Element 25 Limited (ASX:E25) operates under the mining sector. The company is engaged in four key projects; The Butcherbird manganese Project, Pinnacles Cobalt/Nickel Project, Holleton Gold Project, Green Dam Gold/Nickel Project.

The company has signed a Native Title Agreement for the Butcherbird High Purity Manganese Project. The deal has been inked with Karlka Nyiyaparli Aboriginal Corporation RNTBC (KNAC) concerning the Butcherbird Manganese Projectâs eastern portion that lies within the Nyiyaparli determination area.

(Source: Companyâs report)

The agreement is the second and final Native Title Agreement for the development of Butcherbird Manganese Project and grant of M52/1074. It provides a beneficial position for both KNAC and Nyiyaparli people.

The company is seeking to expedite the grant of M52/1074 for the development of the project.

Terms underlying the agreement

According to the agreement, the Nyiyaparli people are deemed to have traditional ownership of the land. This was a result of an approved determination by the Federal Court of Australia on 26th September 2018. The approval pertains to the native title with respect to the native title determination applications numbered WAD 6280 of 1998 (Nyiyaparli Claim) and WAD 196 of 2013 (Nyiyaparili #3 Claim that native title exists in the Determination Area and is owned by the people of Nyiyaparli). KNAC is recognised as the registered native title body holding native title rights concerning the land and interests the subject of the area in trust for the people of Nyiyaparli.

Element 25 Limited, through effective communication, engagement and consultation, bolstered its relationship with KNAC and Nyiyaparli people. The agreement is said to provide KNAC and the people of Nyiyaparli a chance to participate in the project along with future royalties, which would help build a mutually beneficial relationship amongst the parties to the deal.

In order to cut down the carbon intensity of the project and reduce energy costs, E25 has also resolved to integrate renewable energy into the power solution.

According to Justin Brown, Executive Director of Element 25 Limited and Nick Preece, the CEO of Karlka Nyiyaparli Aboriginal Corporation, the deal would be a great success for the parties and will be advantageous in their development in the long run. Going forward, Element 25 has certain chances of development of the Butcherbird Manganese project and is set to build a strong relationship with the people of Nyiyaparli and Ngarlawangga.

All you need to know about the Butcherbird High Purity Manganese Project

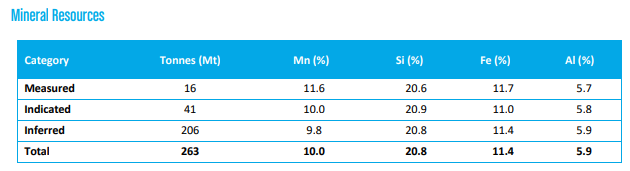

The Butcherbird High Purity Manganese Deposit has world-class JORC resources of manganese ore quantifying more than 263 Mt. E25 has completed a study to produce high-purity manganese sulphate for lithium-ion battery cathodes along with Electrolytic Manganese Metal to be used in specialty steels. The commercial potential of the project is yet to be confirmed after the completion of a PFS being conducted.

Mounting the Goldfields Gas Pipeline and the Great Northern Highway, the project offers logistics and energy solutions.

(Source: Company Reports)

In another announcement dated 29th May 2019, E25 reported that it has entered into a binding agreement with Magmatic Resources Limited to acquire Mt Venn copper-nickel-cobalt project.

At market close on 30th May 2019, the stock of the company was trading at a price of $0.185, with a market cap of $15.53 million.

ALSO READ: Element 25 Announces Its Quarterly Activities Report

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.