithium pegmatites, which is an encouraging piece of news for the company and its shareholders. Some of the notable sampling results are shown in the table below.

The outcrop rock-chip assays included results up to 0.43% Li2O, 1,600 ppm rubidium, 770 ppm tantalum, 460 ppm niobium and 180 ppm caesium, indicating the potential for high grades in the unweathered bedrock.

Along with lithium, the tantalum values recorded in the process have also been highly significant, as values above 200 ppm are considered economic grades and, in this case, the values are reaching up to 770 ppm.

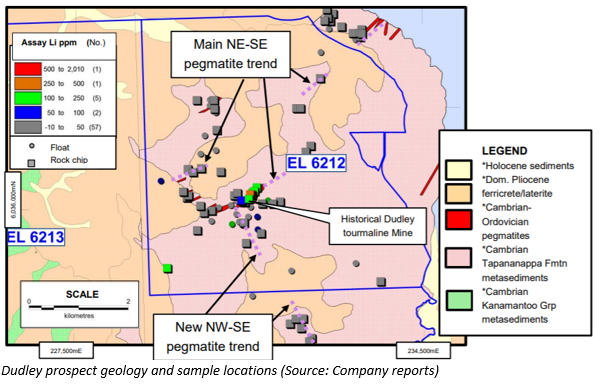

Given these results, it has been confirmed that the Dudley prospect at the Kangaroo Island Project has the potential to host a lithium deposit.

In order to further determine the extent of lithium and tantalum mineralisation of the Dudley, the company is planning a geochemical soil-sampling programme over the Dudley prospect and the nearby areas which will also help the company in locating additional LCT pegmatite.

Taking into the consideration the increasing global demand of lithium, the presence of lithium-anomalous pegmatite dykes at the companyâs Dudley prospect of Kangaroo Island Project is an extremely positive news for the company.

In another recent announcement on ASX, the company confirmed that it has extended its interest in Envirostream Australia Pty Ltd to 11.76 per cent by making further equity subscription of $100,000. The company is planning to increase its stake in Envirostream to 18.91 per cent, which will help Envirostream to expand its capacity for the recycling of lithium-ion batteries.

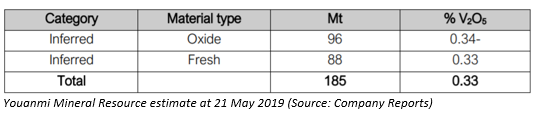

Last month, the company completed a Mineral Resource Estimate for a portion of the Youanmi Complex, as per which, the Inferred Mineral Resource at Youanmi has been estimated at 185 Mt at 0.33% V2O5 using a cut-off grade of 0.2% V2O5, comprising oxide resources of 96 Mt at 0.34% V2O5 and fresh resources of 88 Mt at 0.33% V2O5.

To understand the potential for direct leaching of the vanadium and associated base metals, the company will now evaluate the metallurgical characteristics of the oxide mineralisation at Youanmi and is planning a drilling programme to enable a reasonable quantity of oxide material to be recovered over the full depth of the oxidised profile.

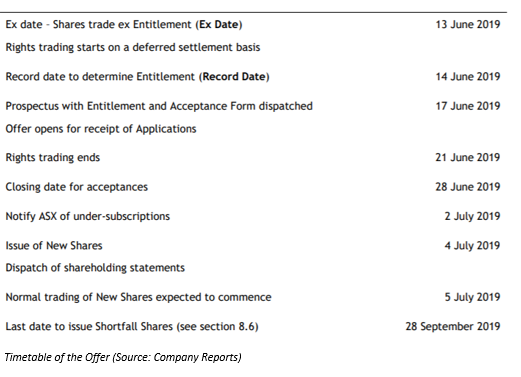

To undertake drilling activities at Youanmi and Medcalf as well as to make progress in the development of SiLeach®, LieNA®, and L-Max® options, the company recently invited its shareholders for a 1 for 6 renounceable pro-rata entitlement offer to raise up to around $6.5 million.

The proceeds of the offer will mainly be used for the following purposes:

- Lithium raw materials, including exploration on Youanmi (drilling) and Medcalf (soil sampling)

- Lithium chemicals, including the development of SiLeach® LieNA® and L-Max® options

- Lithium batteries, including VSPC pilot plant operations and DLG alliance

- Lithium battery recycling, including Envirostream transaction; and

- For Working capital.

The offer will close on 28th June 2019, and the issue of new shares is scheduled to occur on 4th July 2019.

While informing about the nature of the mineralisation at Youanmi, the company has advised that the oxidised mineralisation extends to 20 m - 50 m, with an average depth of 40 m and virtually no overburden. The fresh mineralisation has been estimated to 400 m above sea level, and between 75 m and 80 m below the surface.

During the March quarter, the company completed a successful pilot-plant run at its Generation 2 SiLeach® facility. During the pilot-plant run, it was observed that the recovering lithium as a phosphate has a number of process advantages over carbonate or hydroxide, confirming that the lithium phosphate can easily be used for the synthesis of lithium-iron phosphate (LFP) cathode materials.

During the March quarter, the company continued with (1) the production of cathode materials, which is a lucrative element in the lithium-ion battery production cycle, (2) its 100%-owned VSPC pilot plant located in Brisbane.

In 2019 March quarter, the company reported net cash used in operating activities of $1,132k and net cash used in investing activities of $703k. As at 31st March 2019, the company reported cash and cash equivalents of $9,133k.

At market close on 21st June 2019, the companyâs stock was trading at a price of $0.062, up 3.333%, with a market capitalisation of circa $28.91 million. Its 52 weeks high price stands at $0.139 and 52 weeks low price at $0.060, with an average annual volume of ~761,885.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_09_03_2024_01_03_36_873870.jpg)